The State Bank of Vietnam continuously offers to buy valuable papers while reducing the interest rate on issuing treasury bills, thereby sending a strong signal about the direction of interest rate management towards reducing the market interest rate level.

Excess liquidity, interbank interest rates decrease

Implementing the direction of the Government and the Prime Minister in interest rate management, the State Bank of Vietnam (SBV) has implemented management solutions, thereby supporting credit institutions to access low-cost capital sources to create conditions to continue reducing lending interest rates.

Specifically, the State Bank continuously conducts daily term purchase offers for valuable papers, diversifies and extends the term of purchase offers, and increases the volume of purchase offers to promptly and fully meet the liquidity needs of credit institutions.

At the same time, carry out the purchase of valuable papers with maturities of up to 91 days to inject longer-term liquidity into the system, thereby supporting credit institutions to promptly supply capital for production and business activities.

Along with that, the State Bank continuously reduced the interest rate on issuing State Bank bills from 4.0% to 3.1%/year on March 4, gradually reduced the volume and gradually stopped issuing bills from March 5.

The above move sends a strong and positive signal about the SBV's direction in reducing market interest rates.

As a result, the liquidity of the credit institution system is guaranteed and abundant, the monetary market psychology is strengthened, and the interbank interest rate level tends to decrease.

Short-term trading interest rates on the interbank market on March 5 decreased and are currently around 4.0%/year, closely following the SBV's bid interest rate for valuable papers.

A series of banks reduce deposit interest rates

After the State Bank thoroughly grasped and directed the entire system of credit institutions to implement solutions to stabilize deposit interest rates and reduce lending interest rates as directed, credit institutions simultaneously adjusted to reduce deposit interest rates; at the same time, they launched many preferential credit programs with reasonable interest rates.

As of March 5, 14 credit institutions have adjusted deposit interest rates down by 0.1-0.7%/year and for most terms, specifically:

BVBank reduced 0.1-0.4%/year for terms from 6 to 60 months; MSB reduced 0.2%/year for terms from 13 to 36 months; VietBank reduced 0.1-0.4%/year for terms from 1 to 9 months and 12 months; Saigonbank reduced 0.2%/year for terms from 12 to 36 months; Kienlongbank reduced 0.2-0.7%/year for terms from 1 to 60 months;

VIB reduced 0.1%/year for 1-36 month term; BaoVietBank reduced 0.1-0.3%/year for 12-36 month term; Bac A Bank reduced 0.1-0.2%/year for 1-36 month term; Viet A Bank reduced 0.1% for 12-36 month term; PGBank reduced 0.2% for 24,36 month term;

Eximbank reduced interest rates by 0.1-0.3%/year depending on the term in some programs; LPBank reduced 0.1% for terms from 1-60 months; NCB reduced 0.1%/year for terms from 1-36 months; Nam A Bank reduced 0.3%/year for terms of 1, 3, 4, 5 months, reduced 0.1%/year for terms of 6-8 months and 10-36 months.

| A SERIES OF BANKS HAVE JUST REDUCED INTEREST RATES AFTER THE DIRECTION OF THE STATE OF INDUSTRY FROM FEBRUARY 25, 2025 | ||

| BANK | DISCOUNT LEVEL | TERM |

| NCB | 0.1% | 1 - 36 months |

| Nam A Bank | 0.3% | 1, 3, 4, 5 months |

| 0.1% | 6 - 8 months and 10 - 36 months | |

| BVBank | 0.1 - 0.4% | 6 - 60 months |

| MSB | 0.2% | 13 - 36 months |

| VietBank | 0.1 - 0.4% | 1 - 9 months, 12 months |

| Saigonbank | 0.2% | 12 - 36 months |

| KienlongBank | 0.2 - 0.7% | 1 - 60 months |

| VIB | 0.1% | 1 - 36 months |

| BaoVietBank | 0.1 - 0.3% | 12 - 36 months |

| Bac A Bank | 0.1 - 0.2% | 1 - 36 months |

| Viet A Bank | 0.1% | 12 - 36 months |

| PGBank | 0.2% | 24 - 36 months |

| Eximbank | 0.1 - 0.3% | 6 - 9 months and some programs |

| LPBank | 0.1% | 1 - 60 months |

Credit institutions have launched many product packages with preferential interest rates to stimulate credit demand, such as: ACB launched the preferential loan interest rate package "First Home" for customers aged 18-35 with preferential interest rates from only 5.5%/year, loan term up to 30 years;

LPBank launches the package "Easy settlement - stable future" for young customers to borrow to buy or repair houses with interest rates from only 3.88%/year, loan term up to 35 years;

HDBank announced a preferential credit package worth 30,000 billion VND, applicable to individuals and households wishing to buy houses in 24 major cities, especially young people with interest rates from only 4.5%/year, loan term up to 50 years, principal grace period up to 5 years, helping customers easily balance their finances;

SHB has launched a preferential credit package of VND16,000 billion to serve the home buying needs of customers, especially young people, with interest rates starting from only 3.99%/year, with no principal repayment for up to the first 60 months.

