Lien Viet Post Joint Stock Commercial Bank (LPBank) has just announced the Resolution of the Board of Directors on the issuance plan, issuance interest rate and costs related to the issuance of individual bonds in 2023 - package 02.

Specifically, LPBank plans to issue a maximum of VND8,000 billion in private bonds to the market. The bank plans to issue all bonds in December 2023. Of which, the first issuance will be VND4,000 billion, the second and third issuances will be VND2,000 billion.

Non-convertible, unsecured and unwarranted bonds. The face value of each bond is 1 billion VND.

Bonds have a term of 2 to 3 years. The interest rate will be decided by the bank depending on market conditions at the time of bond issuance, in accordance with the regulations of the State Bank in each period.

However, for a 2-year term, the maximum first-year interest rate is 5.4%/year. For a 3-year term, the maximum first-year interest rate is 6.2%/year.

The subjects buying and owning bonds are organizations (including credit institutions and foreign bank branches) that meet the conditions of being professional securities investors according to current law, except in cases of implementation according to court judgments and decisions that have come into legal effect, arbitration decisions or inheritance according to law.

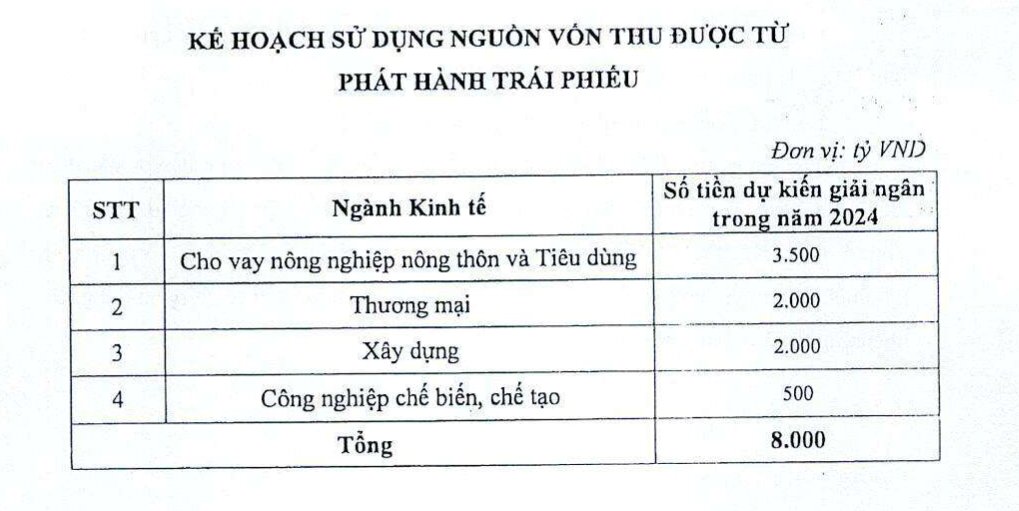

Plan to use the capital obtained by LPBank.

LPBank selected LPBank Securities JSC as the consulting organization for the bond offering documents. The purpose of issuing bonds is to lend to customers according to regulations.

LPBank plans to use the proceeds from the bond issuance to supplement medium- and long-term mobilized capital to meet customers' medium- and long-term borrowing needs. The actual disbursement plan will be flexibly adjusted (including the amount and the area of capital use) according to actual operations, customers' medium- and long-term borrowing needs and LPBank's economic lending progress.

Specifically, LPBank plans to use VND3,500 billion for lending to rural agriculture and consumption, VND2,000 billion for trade; VND2,000 billion for construction and VND500 billion for processing and manufacturing industries.

In case of disbursement according to schedule, the capital collected from the issuance of temporarily idle bonds will be used by LPBank to lend to customers with short-term capital needs.

The time of disbursement of capital from bond issuance in each batch will be based on the customer's credit disbursement needs .

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)