The net selling streak of foreign investors has not ended in the first week of November 2024. However, there is a positive sign when the new product has been used by many foreign organizations in the first payment cycles.

First week of removing pre-funding obstacles: Many bright spots even though foreign investors have not stopped net selling

The net selling streak of foreign investors has not ended in the first week of November 2024. However, there is a positive sign when the new product has been used by many foreign organizations in the first payment cycles.

|

On the afternoon of November 4 - right at the first trading session of Circular No. 68/2024/TT-BTC officially taking effect, the State Securities Commission (SSC) had a working session and exchanged information with the delegation of the market rating organization FTSE Russell and Morgan Stanley - one of the largest financial institutions in the world. The discussion revolved around the story of upgrading the market - a goal that Vietnam will strive to achieve by 2025 in the Strategy for developing the stock market to 2030.

Circular No. 68/2024/TT-BTC also aims to push Vietnamese securities closer to upgrading standards with two main contents, including allowing foreign institutional investors to trade and buy shares without requiring sufficient funds and providing a roadmap for information disclosure in English.

|

| Chairwoman of the State Securities Commission Vu Thi Chan Phuong chaired a meeting, worked and exchanged information with the delegation of FTSE Russell and Morgan Stanley on upgrading the Vietnamese stock market. |

Appreciating the efforts of the Vietnamese management agency in allowing foreign institutional investors to buy and pay by T+2, Ms. Wanming Du - Head of FTSE Russell Index Policy Department at that time affirmed that FTSE Russell will increase exchanges and work with relevant parties in Vietnam to support foreign investors' trading activities in Vietnam, as well as share information and trading methods of FTSE customers in emerging markets.

Mr. Young Lee, Managing Director of Morgan Stanley's Asian equity business, said that removing the requirement to have enough money when placing an order was an important request from investors and required a lot of time to amend the mechanism and policies, but Vietnam has implemented it in just a short time.

In addition to positive reviews from large organizations, the number of foreign organizations directly using the product also showed encouraging signs in the first payment cycles. According to Ms. Ta Thanh Binh, General Director of Vietnam Securities Depository and Clearing Corporation (VSDC), statistics from a custodian bank with a large market share providing services to foreign investors in the Vietnamese market showed that the rate of foreign investors placing orders to buy stocks when they did not have enough money accounted for up to 60% in the first sessions. The number exceeded initial expectations when it was assumed that foreign organizations would spend more time observing before directly experiencing the new product.

At SSI – one of the securities companies operating strongly in the brokerage sector for foreign institutional clients, the non-prefunding product (NPF) was officially launched on November 4 and many clients are ready to trade. According to Mr. Mai Hoang Khanh Minh – Director of Institutional Client Securities Services – Institutional Client Brokerage, many foreign institutional clients have signed agreements to use the NPF product with SSI.

Previously, the company issued internal procedures and policies, including: NPF stock purchase transaction procedures, risk management policies for NPF transactions. At the same time, SSI also established the NPF Transaction Management Subcommittee to carry out tasks related to approving NPF procedures and policies, approving NPF stock portfolios, approving payment support limits for foreign institutional customers, monitoring the implementation and evaluating the effectiveness of NPF transactions. All SSI institutional customers are consulted and clearly understand NPF and related legal regulations, as well as their rights and obligations when participating in using the product.

However, in the first week of applying Circular 68, the transaction value of foreign investors continued to maintain the net selling trend. Last week alone, foreign investors net sold more than VND3,630 billion in the whole market. Of which, MSN and VHM stocks were net sold the most, with values of VND765 billion and VND732 billion, respectively. CMG, SSI, and VCB stocks were net sold in the range of VND200-300 billion. On the contrary, TCB and HPG were two rare stocks that were net bought over VND100 billion.

This is also a week with many events that have a strong impact on the global financial market, such as the US presidential election and the US Federal Reserve's November policy meeting. Despite an exciting trading session after receiving news of former President Trump's election victory, Vietnam's stock indexes quickly turned around and fell. Meanwhile, foreign investors' net selling streak has not stopped since mid-October 2024.

Circular 68 indirectly impacts the ability of market rating organizations such as FTSE to upgrade Vietnamese stocks to emerging market status. This announcement will positively improve market sentiment and individual investor purchasing power.

Circular 68 indirectly impacts the ability of market rating organizations such as FTSE to upgrade Vietnamese stocks to emerging market status. This announcement will positively improve market sentiment and individual investor purchasing power.  - Mr. Barry Weisblatt David, Director of Analysis VNDIRECT

- Mr. Barry Weisblatt David, Director of Analysis VNDIRECTAssessing the impact of Circular 68, Mr. Barry Weisblatt David, Director of Analysis at VNDIRECT Securities Joint Stock Company, said that some fund managers will actively increase their allocation to Vietnam because investing becomes more cost-effective. However, this group is quite small. The new Circular does not greatly affect the allocation activities of funds that have invested 100% in Vietnam, but mainly affects regional funds or funds specializing in global frontier and emerging markets that are interested in Vietnam.