Source: https://vietnamnet.vn/nhnn-phat-tin-hieu-manh-me-dinh-huong-dieu-hanh-lai-suat-2377748.html

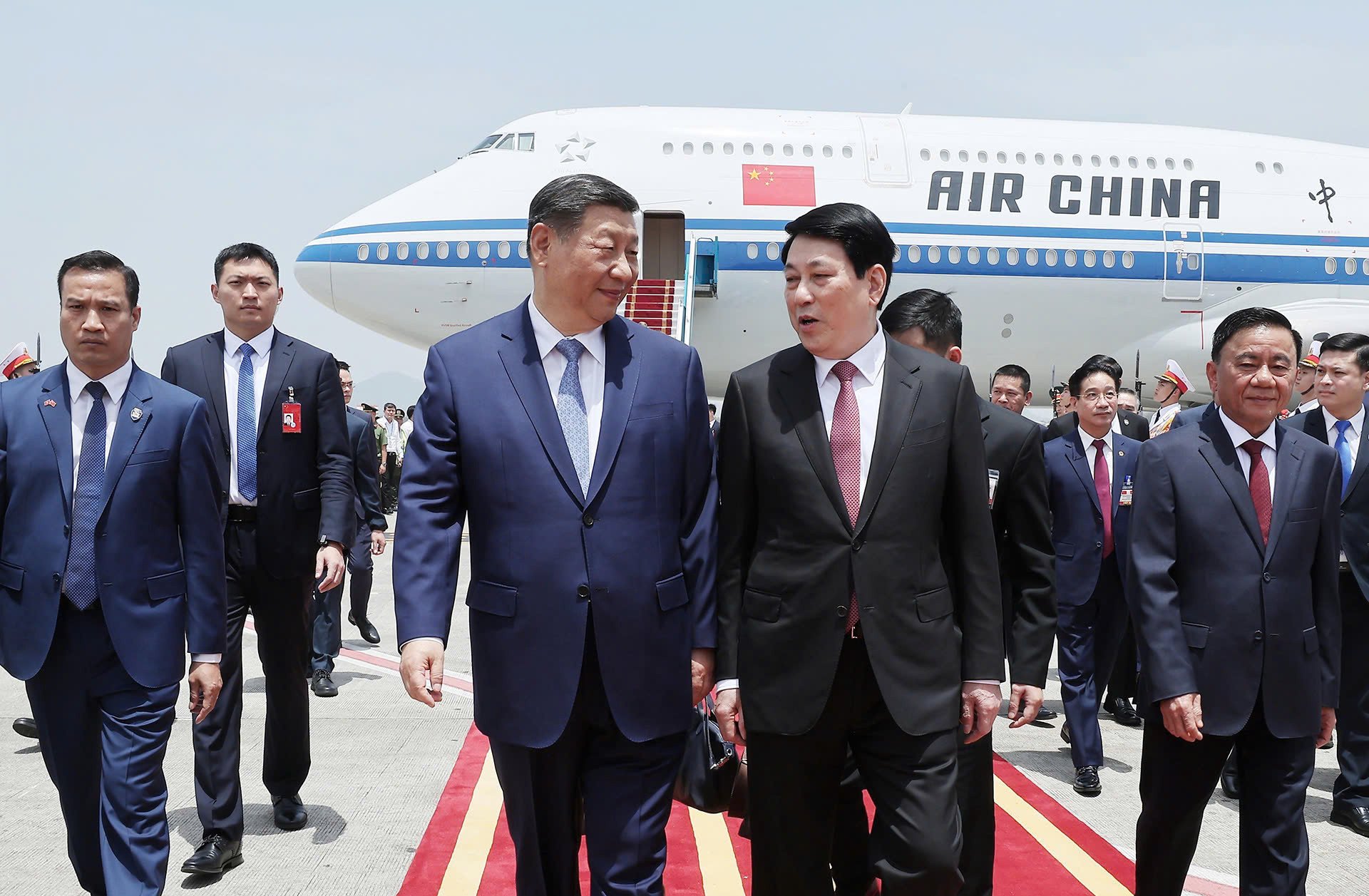

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

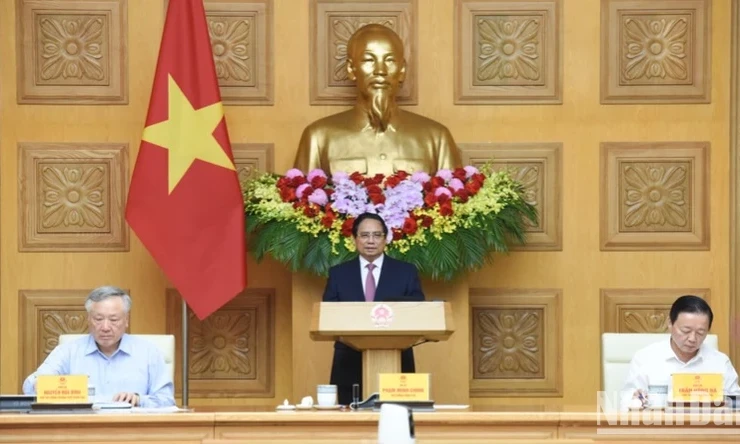

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)