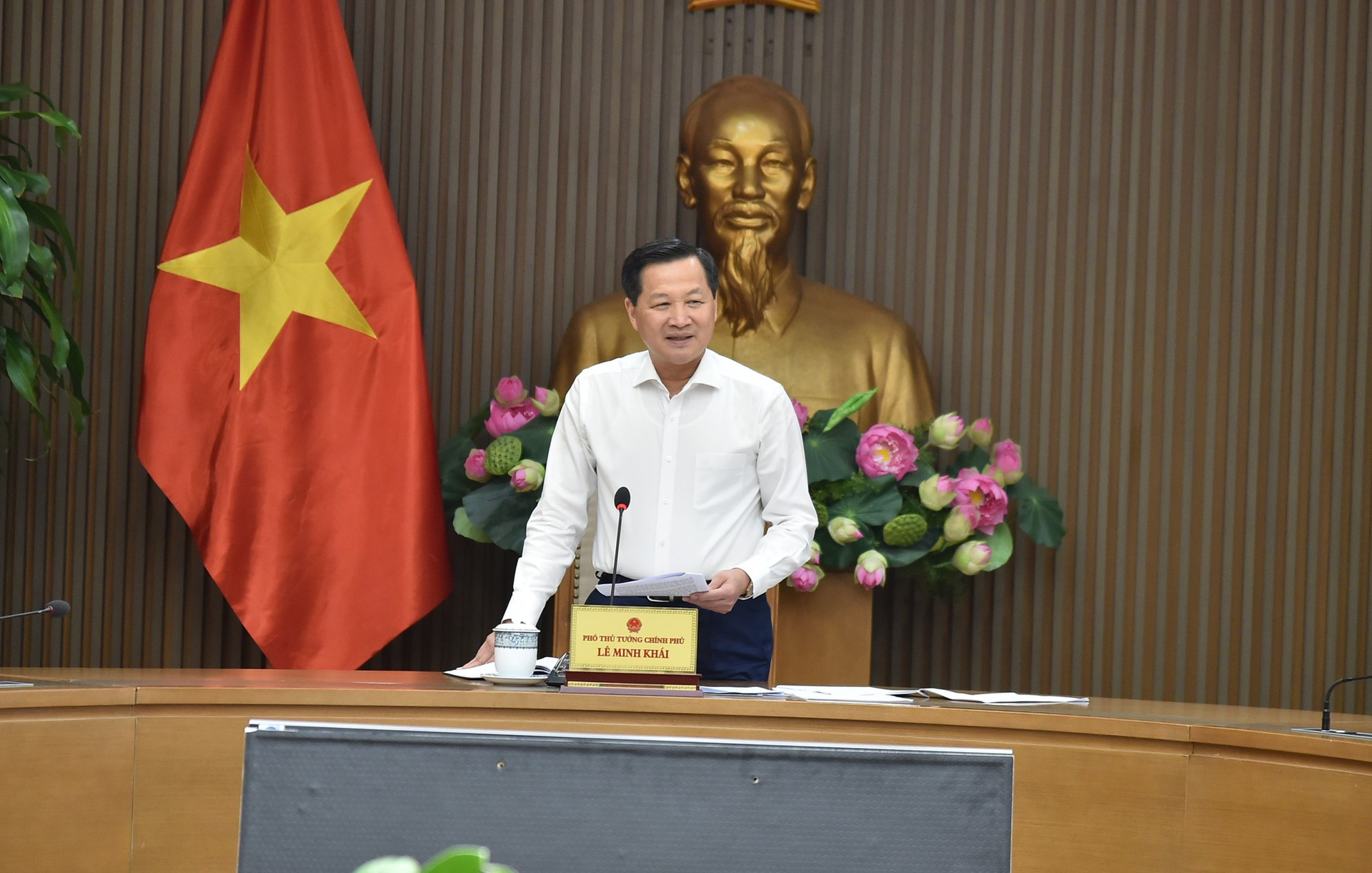

Deputy Prime Minister Le Minh Khai chaired a meeting with ministries and several state-owned commercial banks on solutions to improve access to capital and reduce interest rates. Photo: VGP/Quang Thuong

On May 24, Deputy Prime Minister Le Minh Khai chaired a meeting with ministries and several state-owned commercial banks on solutions to improve access to capital and reduce interest rates.

Continuously adjust interest rates down

The State Bank's report on solutions to improve access to credit and reduce interest rates said: as of May 16, 2023, capital mobilization of credit institutions reached over VND 12.4 million billion, up 2.1% compared to the end of 2022 and up 6.28% compared to the same period in 2022. Outstanding debt of the whole economy reached over VND 12.25 million billion, up 2.72% compared to the end of 2022 and up 9.32% compared to the same period in 2022.

