Dr. Can Van Luc - Chief Economist of BIDV and Director of BIDV Training and Research Institute - Photo: VGP/Thanh Huyen

Need to clarify the concepts of digital currency

Sir, currently there are some concepts of money that not everyone can distinguish the difference such as digital money, electronic money, virtual money, encrypted money... Can you clarify more about these concepts?

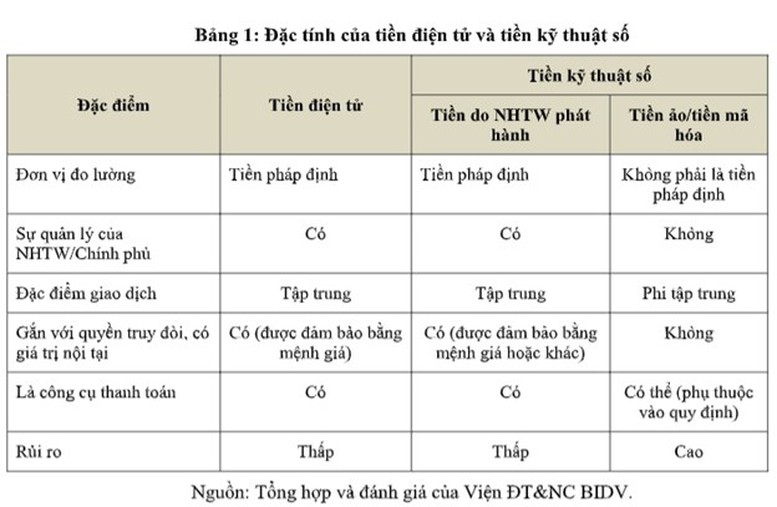

Dr. Can Van Luc: Digital currency is an umbrella category, including all types of currencies that exist in the form of .

According to the European Central Bank (ECB), electronic money is a monetary value stored on an electronic device that is commonly used to make payment transactions and transfers to each other. It is legal currency, so it has been legalized and widely used in the world and in each country. Electronic money in Vietnam has also existed for a long time and is legalized (in the Law on Credit Institutions 2024 and Decree 52/2024/ND-CP...).

A virtual currency is "an unregulated, non-legal digital currency, issued by software developers who are often also in control of the system; used and accepted as payment among members of a particular virtual community" (according to the ECB). A crypto currency is a type of virtual currency (such as bitcoin, ethereum, XRP, Tether, Pi…).

Thus, digital money has two forms: one is legal currency (if issued by the central bank of a country); or not legal currency, unofficial (if issued by other individuals or organizations, such as Bitcoin, onecoin, ethereum ...), can be called virtual money or cryptocurrency.

4 core principles in building a legal framework

In your opinion, what are the core principles that Vietnam needs to apply in building a legal framework for digital currency, in order to both control risks and promote the development of this field?

Dr. Can Van Luc: I think that to effectively manage digital currency, Vietnam needs to rely on four important principles:

Firstly, the legal framework must closely follow the guidance of the Party and State, aiming to create and promote development in parallel with risk control.

Second: It is necessary to remove immediate barriers while having a long-term vision to ensure policy sustainability. The legal framework needs to be stable, highly predictable and not cause a cost burden on businesses and people.

Third: We must stay ahead of major global trends, especially changes related to science and technology, digital transformation, digital economy and digital assets. The early promulgation of a legal framework will help Vietnam take advantage of development opportunities, while minimizing risks and promoting safe and healthy economic operations.

Fourth: Ensure feasibility, effectiveness and efficiency. When issued, policies must be highly applicable, easy to implement and not create additional cost burdens. At the same time, they must be consistent with international commitments as well as Vietnam's current legal system.

Many countries have issued central bank digital currencies (CBDC). In your opinion, should Vietnam research and implement a national digital currency? If so, how will this impact the economy?

Dr. Can Van Luc: I think that researching and implementing a national digital currency is necessary. Regarding the implementation of CBDC, I suggest that Vietnam can learn from China's experimental model: Piloting in some localities or through large commercial banks, then summarizing, evaluating and deciding whether to expand or not.

As an economic expert, what suggestions and recommendations do you have for the Government in perfecting the legal framework for digital currency, to both seize opportunities and avoid the risk of falling behind after policy development?

Dr. Can Van Luc: In the next 5-10 years, the global trend of digital currency development will have a strong impact on Vietnam. In order not to fall behind, I think we need to carry out four key, comprehensive tasks such as:

Firstly, build a legal framework for digital assets in general and digital currencies in particular, in the direction of testing, then evaluating and finalizing, to decide whether to expand or narrow down. In the immediate future, the Government also needs to soon issue a Controlled Testing Mechanism (Sandbox) in Fintech (financial technology) activities in the banking sector, then in the fields of securities, insurance, investment funds, etc. to both create development and control risks.

Second, the trend of digital currency issued by the Central Bank (CBCD) will become more and more popular. Therefore, Vietnam needs to soon conduct full and serious research and have a suitable approach to digital currency in general and CBCD in particular, including CBCD issued by other countries and wishing to be traded and accepted in Vietnam.

Third, the Government needs to license the exchanges and set clear criteria to ensure the safety of investors. In the long term, we need to consider taxing digital currency transactions, both on and off the exchange. We need to pay attention to and improve the understanding of people, businesses, localities, and management agencies. Build a broad financial education program on digital assets and digital currencies for people, businesses, and management agencies.

Finally, there needs to be close coordination between agencies, ministries and sectors to ensure that policies related to KTS are implemented in a synchronous and effective manner. This coordination will help limit overlaps or omissions in management, while creating a premise for sustainable development of this field in the future.

Thanks for sharing!

Ngo Thanh Huyen

![[Photo] General Secretary To Lam and Prime Minister Pham Minh Chinh attend the first Congress of the National Data Association](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/22/5d9be594d4824ccba3ddff5886db2a9e)

Comment (0)