Profits and debt skyrocket

Techcom Securities Corporation (TCBS) has just announced its business results for the third quarter of 2023 and the first 9 months of the year.

In the third quarter, TCBS recorded pre-tax profit of VND1,148 billion, more than double that of the previous quarter and a sharp increase compared to VND730 billion in the same period last year. Accumulated for the first 9 months, pre-tax profit reached more than VND2,148 billion, exceeding the annual plan by 7%.

Brokerage revenue decreased by 35% year-on-year to VND147 billion. Revenue from margin lending and sales advances increased slightly to nearly VND424 billion.

In the third quarter, Techcom Securities recorded strong growth again from the capital source and bond distribution business segment. This segment contributed VND 793 billion to TCBS's total operating revenue, accounting for nearly 50%.

As of September 30, Techcom Securities' total assets reached nearly VND38.4 trillion, up 33% year-on-year. Owners' equity increased sharply from nearly VND10,990 billion at the end of 2022 to VND22,960 billion at the end of the third quarter of 2023 thanks to an additional VND9,192 billion in equity surplus.

Outstanding margin loans and sales advances reached VND 12,827 billion, up 26% compared to the end of the second quarter of 2023.

On the other hand, TCBS's outstanding short-term loans and financial leases skyrocketed from VND6,872 billion at the end of 2022 to VND13,142 billion at the end of September 2023. The outstanding loans increased sharply in the context of a sharp decrease in payables for securities trading activities from VND5,305 billion to more than VND42 billion. This is mostly the amount that TCBS received to manage under the "Profitable Safe" program, which ended on May 24, 2023.