The report emphasized: Although credit institutions have conditions to increase credit in the first months of the year due to abundant liquidity in the system and not yet being limited to the ceiling. However, credit growth is still low compared to the same period of previous years.

The reasons are due to reduced credit demand, capital absorption by businesses and the economy facing difficulties when the three growth drivers are weakened; some customer groups have needs but have not met the loan conditions or are still entangled in legal procedures.

Regarding interest rates, implementing the policy of the National Assembly, the direction of the Government and the Prime Minister on reducing lending interest rates to remove difficulties for the economy, businesses and people, in March, April and May 2023, the State Bank continuously adjusted the operating interest rate down 3 times by 0.5-1.5%.

The State Bank's report emphasized: This decision demonstrates a very high level of determination. The State Bank of Vietnam is one of the first few central banks in the world to adjust down the operating interest rate in the first months of 2023, in the context that central banks are still in the process of raising interest rates in the fight against inflation.

Deputy Prime Minister Le Minh Khai: Banks and businesses must "go the same way". Photo: VGP/Quang Thuong

Continue to "spar" and cut costs to reduce interest rates, serving businesses and people

After listening to the report of the State Bank, the leaders of state-owned commercial banks (Agribank, Vietinbank, BIDV, Vietcombank, MB, Techcombank) expressed their consensus and high approval with the analysis and solutions proposed by the State Bank. The banks also reported on the disbursement of the 2% support package, the 120,000 billion package, credit growth results in the first months of the year;...

Banks affirmed that they will continue to proactively connect with businesses and traditional customers to resolve difficulties with the spirit of "businesses survive, banks survive". Banks agreed to continue to "save", reduce operating costs, make efforts to continue to reduce deposit interest rates, and move towards reducing lending interest rates; direct credit to areas with access to capital, priority areas to promote production and business...

Banks propose that competent authorities continue to direct the entire system to seriously implement the directive on reducing input interest rates; resolve problems related to legal procedures of real estate projects to deploy disbursement; support the tourism, service, renewable energy sectors, etc. to strengthen inspection, supervision, and prevent systemic risks and policy profiteering;... At the same time, continue to focus on implementing synchronous solutions to stimulate domestic consumption; promote disbursement of public investment capital, especially prioritizing key projects; rectify weak contractors;...

Research credit solutions suitable for small and medium enterprises

Speaking at the meeting, Deputy Minister of Planning and Investment Tran Quoc Phuong shared that in the difficult context, the banking system has made great efforts to implement many solutions to improve the situation, however, in reality, there are still many issues that need to be further focused on and resolved.

Regarding credit for businesses, Deputy Minister Tran Quoc Phuong said: In reality, there are currently a group of businesses that do not dare to borrow because they are afraid of business losses. There are a group of businesses that meet the conditions to borrow capital, but do not want to borrow because orders have decreased, there are many goods in inventory, and there is no production so there is no need to borrow capital. The remaining group is the group that cannot borrow capital, this is the largest group, most of which are small and medium-sized enterprises, lacking the conditions to borrow capital...

"Therefore, the banking system should consider and research to find suitable solutions for this group of enterprises," Deputy Minister Tran Quoc Phuong proposed and emphasized: There must be a solution to deal with the root of the problem. The world economy in general is in recession and the domestic business system is not healthy, so it must be dealt with gradually. Currently, inflation is under control, the macro economy is stable, so it can promote credit growth to help businesses overcome this difficult period.

