In a speech at a fundraising event in June 2023 in Kentfield, California (USA), US President Joe Biden affirmed: "We always talk about China as a great power, but China is having significant problems."

On the contrary, according to the head of the White House, America is doing better and better. The industrial migration of the past decades is a sign of the strength of this country.

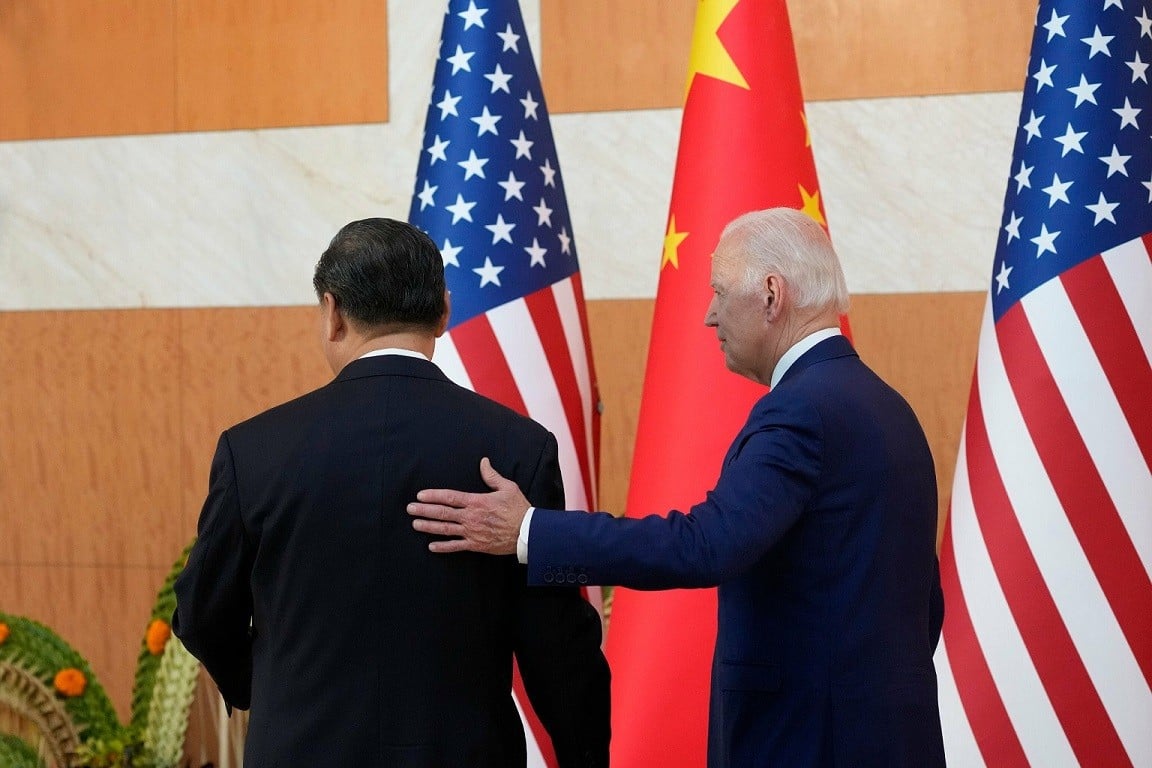

|

| US President Joe Biden said that China is facing significant problems. (Source: Handelsblatt) |

The balance of power shifts

The balance of power in the struggle for global economic and political dominance in the 21st century is shifting. For a long time, it seemed that China's rise to become the world's largest economic power was unstoppable.

But now the picture is not so clear. The World Bank forecasts that China’s economy will grow by an average of 4% a year until 2030, unless Beijing makes sweeping reforms.

While the world's second-largest economy could catch up with the US in the next 15 years, it will "not be significantly ahead", according to Alicia Garcia Herrero, chief Asia-Pacific economist at French investment bank Natixis. She believes that from 2035, growth rates in both countries will be similar.

This means that “no economy will outperform the other,” she said, but she also stressed that there are many uncertainties in the longer-term scenario, most notably the adverse impact of China’s rapidly aging population.

Expert Mikko Huotari, head of the German Merics Institute for China Studies, even said that China is "at a turning point in its economic development" and will face "a lost decade" ahead.