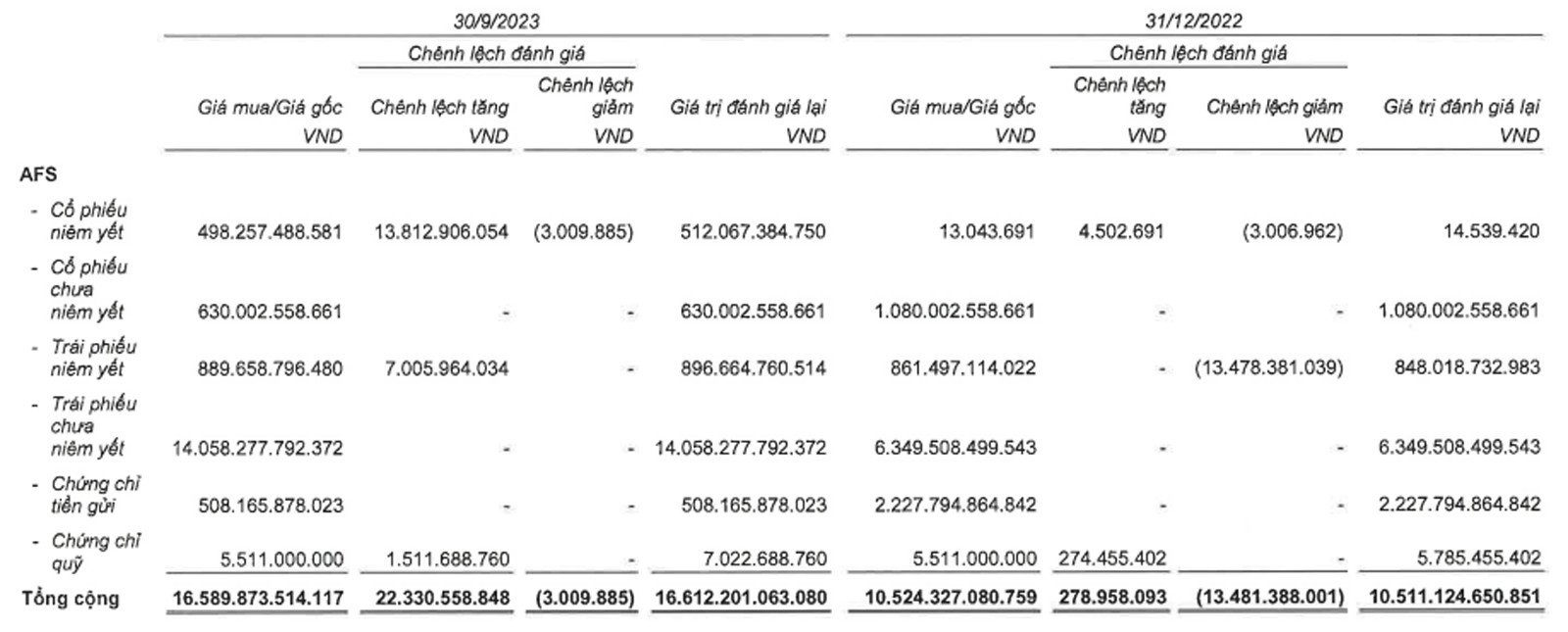

A noteworthy point is that, in the first 9 months of the year, Techcom Securities recorded a sharp increase in the value of unlisted bonds held by enterprises, from nearly VND 6,350 billion at the end of 2022 to VND 14,058 billion at the end of the third quarter of 2023.

Thus, in 9 months, TCBS bought an additional 7,708 billion VND of unlisted corporate bonds.

Pump money through bonds for which businesses?

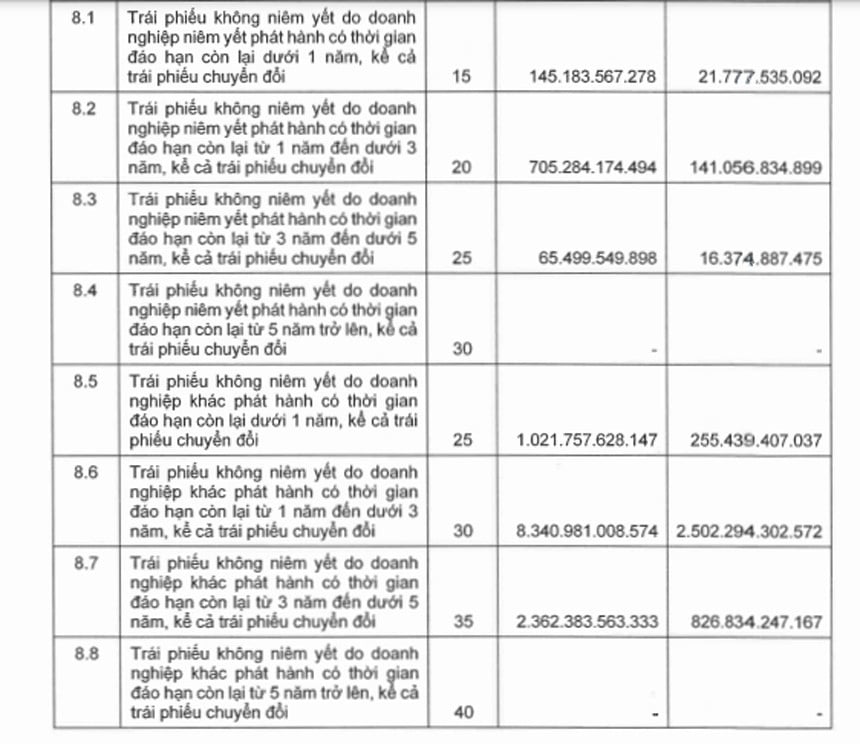

In the third quarter 2023 financial report, TCBS did not explain which unlisted companies this securities company purchased bonds from.

However, it can be seen that at the stage when the Government has policies to support this market and the issue of corporate bonds has become less sensitive, financial institutions have started to return to inject capital into businesses through this channel.

By the end of 2022, TCBS recorded holding nearly VND6,350 billion in unlisted bonds. By mid-2023, this figure was VND12,570 billion. And by the end of the third quarter of 2023, it was VND14,058 billion.

The corporate bond market still has its own life. Many loyal customers of banks and securities companies need to mobilize capital even though interest rates in the banking system are falling rapidly and credit institutions show signs of having “excess money”. Meeting the standards for borrowing capital is not easy, especially in difficult times when the financial health of businesses is often very weak.

The names of unlisted enterprises that have issued bonds to TCBS will be announced in the 2023 audit report.

