According to the recently published electricity industry report of VNDirect Securities, the analysis team pointed out that the promulgation of the VIII Electricity Plan has clarified the picture of Vietnam's electricity industry in the coming time, while also opening up bright growth opportunities for businesses in this industry group.

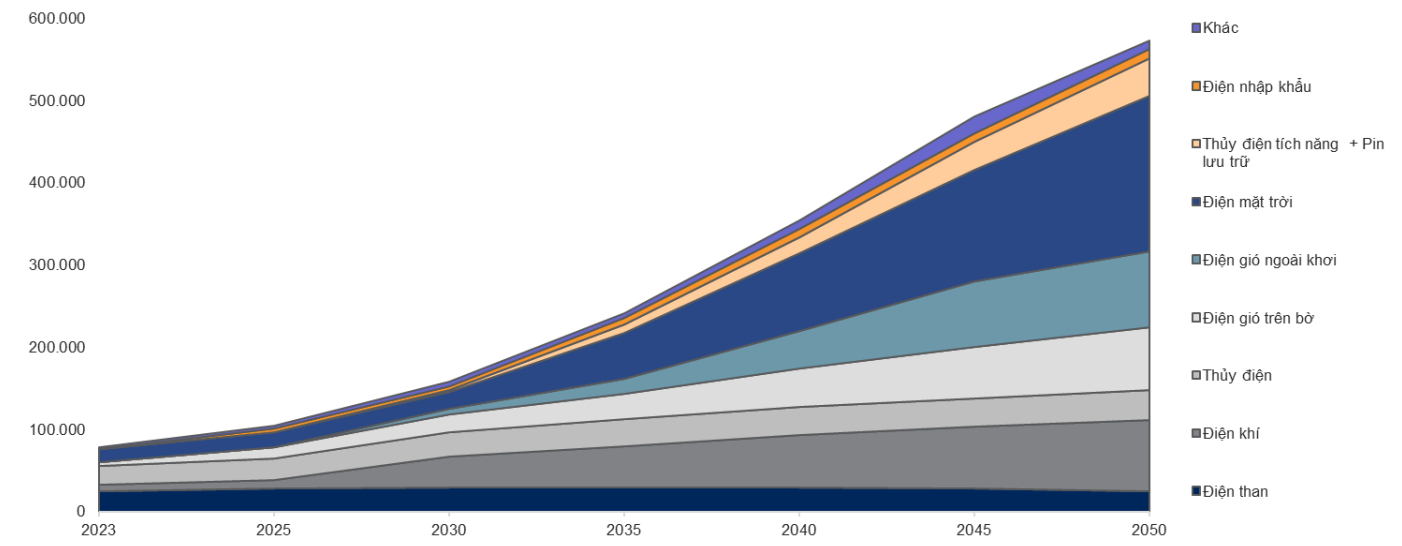

On May 15, 2023, the Prime Minister officially approved the Power Plan VIII, opening a new chapter for Vietnam's electricity industry, officially eliminating about 13,220 MW of coal power. Accordingly, coal power is expected to achieve a low compound growth rate of 2% in the 2021-2030 period and then decrease by 1% in the 2030-2050 period, accounting for 19% and 4% of total power capacity, respectively.

Regarding gas-fired power, this will be the spearhead in Vietnam's development plan for the 2021-2030 period with a compound growth rate of 26%, accounting for 27% of total power capacity. In 2030-2050, gas-fired power development will slow down to 4%, accounting for 15% of total capacity in 2050.

In addition, wind power is also a top development target in both the short and long term. Of which, onshore wind power will grow at a compound rate of 25% in 2021-2030, and 6% in 2030-2050, accounting for 14% and 13% of total capacity in this period, respectively.

The 8th National Power Plan prioritizes the development of wind and gas power in 2021-2030 after further promoting the development of renewable energy after 2030 (Unit: MW) (Source: VNDirect).

Vietnam is expected to develop the first 6,000MW of offshore wind power from now until 2030, then grow strongly by 15% in 2030-2050, accounting for 16% of total power capacity.

Solar power is expected to grow at a slower pace after the period of rapid growth in 2020-2021. However, the Government still encourages the development of solar power for self-consumption purposes. Accordingly, solar power capacity will increase modestly in 2021-2030, then increase sharply by 13% from 2030-2050, accounting for 33% of total capacity.

VNDirect emphasized that businesses in the field of electricity infrastructure construction will benefit most clearly thanks to the relatively high workload in the plan of Power Plan VIII, especially in the electricity and renewable energy sectors.

Accordingly, the power construction and installation industry group including power lines and transformer stations will also record a corresponding increase to ensure the absorption capacity and efficiency of the system.

However, for the renewable energy group, the new renewable energy pricing policy is the factor that makes the prospects of this industry group clearer.

Some of the prominent listed enterprises in the power infrastructure construction group including PC1 Group Corporation (HoSE: PC1) , FECON Corporation (HoSE: FCN) , Power Construction Consulting Corporation 2 (HoSE: TV2) will be the enterprises that benefit the earliest from this argument.

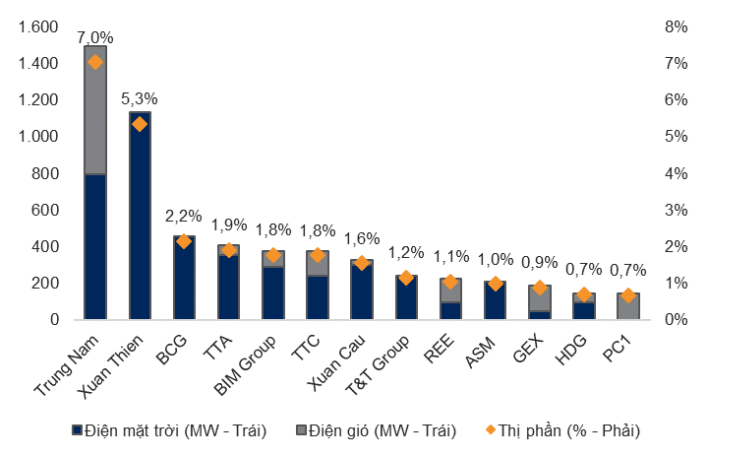

Some leading renewable energy enterprises will have advantages in the next development stage of this industry group (Source: VNDirect).

In the longer term, Vietnam Oil and Gas Technical Services Corporation (HNX: PVS) is also expected to benefit from its participation in the offshore wind power construction sector, with experience in recent projects such as Thang Long and La Gan.

Electricity enterprises in general and LNG electricity in particular have brighter prospects due to owning approved projects in the Power Plan VIII including Nhon Trach 3&4 (undertaken by Vietnam Oil and Gas Power Corporation (HoSE: POW); or Long Son LNG project managed by Power Generation Corporation 3 (HoSE: PGV) and Power Construction Consulting Joint Stock Company 2 (TV2); O Mon 3,4 project of Power Generation Corporation 2 (GE2).

PetroVietnam Gas Corporation (HoSE: GAS) will also benefit from this development phase due to the development of LNG port warehouse projects.

"The approved Power Master Plan VIII will accelerate the progress of long-stalled billion-dollar gas field projects such as Block B and Blue Whale in the coming years to ensure domestic gas sources and reduce dependence on LNG imports for power generation in Vietnam," the analysis group said .

Source

Comment (0)