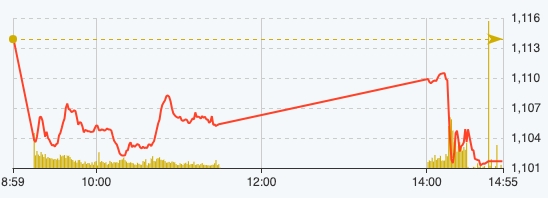

The market opened with less optimism as selling pressure increased from the beginning of the session, causing the VN-Index to drop by up to 10 points at times, but the 1,100 point mark was still maintained.

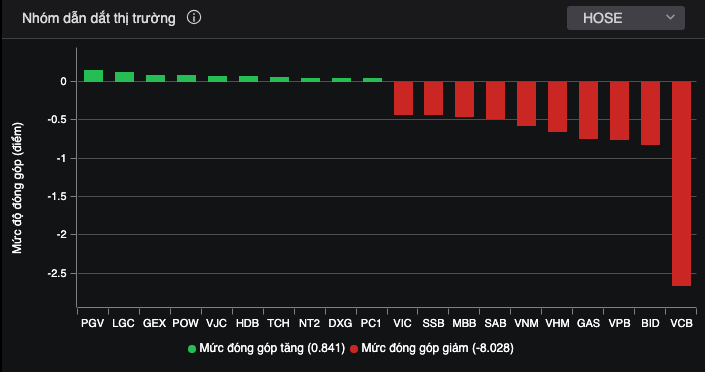

Banking continued to be the most negative group in the morning session when red covered the entire industry, in which VCB was the heaviest burden taking away 2 points from the market, SAB decreased by 1.7%, SHB decreased by 1.3%. The VN30 group also had only 2 stocks going against the trend: POW increased by 2.6% and SSI increased by 0.6%.

At the end of the morning session on November 10, VN-Index decreased by 8.45 points, equivalent to 0.76% to 1,105.4 points. The entire floor had 121 stocks increasing and 378 stocks decreasing. HNX-Index decreased by 0.93 points to 227.2 points. UPCoM-Index decreased by 0.42 points, equivalent to 0.48% to 85.81 points.

VN-Index developments on November 10 (Source: Fire Ant).

In the afternoon session, there was a recovery at the beginning of the session, at times the index exceeded the reference. However, the market continued to be hindered by large-cap stocks and continued to fall, struggling around the reference.

At the end of the trading session on November 10, VN-Index decreased by 12.21 points, equivalent to 1.1% to 1,101.6 points. The entire floor had 148 stocks increasing but 417 stocks decreasing and 49 stocks remaining unchanged.

HNX-Index decreased by 1.57 points, equivalent to 0.69% to 226.65 points. The whole floor had 54 stocks increasing, 104 stocks decreasing and 72 stocks remaining unchanged. UPCoM-Index decreased by 0.51 points to 85.7 points.

The VN30 basket alone recorded 27 stocks decreasing in price, with only 3 stocks escaping: HDB up 0.53%, POW up 1.3%, VJC up 0.55%. The large-cap group was a burden when only 10 stocks VCB, VPB, BID, GAS, VHM, VNM, SAB, MBB, VIC, SSB took away nearly 8 points from the market.

Market leading stocks.

In the same situation, the banking group continued to be a negative group with SSB down 2.86%, LPB down 2.55%, VPB down 2.25%, VCB down 2.16%, MBB down 1.91%, BID down 1.52%, TCB down 1.43%, ACB, TPB, STB, MSB, CTG, SHB, NAB down less than 1%.

In contrast to yesterday's session, today's real estate group was again in red with NVL down 1.84%, CEO down 2.49%, VRE down 1.44%, KDH down 1.72%, HUT down 1.99%, VIC, KBC, VCG, CII, NLG, LCG, HVV down less than 1%. Some codes still recorded green with DXG up 1.8%, PDR up 0.79%, TCH up 2.92%, CTD up 1.61%.

The total order matching value in today's session reached VND23,790 billion, down 5% compared to the previous session, of which the order matching value on HoSE alone reached VND20,768 billion, down 6%. In the VN30 group, liquidity reached VND7,010 billion.

After the highest net foreign buying session in more than 2 months, today's session has decreased with a net buying value of 235.28 billion VND, of which this group disbursed 1,517 billion VND and sold 1,753 billion VND.

The codes that were bought heavily were mainly STB 43 billion VND, TPB 29.8 billion VND, FUEVFVND 29 billion VND, GMD 25 billion VND, HDB 23.7 billion VND... On the contrary, the codes that were sold heavily were FUESSVFL 234.8 billion VND, VCB 57.7 billion VND, VNM 45.8 billion VND, VHM 41 billion VND, KDH 29 billion VND,... .

Source

Comment (0)