According to the 2022 audit report, out of nearly VND 6,350 billion of unlisted bonds, more than VND 3,167 billion was spent by TCBS to buy bonds of Saigon Investment and Development Corporation, nearly VND 1,217 billion to buy bonds of Vinfast Production and Trading Company Limited and VND 676 billion to buy bonds of Golden Hill Investment Corporation...

Saigon Investment and Development Corporation is a secretive enterprise but has the third largest asset scale in Vietnam, only after Vinhomes of billionaire Pham Nhat Vuong and Novaland of Mr. Bui Thanh Nhon.

Saigon Investment and Development Corporation is known as the investor of the Saigon Binh An project (commercial name The Global City). Meanwhile, the project developer is Masterise Homes, a member of Masterise Group.

Masterise, meanwhile, is known as a real estate company related to Techcombank, owned by Chairman Ho Hung Anh, a billionaire who also started his career in Eastern Europe.

In a report in mid-2023, Techcom Securities said that the risk ratio of unlisted bonds of unlisted enterprises is from 25-35%. The size of these amounts is more than VND 11,800 billion, equivalent to a risk value of VND 3,584 billion.

The financial report for the first 6 months of 2023 shows that by the end of the second quarter of 2023, Saigon Investment and Development had a negative equity of nearly VND 1,557 billion. This enterprise has a total debt of up to VND 97,000 billion (nearly USD 4 billion). Outstanding bonds are more than VND 6,500 billion.

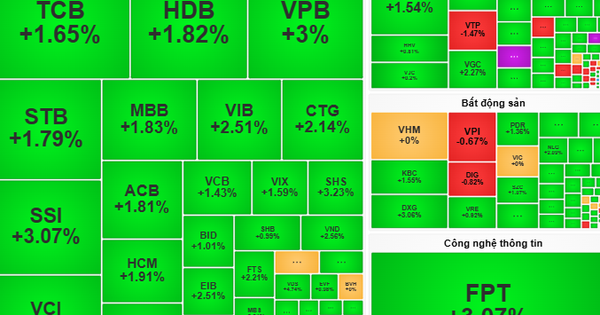

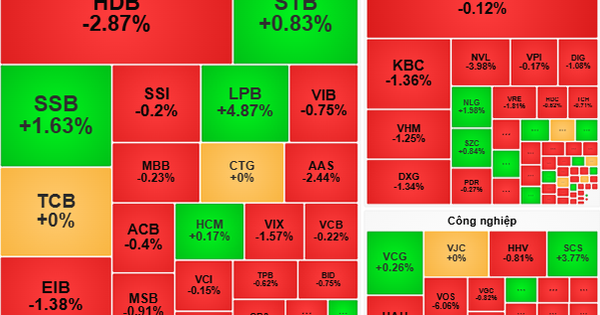

Stocks in the third quarter increased sharply, securities companies rushed to report profits

Many securities companies (SCs) announced a sharp increase in profits in the third quarter of 2023 amid a strong stock market rally during this period. In addition to TCBS with a profit of more than VND 1,100 billion, VIX Securities recorded a 2.4-fold increase in pre-tax profit over the same period to VND 248 billion. In the first 9 months, VIX's pre-tax profit increased by 90% to VND 964 billion.

MB Securities (MBS) recorded a profit after tax of VND 166 billion in the third quarter of 2023, up 37% over the same period. Accumulated profit after tax in the first 9 months decreased by 7% to VND 411 billion.

Dragon Viet Securities (VDS) reported a 3-fold increase in after-tax profit in the third quarter of 2023 compared to the same period last year to VND92 billion. Accumulated profit in the first 9 months was VND252 billion, while in the same period last year, net loss was VND105 billion.

Thanh Cong Securities (TCI) reported after-tax profit of more than 17.1 billion VND, up 22% over the same period in 2022. Accumulated for 9 months, TCI's after-tax profit was 44.4 billion VND, down 34.5%.

Bao Minh Securities (BMS) reported that its after-tax profit doubled to VND89 billion over the same period. In the first 9 months, BMS recorded after-tax profit of VND128 billion, compared to a loss of VND16 billion over the same period.

Meanwhile, Yuanta Vietnam Securities (YSVN) recorded a 23% increase in pre-tax profit compared to the third quarter of 2022, reaching VND49 billion. Profit in the first 9 months decreased by 16% compared to the same period last year.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)