Gold price today July 3, 2024, recorded fluctuations in gold ring prices following the increase in the world market. World gold prices are said to be still in a strong upward trend when the general price level is still maintained at a support level above 2,300 USD/ounce.

LIVE UPDATE TABLE OF GOLD PRICE TODAY 7/3 and EXCHANGE RATE TODAY 7/3

| 1. SJC - Updated: 07/02/2024 08:28 - Website time of supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 74,980 | 76,980 |

| SJC 5c | 74,980 | 77,000 |

| SJC 2c, 1c, 5 phan | 74,980 | 77,010 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 74,000 ▲50K | 75,600 ▲50K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 74,000 ▲50K | 75,700 ▲50K |

| Jewelry 99.99% | 73,900 ▲50K | 74,900 ▲50K |

| Jewelry 99% | 72,158 ▲49K | 74,158 ▲49K |

| Jewelry 68% | 48,587 ▲34K | 51,087 ▲34K |

| Jewelry 41.7% | 28,886 ▲20K | 31,386 ▲20K |

Update gold price today 7/3/2024

Domestic gold price has slight fluctuations of 9999 gold ring.

At the beginning of the trading session on July 2, some brands such as Saigon Jewelry Company, Doji Group, ... adjusted the price of 9999 gold rings to increase by 100,000 VND/tael compared to the closing price of the previous day. The reason for this slight change is said to be due to the world gold price bouncing up from the previous low price range.

The price of SJC gold bars continued to "stand still" for the 4th week. This is the 19th consecutive session that the 4 state-owned commercial banks including Agribank, BIDV, Vietcombank and VietinBank have sold at the same price of 76.98 million VND/tael.

The world gold price converted to the bank USD exchange rate is 71.7 million VND/tael (including tax and fees), about 5.28 million VND/tael lower than the domestic gold price.

The gap between domestic and world gold prices has narrowed. However, according to experts, gold buyers should be cautious in transactions as world gold prices are always fluctuating.

|

| World gold prices are on a strong upward trend, 'gold is the winner' in the 2024 US election. (Source: Kitco) |

Summary of SJC gold prices at major domestic trading brands at the closing time of July 2:

Saigon Jewelry Company listed at 74.98 - 76.98 million VND/tael.

Doji Group is currently listed at: 74.98 - 76.98 million VND/tael.

PNJ system listed at: 74.98 - 76.98 million VND/tael.

Phu Quy Gold and Silver Group listed at 75.50 - 76.98 million VND/tael.

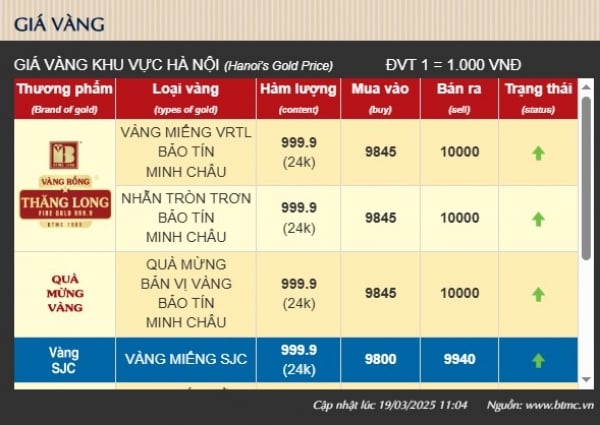

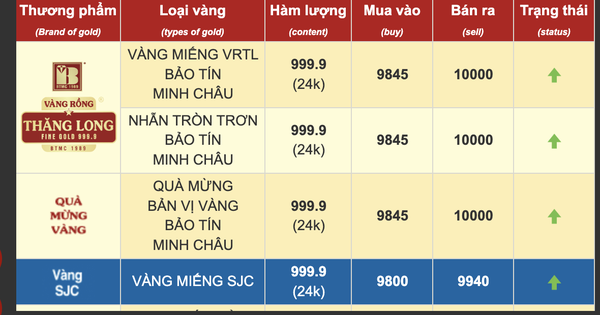

SJC gold price at Bao Tin Minh Chau is listed at: 75.50 - 76.98 million VND/tael; Rong Thang Long gold brand is traded at 74.88 - 76.18 million VND/tael; jewelry gold price is traded at 74.00 - 75.90 million VND/tael.

