► Stock market commentary March 24: VN-Index may face correction pressure

Positive recommendation for BID stock

Vietcap Securities Company (VCSC) maintains its target price at VND47,300/share and adjusts its recommendation from buy to outperform for Vietnam Joint Stock Commercial Bank for Investment and Development (BID).

VCSC has revised up its 2025-2029 profit forecast by 2.8% (+2.0%/+2.0%/-0.6%/+2.6%/+6.5% for 2025/2026/2027/2028/2029, respectively). This upward adjustment is mainly due to a 4.3% decrease in provision expenses in 2025-2029 as VCSC expects the bad debt formation rate to gradually decrease and a 2.5% decrease in operating expenses in 2025-2029 as VCSC expects BID to take advantage of operating leverage from strong revenue growth.

VCSC assumes that BID will issue 262 million shares (equivalent to 3.8% of outstanding shares at the end of 2024) through two separate issuances in February 2025 (1.8% of shares; selling price of VND38,800/share, buyers include SCIC and Dragon Capital) and at the end of 2025 (2.0% of shares; assumed selling price of VND45,000/share). The total expected proceeds will be VND10,900 billion.

Buy recommendation for VPB stock

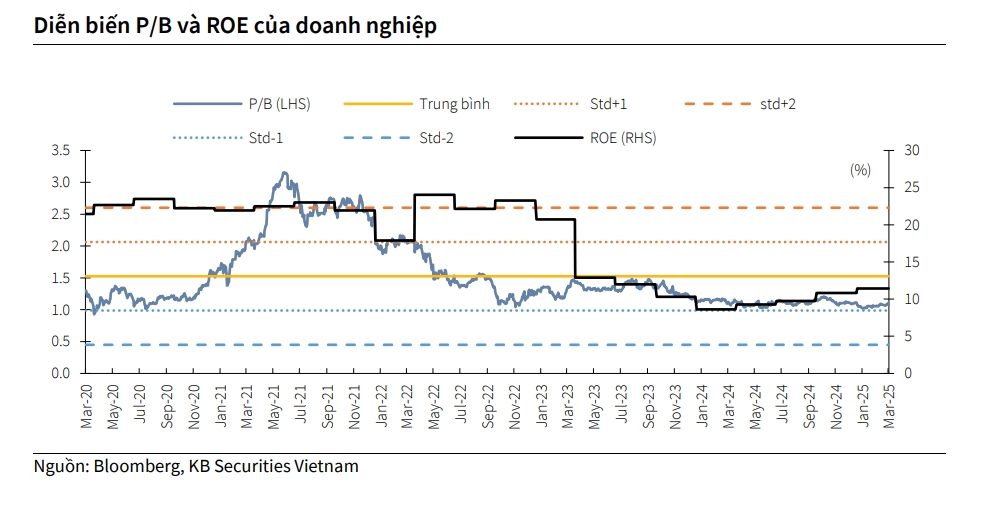

According to KB Securities Vietnam (KBSV), the positive outlook for NIM of Vietnam Prosperity Joint Stock Commercial Bank (VPBank, code VPB) is thanks to the high proportion of retail loans, contributions from FE Credit and improved asset quality. Cost of capital is expected to be controlled thanks to flat deposit interest rates and borrowing advantages when taking over weak credit institutions.

The 2025 profit and credit growth target (20-25%) is relatively feasible. VPB is supported by economic recovery, credit expansion from GPBank and increased income from bad debt settlement under Resolution 42.

KBSV recommends buying VPB shares with a target price of VND25,700/share. Support zone/buy point 1 is VND19,000-19,500/share, expected profit is 31%; support zone/buy point 2 is VND17,000-17,600/share, expected profit is 46%.

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia received the delegation of Nhan Dan Daily](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/cdb71275aa7542b082ec36b3819cfb5c)

![[Photo] Prime Minister Pham Minh Chinh meets with the Ministry of Education and Training; Ministry of Health on the draft project to be submitted to the Politburo](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/c0e5c7348ced423db06166df08ffbe54)

![[Photo] Nhan Dan Newspaper Youth Union visits Vietnam Military History Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/374e4f70a35146928ecd4a5293b25af0)

![[Photo] General Secretary To Lam chairs the Standing Meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/839ea9ed0cd8400a8ba1c1ce0728b2be)

Comment (0)