However, he expects the new circular’s bigger impact to be its indirect impact on the possibility of market rating organizations like FTSE upgrading Vietnam’s stocks to emerging market status. This announcement will positively improve market sentiment and individual investor purchasing power.

The management agency admitted that it is difficult to determine the specific time when the Vietnamese stock market will be upgraded. However, Ms. Ta Thanh Binh - General Director of VDSC said that it will take more time for foreign investors to experience the new solutions. She also expected FTSE to have positive assessments of the changes in the Vietnamese stock market in the review in March 2025.

|

Along with the convenience for foreign organizations, the new circular creates some risks for securities companies in case foreign institutional investors do not make payments and must include securities in the trading portfolio of self-trading. Specifically, according to the provisions of Circular 68 and Decision No. 48/QD-HDTV on promulgating the Regulation on clearing and settlement of securities transactions at VSDC, no later than 09:30 on T+2, the depository member must send VSDC a written notice requesting/refusing payment and transferring the transaction with insufficient funds to the self-trading account of the securities company where the foreign institutional investor purchases shares without requiring sufficient funds to place an order for clearing and settlement.

No later than the trading day following the day the shares are recorded in the proprietary trading account, the securities company is allowed to transfer ownership outside the trading system for the shares transferred to its proprietary trading account to the foreign investor who is an organization lacking payment. Otherwise, after the above deadlines, the securities company's proprietary trading portfolio will be subject to the risk of price fluctuations of the transferred shares.

In fact, in the first payment cycles when Circular 68 took effect, VSDC representative said that many foreign organizations were also cautious and chose to make early payments on T+1. “VSDC has set up assumptions for contingency situations and focused on observing transactions. It is still too early to say anything, but up to now, transactions have been relatively safe and smooth, without any incidents,” said VSDC General Director.

According to Mr. Barry Weisblatt David, Director of Analysis at VNDIRECT Securities Joint Stock Company, there are currently only a few securities companies operating strongly in the brokerage sector for foreign institutional clients. Companies will need to invest significantly in developing systems and policies to assess risks and deploy products for customers, especially securities companies that intend to expand their presence in this field and capture brokerage market share from foreign investors need to implement risk management measures.

For VNDIRECT, the company previously performed KYC on foreign customers but did not assess counterparty risk. To prepare for the new product, Mr. Barry Weisblatt David said that the company followed the VSD's instructions and Circular 68 to receive customers, deploy services on demand; worked with consulting organizations, belonging to the Big4 auditing group, to establish counterparty risk assessments for each customer. Internally, the company leveraged technological capabilities to improve risk management capabilities and bring a seamless experience to customers during transactions under new regulations.

At SSI, Mr. Nguyen Khac Hai - Director of Law and Compliance Control said that up to now, the company has prepared business processes, people, systems, risk management mechanisms and capital. In addition to internal processes and policies to deploy new products, SSI also provides professional training for brokerage staff serving foreign institutional customers. In addition, related departments such as business control and risk management are also trained.

SSI is confident that it is one of the securities companies with the largest capital scale and financial potential in the market and has enough capital resources to meet the NPF order requirements of foreign investors.

SSI is confident that it is one of the securities companies with the largest capital scale and financial potential in the market and has enough capital resources to meet the NPF order requirements of foreign investors.  - Mr. Nguyen Khac Hai - Director of SSI Securities Law and Compliance Control

- Mr. Nguyen Khac Hai - Director of SSI Securities Law and Compliance ControlAt the same time, SSI's trading system has also been supplemented with new functions with NPF orders, risk management specific to this type of transaction to maximize automation, increasing customer service capacity. Regarding capital, SSI also prepares capital to have a limit for NPF orders to meet the maximum needs of foreign investors. According to Mr. Hai, at this point, SSI is confident that it is one of the securities companies with the largest capital scale and financial potential in the market and has enough capital resources to meet the requirements of placing NPF orders of foreign investors.

Mr. Hai said that the determination of the limit for each specific customer is based on a set of criteria developed by SSI. The institutional customer brokerage department will collect information from customers and propose to the NPF Transaction Management Subcommittee the limit granted to each customer based on criteria such as the customer's transaction history at SSI, the size and reputation of the customer in Vietnam as well as globally, etc. The NPF Transaction Management Subcommittee will review and approve the specific limit and this limit will be configured for SSI's transaction system to monitor in real time.

|

Circular 68 stipulates the limit for receiving stock purchase orders equal to the total amount that can be converted into cash, including cash at the fund; bank deposits, government debt instruments, unused deposit certificates to secure financial obligations; available overdraft limit; payment guarantee limit issued by domestic and foreign credit institutions; pending proceeds from selling self-trading securities; receivables in advance from selling listed securities, registered for trading; money from foreign investors who are regulated organizations...

