The State Bank of Vietnam (SBV) has just announced some information on banking performance results in the first 6 months of 2023 and deployed tasks for the last 6 months of 2023.

Accordingly, the State Bank has operated monetary policy firmly, flexibly, proactively, promptly and effectively, contributing to controlling inflation, stabilizing the macro-economy and supporting and prioritizing growth promotion.

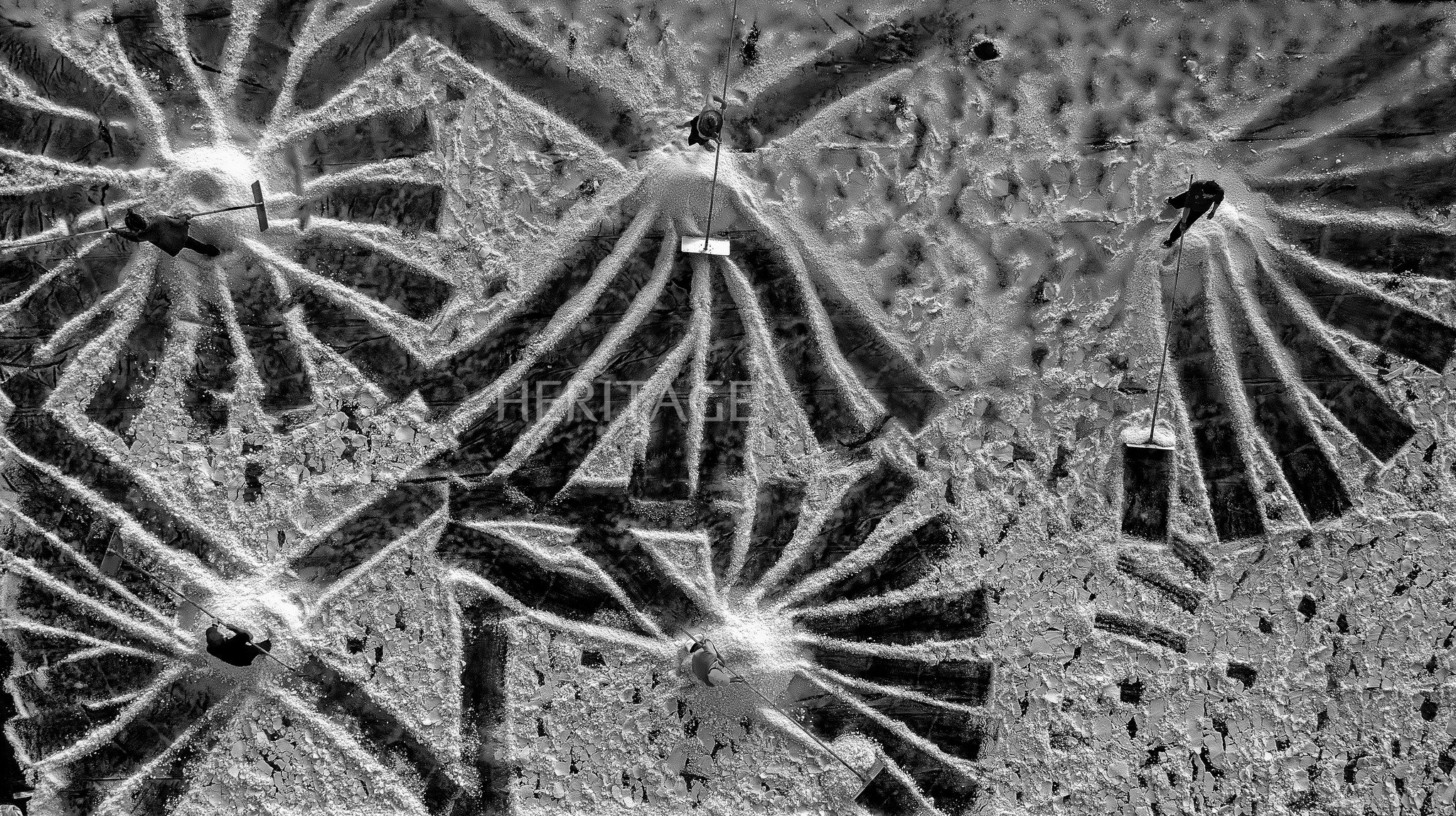

By the end of June 2023, the average deposit and lending interest rates of new transactions in VND of commercial banks will decrease by about 1.0%/year compared to the end of 2022. Illustrative photo

Regarding interest rate management: In the context of the world interest rate level continuing to increase and anchored at a high level, implementing the policy of the National Assembly, the direction of the Government and the Prime Minister on reducing lending interest rates to remove difficulties for the economy, businesses and people, the State Bank has continuously adjusted the interest rates down 4 times with a reduction of 0.5-2.0%/year.

Market interest rates have tended to decrease. By the end of June 2023, the average deposit and lending interest rates of new transactions in VND of commercial banks (CBs) decreased by about 1.0%/year compared to the end of 2022; CBs have proactively adjusted and implemented preferential credit programs/packages to reduce lending interest rates by about 0.5-3.0%/year depending on the customer for new loans.

Regarding exchange rate management: The State Bank has closely followed the market situation to flexibly and appropriately manage exchange rates, synchronously coordinating monetary policy tools to stabilize the foreign exchange market, contributing to controlling inflation and stabilizing the macro-economy. The domestic foreign exchange market and exchange rates have been relatively stable, market liquidity is smooth, and legitimate foreign currency needs are fully met. The State Bank has purchased foreign currency from credit institutions to supplement the state foreign exchange reserves.

In credit management: From the beginning of the year, the State Bank has allocated credit growth targets to credit institutions and directed credit institutions to direct credit to production and business sectors, priority sectors and economic growth drivers according to the Government's policy, strictly control credit to sectors with potential risks, implement solutions to facilitate customers in accessing credit capital; diversify banking products and services, simplify lending procedures, publicly and transparently list lending procedures and processes; improve the efficiency of appraisal and assessment of customer creditworthiness to increase unsecured lending;...

Implementing the directions of the Government and the Prime Minister, the State Bank has proactively and synchronously deployed many specific solutions to help remove difficulties for businesses and people.

Source

Comment (0)