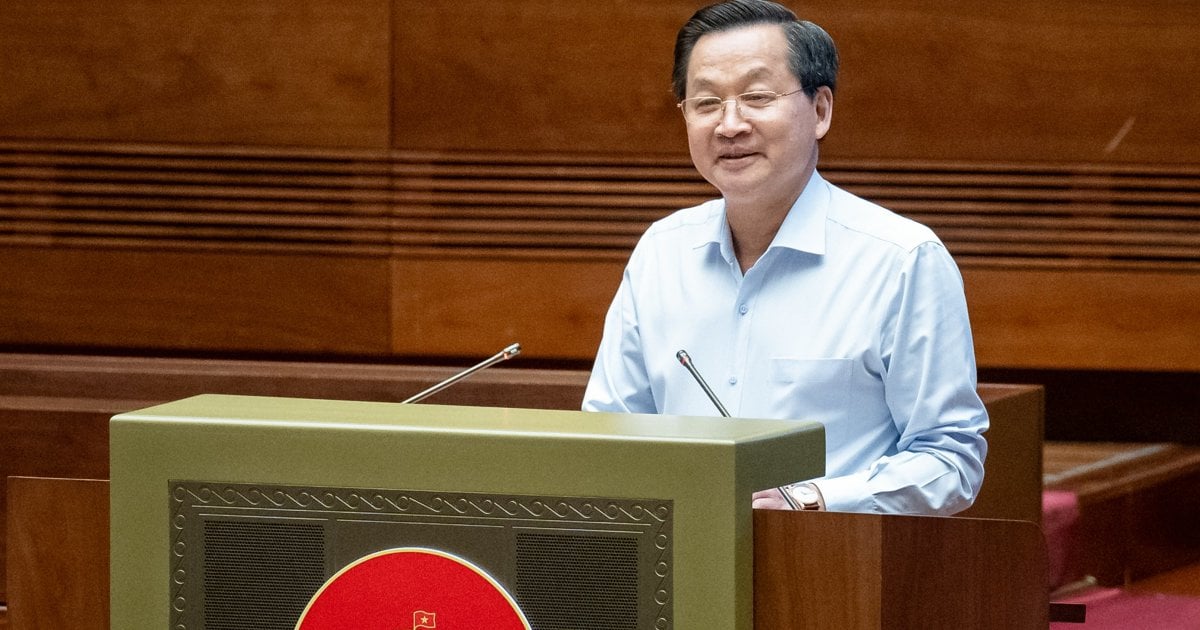

Deputy Governor Dao Minh Tu: In March, April and May 2023, the State Bank continuously adjusted the operating interest rate down 3 times by 0.5-1.5%. Photo: VGP/Quang Thuong

Access to credit: Both businesses and banks must be proactive

According to Deputy Minister of Finance Nguyen Duc Chi, in reality, besides the story about businesses' access to banks, there is another story that "banks are also looking for businesses to lend to. Every bank wants to find good customers to disburse loans. No bank wants to keep money in the safe. Because if they cling to capital, banks will "have difficulty surviving".

Deputy Minister Nguyen Duc Chi emphasized: In operating a socialist-oriented market economy, the most important task of the Government is to maintain macroeconomic stability.

"If there were no timely and effective solutions to control inflation, ensure exchange rates, and not regulate interest rates smoothly like in the past, would we be where we are today? 7-8 months ago, we also hoped to maintain macroeconomic stability like now. The Government has managed the macro economy very well!" Deputy Minister Nguyen Duc Chi emphasized.

Deputy Minister Nguyen Duc Chi said: "Access to credit is the midpoint of the road, both businesses and credit institutions must proactively seek each other, there must be initiative from both sides". However, in the context of reduced "demand", many businesses cannot sell their products so they do not have the need to borrow capital, so solutions need to be patient, hasty is not good. Deputy Minister Nguyen Duc Chi also suggested that the State Bank and commercial banks need to continue to do a better job of communicating information about credit so that society can understand and agree.

Agreeing with the assessment of the current situation, difficulties, and causes in the State Bank's report, Deputy Minister of Justice Dang Hoang Oanh emphasized: "Whatever you do, you must follow the regulations and comply with the law."

It is recommended to review Circular 39 of the State Bank of Vietnam on credit conditions to see if there is any relaxation to help businesses. In the long term, the revised Law on Credit Institutions needs to study and propose a mechanism to be able to "adapt to all changes" in operations.