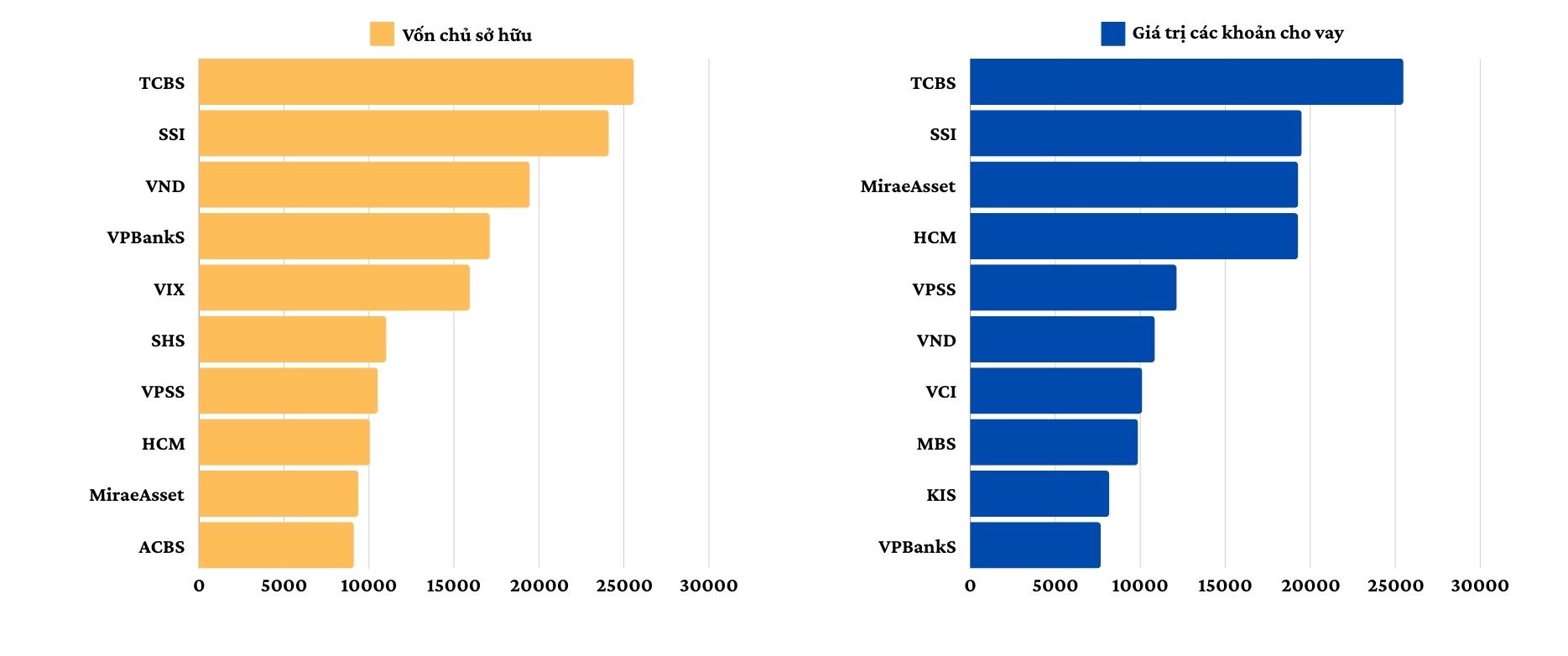

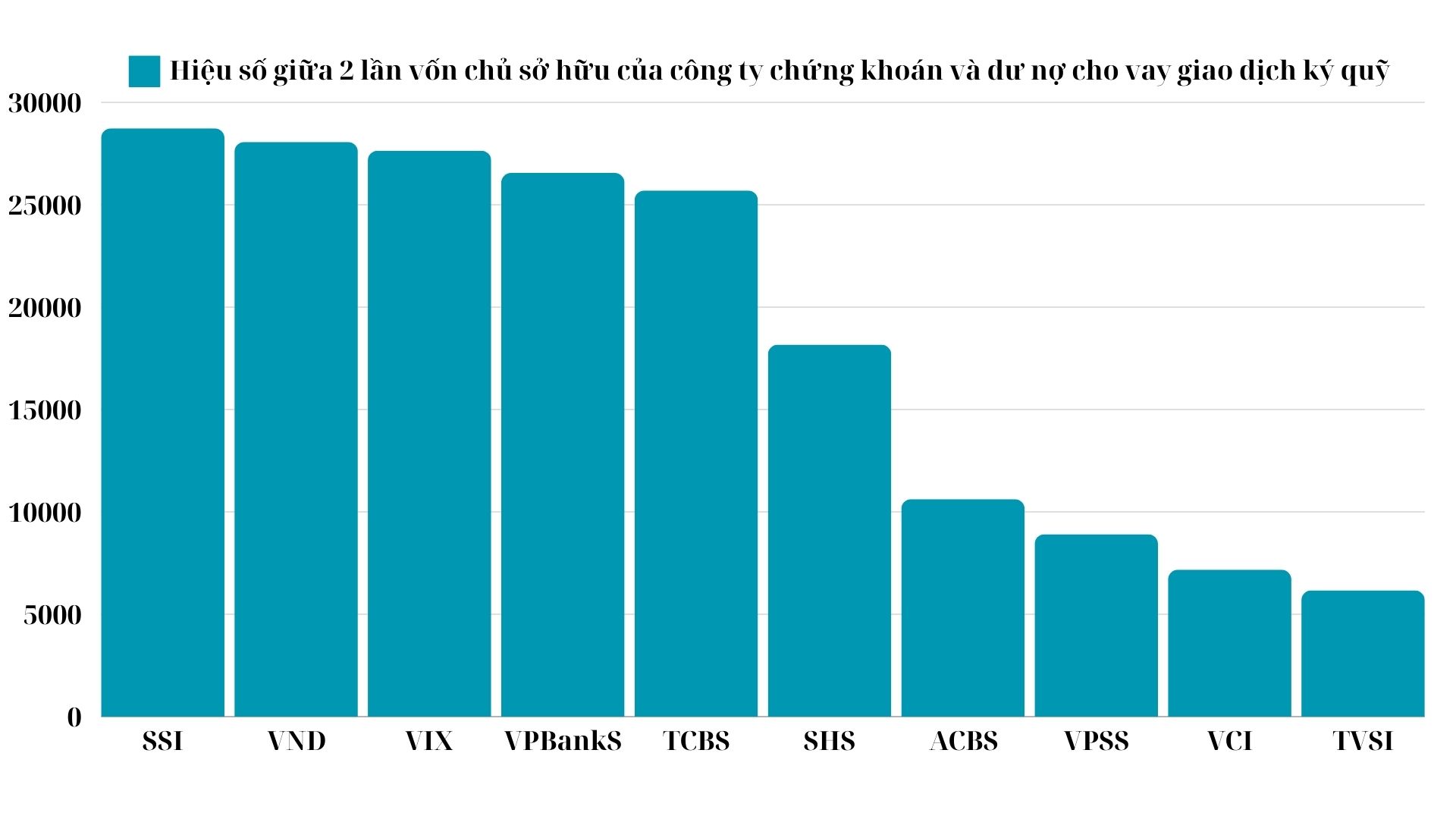

At the same time, the limit will not exceed the difference between 2 times the equity of the securities company and the outstanding margin loan for securities trading. During the booming market trading period in 2020-2021, the outstanding margin loan balance at many securities companies even approached the limit when it was nearly 2 times the equity. However, at present, the equity size of all companies has increased sharply through accumulation from profits and mobilization through the issuance of new shares to shareholders.

|

| Equity size and loan value at top securities companies as of September 30, 2024 - Unit: Billion VND |

The wave of capital increase over the past 4 years, along with the entry of many new recruits after M&A deals and changes of ownership, has helped improve the financial capacity of companies in the securities industry. In the past 9 months alone, the equity of more than 70 securities companies has increased.

Some companies will also complete capital increase in this fourth quarter, such as Vietcap Securities, which has just issued a private issue to raise up to VND4,021 billion; SSI is issuing a maximum of 453.3 million additional shares, including 151.1 million shares offered to existing shareholders at VND15,000/share. Some companies have planned or prepared to submit to shareholders capital increase plans such as SHS, HSC, etc.

|

| Difference between 2 times the equity of the securities company and outstanding loans for securities margin trading - Unit: Billion VND |

Circular 68 stipulates that securities companies are not allowed to continue to perform the above business in case of exceeding the prescribed investment limit, until the investment limit is met. At the same time, when violating, securities companies must also be punished by applying necessary measures within a maximum period of 1 year to comply with the investment limit. With strict regulations on limits, capital strength is an important advantage in providing this new service.

Source: https://baodautu.vn/tuan-dau-go-vuong-pre-funding-nhieu-diem-sang-du-khoi-ngoai-chua-dut-ban-rong-d229691.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)