The Asian nation's economic rise has spanned more than 40 years, and the West has played a crucial role in it. But many forecasts suggest that rise is coming to an end.

The economic race between China and the US is not just about increasing prosperity in each country. How each country performs in different areas has a direct impact on the geopolitical influence of the two superpowers and the ideologies they represent – and thus, on the international order.

The more successful China becomes economically, the more likely other governments will side with Beijing politically. The more technologically advanced China becomes, the less it will have to consider partnerships with countries like the United States, on which Beijing still depends technologically.

Washington has always wanted to contain Beijing's power. Meanwhile, China sees the West as in decline and wants to expand its influence globally.

Political power stems from economic and technological strength. But it is also important to consider where the two superpowers currently stand in these areas; and how the balance of power has changed.

Beijing needs a 'new China story'

On the US side, investment packages worth hundreds of billions of dollars under the Inflation Reduction Act (IRA), the CHIPS and Science Act and the infrastructure investment package, financed with new debt, have created a real boom in the investment sector as well as in industry.

Private companies have announced $503 billion in new investments so far during President Biden’s term, according to White House data. Compared to the pre-Covid-19 pandemic period, the US economy grew 5.4%, while the average growth in other countries in the Group of Seven (G7) was only 1.3%.

According to Moody's chief economist Mark Zandi, the Biden administration's economic policies have indeed succeeded in quickly returning the economy to normal after the pandemic, helping to increase competitiveness and productivity in the long term. The high inflation rate in the US has also decreased faster than expected and is now only around 3%.

But the boom has had its downside. America's total debt is now 120% of GDP, higher than Spain, Portugal and France.

However, Zandi said that American households and private companies have recently taken on less debt, which is a good sign. He said that the US economy will not fall into recession, but will probably gradually slow down after a strong boom.

|

| The global economy in general is weakening and demand for "Made in China" products is decreasing worldwide. (Source: Cafe Biz) |

In China, by contrast, the initial euphoria quickly faded after strict Covid-19 restrictions were lifted in early December. Instead, unusual signs are spreading across the Asian country.

Instead of spending and investing, people and businesses are actively hoarding savings. This makes the Chinese economy recover more slowly than expected after the pandemic. In addition, the global economy in general is weakening and demand for "Made in China" products is decreasing worldwide.

Lower demand at home and abroad has caused consumer prices to fall sharply in China. While households in many other countries are facing high inflation, deflation fears are growing in Asia’s No. 1 economy. As consumers and companies expect prices to fall, they continue to delay investment, which in turn weakens economic growth.

China's economy grew 6.3% year-on-year in the second quarter of this year, according to official figures from Beijing. But a big reason for the relatively high growth rate is primarily due to the comparison with the same period last year, when the prolonged pandemic lockdown paralyzed much of the country's economy.

Compared to the first three months of 2023, China's second-quarter GDP growth was just 0.8%. China's strong comeback from the pandemic has temporarily failed to materialize.

The most important thing is to regain the trust of Chinese consumers and businesses both at home and abroad, said Xu Bin, a professor at the China Europe International Business School (CEIBS) in Shanghai. To do that, Beijing needs a “new China story.”

In the first 30 years of the reform and opening-up era, high growth rates not only motivated the Chinese people but also attracted huge foreign investments. But it is clear that the country's previous growth model is reaching its limits, and this is not only demonstrated by the pandemic.

Since the 2008 global financial crisis, China's economic growth has been largely driven by state and private investment, which has flowed mainly into infrastructure and real estate.

Over the past decade, investment has been the basis for about 40 percent of China’s economic output. Before the property crisis, the real estate market contributed as much as a quarter of China’s economic output, both directly and indirectly. Economists say this is unsustainable in the long run.

As a result, China says it needs to move away from “illusory growth” and toward “real growth.” Now, the world’s second-largest economy is focusing on a different kind of investment: less concrete, more green technology.

China is now moving more towards green and technology sectors, according to chief economist Louise Loo from British analysis firm Oxford Economics.

For example, with massive state subsidies, Chinese manufacturers have succeeded in becoming global market leaders in battery technology. However, it remains to be seen whether the industry can operate profitably after the government subsidies end.

Beijing has yet to approve any major stimulus packages, which could be a sign that China is not only willing to endure the hardships of its economic transformation, but also confident that it will succeed.

Source

Comment (0)