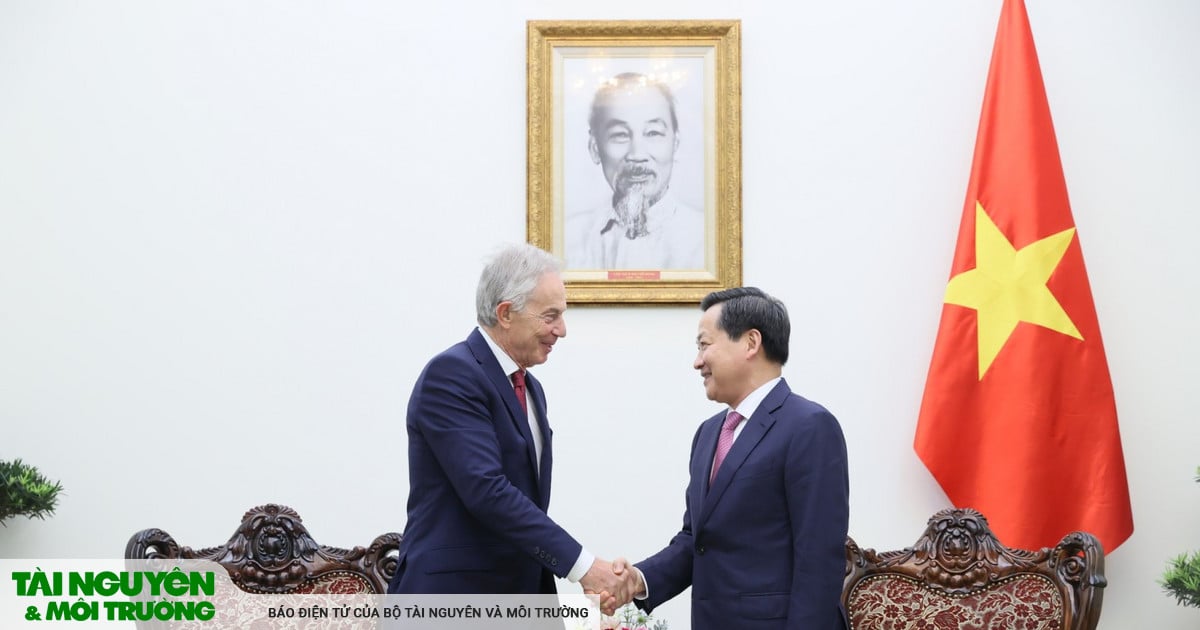

Deputy Prime Minister Le Minh Khai: A reasonable deposit interest rate must be established for a suitable lending interest rate. Businesses must develop before banks can develop. Photo: VGP/Quang Thuong

Banks and businesses "must go the same way"

Speaking at the meeting, Deputy Prime Minister Le Minh Khai emphasized: Banks and businesses "must go the same way". However, banks are particularly important institutions, so they must ensure the safety of the system; the management of the monetary market must also comply with market rules...

The Deputy Prime Minister requested the State Bank to absorb opinions, continue to review regulations and procedures, and immediately remove any subjective issues to best serve the borrowing needs of businesses and people, especially small and medium enterprises.

Deputy Prime Minister Le Minh Khai requested the State Bank to analyze more deeply the factors related to credit provision for enterprises, especially small and medium enterprises; carefully assess the capital absorption capacity of business groups; review policy mechanisms to amend, supplement, complete or propose to competent authorities for consideration and decision;... "If the cause assessment is not thorough and accurate, there cannot be an effective solution," the Deputy Prime Minister emphasized.

Regarding interest rate management, appreciating the positive actions of banks in response to the Prime Minister's direction in implementing solutions to reduce lending interest rates, Deputy Prime Minister Le Minh Khai requested the State Bank and the banking system to continue implementing solutions to reduce operating costs and lower deposit interest rates to establish a reasonable interest rate level to support businesses in accessing capital, overcoming difficulties, and developing production and business.

Deputy Prime Minister Le Minh Khai requested the State Bank and ministries to "respond to policies more quickly" and provide timely information so that public opinion can understand and reach consensus in the process of directing the implementation of monetary policies. Photo: VGP/Quang Thuong

Business development, new bank development

A reasonable deposit interest rate must be established so that the lending interest rate is suitable. Enterprises develop and banks develop. The Deputy Prime Minister requested the State Bank, based on the Government's and Prime Minister's resolutions, to continue implementing solutions to manage credit growth, interest rates, exchange rates, and connect banks and enterprises, etc. to review, complete, and create a synchronous legal environment for credit institutions to operate openly and transparently; create favorable conditions for enterprises to access credit, ensuring the task of stabilizing currency value, macroeconomics, exchange rates, and the safety of the commercial banking system.

Deputy Prime Minister Le Minh Khai requested the State Bank and ministries to "respond to policies more quickly", provide timely information so that public opinion can understand and reach consensus in the process of directing the implementation of monetary policies; strengthen inspection and supervision work, and resolutely and strictly handle cases of harassment, annoyance, corruption, negativity, and group interests in accordance with the law.

Ministries and sectors, according to their assigned functions and tasks, especially the Ministry of Planning and Investment, continue to research and propose policies to perfect institutions and create a common environment for businesses to develop and manage effectively.

Receiving the direction of Deputy Prime Minister Le Minh Khai, Deputy Governor Dao Minh Tu said that in the coming time, the State Bank will continue to direct the commercial banking system to reduce operating costs in order to continue to lower interest rates, share profits with businesses; review and reduce fees; create synchronization for banks; restructure debts, "more urgently"... The State Bank will also revise a number of points of Circular 39/2016/TT-NHNN regulating lending activities of credit institutions and foreign bank branches to customers in the direction of "being more open but not lowering standards".

Source

Comment (0)