World gold prices have just had a slight decrease, but Still in a strong uptrend, as prices remain supported above $2,300/ounce.

According to TG&VN 's records at 6:30 p.m. on July 2 (Hanoi time), the gold price traded on the Kitco electronic trading floor was at 2,323.50 - 2,324.50 USD/ounce, down 8.1 USD compared to the previous trading session.

Global gold prices are still in an overall uptrend, thanks to strong investor buying. In addition, the precious metal market is also supported by the weakening of the US dollar and Nymex crude oil prices slightly increased, trading around 81.85 USD/barrel.

Many analysts believe that the gold market is in a period of calm and may fluctuate again at least until the end of this week. Investors increased their buying at the beginning of the session, expecting prices to rebound after the precious metal was in a low price range. Chief Investment Officer Naeem Aslam of Zaye Capital Markets is quite optimistic, saying that if the US Federal Reserve (Fed) loosens monetary policy, it will put pressure on the USD and push gold prices up.

Meanwhile, for pessimists like FxPro senior market analyst Alex Kuptsikevich , the Fed's current monetary policy stance could trigger a market sell-off.

Indeed, commodity markets are bracing for a shortened trading week due to the US Independence Day holiday, with gold investors focused on a number of key economic events that could influence the precious metal’s price trajectory in the coming period.

The latest report showed a cooling in inflation, in line with last week's Personal Consumption Expenditures Price Index (PCE) report, which showed inflation pressures continuing to ease and the trajectory moving closer to the Fed's 2% target. Market expectations, as reflected in the CME FedWatch tool, now show a 91.2% probability that the Fed will maintain its current benchmark interest rate range of 5.25% to 5.5% at the July FOMC meeting. However, the probability of a rate cut at the September FOMC meeting has risen to 65.3%, up from 62.4% on Friday and 45.8% just over a month ago.

Growing optimism about a September rate cut has supported solid gains in gold prices, although significant short-term price movements remain limited.

Investors are now eagerly awaiting Fed Chairman Powell’s speech and the FOMC meeting minutes for further details on the Fed’s monetary policy outlook. Attention then turns to the jobs report later in the week, with market participants hoping to glean insights into the timing and number of potential rate cuts this year.

US Election 2024 - "Gold wins"

As US voters continue to learn about last week's 2024 presidential debate, commodities analysts say, "gold could ultimately be the winner as comments from President Joe Biden and former President Donald Trump have failed to ease ongoing economic and geopolitical concerns."

According to many experts, the debate was quite disappointing, especially from the Democratic Party's perspective, as President Biden was unable to express his thoughts coherently. However, Mr. Trump was not the final winner, as political analysts continued to point out many "fault points".

“Gold won between the two of them,” concluded Michele Schneider, chief strategist at MarketGauge.com . “No matter who wins the November election, gold will go higher.” While Biden is overseeing a strong economy with record-low unemployment and record-setting stock indexes, his administration has also seen inflationary pressures hit a 40-year high.

Meanwhile, while in office, Mr. Trump passed significant tax cuts, while overseeing low unemployment and a strong stock market, at least until the global Covid-19 pandemic struck.

However, both candidates have contributed significantly to the growing debt burden of the US economy during their respective terms. For many analysts and economists, US debt levels are approaching critical levels and are on an unsustainable trajectory.

Looking ahead, while inflation has fallen sharply from its 2022 peak, Schneider said there is no clear message from either candidate about how they would handle a slowing economy with rising inflation. “I don’t see any sound economic policy from either party at this point. In this environment, I think it’s important to own some gold and investors will realize they don’t own enough gold,” Schneider said.

All eyes will be on gold as a geopolitical asset, as investors look to create a portfolio of commodities to hedge against risk.

Source: https://baoquocte.vn/gia-vang-hom-nay-372024-gia-vang-the-gioi-se-bat-tang-vang-chien-thang-trong-cuoc-dua-bau-cu-my-2024-277131.html

Comment (0)