VN-Index still maintains short-term growth with the nearest support zone around 1,315 points.

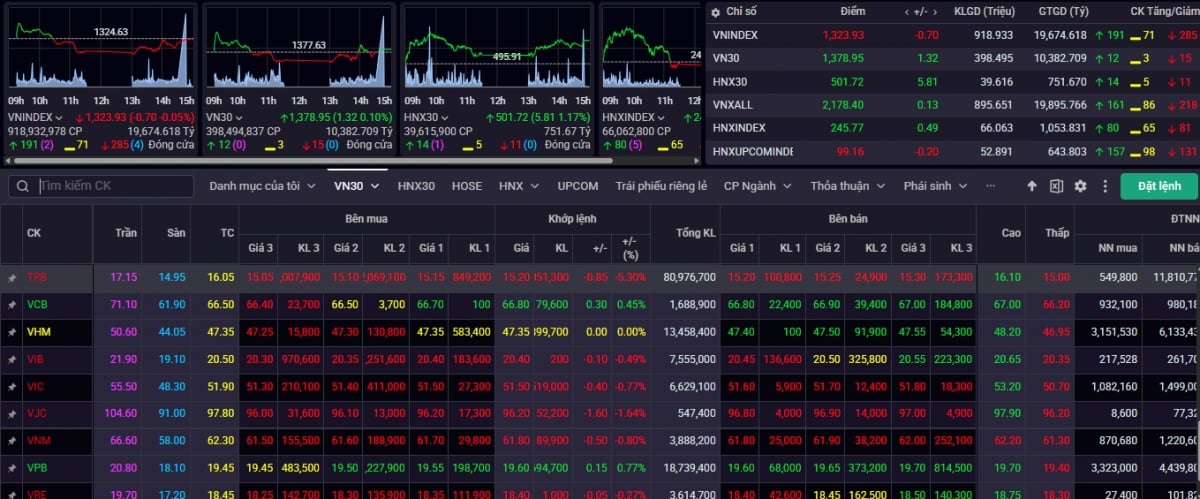

VN-Index continued to be under pressure to correct for the third consecutive session. In the trading session on March 20, VN-Index decreased to the nearest support zone around 1,315 points. The market was quite well differentiated in this area when many groups of stocks that were under pressure to correct before such as technology, construction, seaports... recovered well. At the end of the trading session on March 20, VN-Index decreased slightly by 0.70 points (-0.05%) to 1,323.93 points, remaining above the average price of 20 sessions around 1,315 points. Meanwhile, VN30 increased slightly by 1.32 points (+0.10%) to 1,378.95 points, above the highest price zone in October 2024 around 1,374 points.

The breadth on HOSE was negative with 190 stocks decreasing in price. Strong differentiation, selling pressure increased quite suddenly in many stocks in the banking, securities, real estate, seafood groups...; 125 stocks increased in price, recovered well in the port, maritime transport, construction, industrial park, securities groups... and 51 stocks kept the reference price. Market liquidity decreased with a slight decrease in trading volume on HOSE. Investor sentiment was more pessimistic in many stocks, with strong selling pressure quite suddenly. Foreign investors continued to net sell strongly with a value of -1,409.3 billion VND on HOSE in the session of March 20.

According to experts from Saigon - Hanoi Securities Company (SHS), VN-Index is still maintaining short-term growth with the nearest support zone around 1,315 points, corresponding to the lowest price on March 11, with a stronger support zone of 1,300 points. However, after a period of price increase over the past 8 weeks, VN-Index is under pressure to adjust and restructure its portfolio. VN-Index may be under pressure to adjust and retest the psychological support zone around 1,300 points.

In the short term, with the VN-Index, this is not an attractive price range for further disbursement. The market is still quite positively differentiated, with short-term rotation. Although the VN-Index is under relatively normal adjustment pressure under the rotational influence of many groups of codes in the market. However, many groups of codes have also been under strong selling pressure, with prolonged adjustments to relatively attractive price ranges and are gradually starting to rebalance, such as technology, telecommunications, aviation, insurance, and seaport groups.

“Many stocks are returning to a relatively reasonable price range, and can be gradually monitored and evaluated for further growth potential, to consider re-accumulating. Investors should maintain a reasonable proportion. The investment target is stocks with good fundamentals, leading in strategic industries, and outstanding growth of the economy,” said the SHS expert.

VN-Index may continue to fluctuate near 1,320 points.

According to Kien Thiet Securities Company (CSI), VN-Index had a rather strong fluctuation on March 20 (fluctuating 16.3 points), but closed with a very slight decrease (-0.05%). Liquidity on March 20 decreased compared to the previous session with matched volume slightly lower than the average of 20 sessions (-2.2%), showing the cautious sentiment of investors. The cautious sentiment may continue to prevail in the coming sessions as liquidity has shown signs of slowing down in the last 4 consecutive sessions, so the possibility of a breakthrough cannot be quick and immediate.

“There is a high probability that VN-Index will enter the accumulation zone and it is possible that there will be a short-term correction to the strong support zone of 1,286 - 1,290 points before returning to the uptrend. Investors should still be cautious, limit disbursement at this stage and patiently wait for the above support zone to be strong in net buying positions,” CSI experts noted.

Sharing the same view, experts from Yuanta Vietnam Securities Company (YSVN) said that the market may still face a correction in today's session, March 21, and the VN-Index may continue to fluctuate near 1,320 points. At the same time, the market is still in a short-term accumulation phase and there is a divergence between stock groups, but short-term risks remain high and the "green skin, red heart" situation may still occur. In addition, the short-term sentiment indicator continues to decrease, showing that investors are still pessimistic about the current market developments.

“The short-term trend of the general market remains neutral. Therefore, investors can continue to hold stocks at 40-50% of their portfolio and should not buy at this stage,” YSVN experts recommended.

► Some stocks to watch on March 21

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

Comment (0)