LIVE UPDATE TABLE OF GOLD PRICE TODAY OCTOBER 30 AND EXCHANGE RATE TODAY OCTOBER 30

| 1. PNJ - Updated: October 29, 2023 21:30 - Time of website supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 58,700 | 59,950 |

| HCMC - SJC | 70,100 | 71,000 |

| Hanoi - PNJ | 58,700 | 59,950 |

| Hanoi - SJC | 70,100 | 71,000 |

| Da Nang - PNJ | 58,700 | 59,950 |

| Da Nang - SJC | 70,100 | 71,000 |

| Western Region - PNJ | 58,700 | 59,950 |

| Western Region - SJC | 70,000 | 70,900 |

| Jewelry gold price - PNJ rings (24K) | 58,700 | 59,900 |

| Jewelry Gold Price - 24K Jewelry | 58,600 | 59,400 |

| Jewelry Gold Price - 18K Jewelry | 43,300 | 44,700 |

| Jewelry Gold Price - 14K Jewelry | 33,500 | 34,900 |

| Jewelry Gold Price - 10K Jewelry | 23,460 | 24,860 |

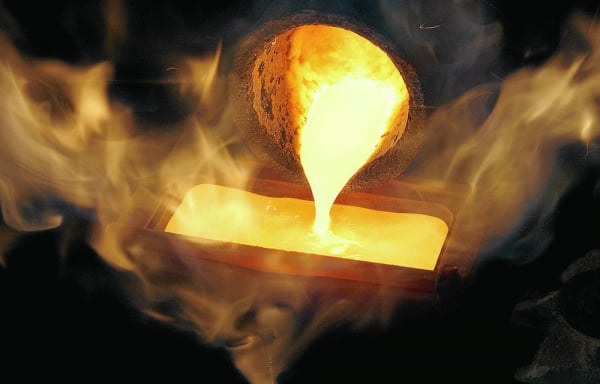

Domestic gold prices once again "conquered" the threshold of 71 million VND/tael on the last trading day of the week (October 28) when businesses simultaneously increased transaction prices.

World gold prices also exceeded 2,000 USD/ounce in the session of October 27, when the escalating conflict in the Middle East promoted buying of safe assets, while investors awaited the monetary policy meeting of the US Federal Reserve (Fed) next week.

Spot gold rose 1.2% to $2,009.19 an ounce, its highest since mid-May 2023, and was up 1.4% for the week. U.S. gold futures rose 0.1% to $1,998.50 an ounce.

Gold prices have risen about 8%, or more than $140, since the Middle East conflict broke out on October 7.

|

| Gold price today October 30, 2023: Gold price is being 'stretched', difficult to increase, difficult to decrease sharply; investors increase holdings. (Source: SCMP) |

Summary of SJC gold prices at major domestic trading brands at the closing time of October 29:

Saigon Jewelry Company listed the price of SJC gold at 70.15 - 70.95 million VND/tael.

Doji Group currently lists SJC gold price at: 70.1 - 71.0 million VND/tael.

PNJ system listed at: 70.1 - 71.0 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 70.2 - 70.97 million VND/tael; Rong Thang Long gold brand is traded at 58.78 - 59.73 million VND/tael; jewelry gold price is traded at 58.35 - 59.55 million VND/tael.

Converted according to the USD price at Vietcombank on October 28, 1 USD = 24,730 VND, the world gold price is equivalent to 59.78 million VND/tael, 11.17 million VND/tael lower than the selling price of SJC gold.

Gold is in a holding trend

World gold prices closed last week's trading session above $2,000/ounce, as investors sought to enter the market.

Retail investors remain bullish on the precious metal, with a majority of market analysts also bullish on gold prices this week, according to the latest Kitco News weekly gold survey.

“I’m neutral on this week’s survey,” said Colin Cieszynski, chief market strategist at SIA Wealth Management. “In my view, gold could actually have a big move; I’m just not sure which way it’s going to go.”

The expert said he expects another "hawkish" decision at the US Federal Reserve (Fed) meeting next week.

“I don’t think they’re done raising rates,” he said. “The Fed will keep rates on hold and leave the door open for another rate hike in December. Being hawkish could mean that the Treasury yield hike is almost done. That would actually be bullish for gold.”

The technical picture remains bullish, even as equity markets weigh on gold, said Michael Moor at Moor Analytics.

This week, 11 Wall Street analysts participated in the Kitco News Gold Survey. Six experts, or 54%, see higher gold prices next week. Three analysts, or 27%, see lower prices, and two analysts, or 18%, are neutral on gold.

Meanwhile, 602 votes were cast in the online poll, of which 395 retail investors, or 66 percent, expect gold to rise next week. Another 126, or 21 percent, predict lower prices, while 81 respondents, or 13 percent, are neutral on the precious metal’s near-term outlook.

The Fed’s interest rate decision will be the main economic event next week, with 94.2% of markets expecting the central bank to leave rates unchanged. It will also be a key week for the US labor market, with the release of the October non-farm payrolls report.

Marc Chandler, CEO at Bannockburn Global Forex, is neutral on gold prices in the near term but expects gold to fall back to support after its recent gains.

The expert noted that gold's failure to reach new highs in price movements over the past week shows that the market is stretched.

“The $1,950 area could be the first support level and then closer to $1,930,” he said.

“Down, but not significantly,” said Adrian Day, chairman of Adrian Day Asset Management.

“Gold is in a holding pattern, unlikely to go much higher at this point but unlikely to fall much further either. The situation in the Middle East, as well as the turmoil in global bond markets, is causing investors to increase their holdings of the precious metal,” he said.

Source

Comment (0)