FLC Group (stock code FLC) announced on February 23 that it had received decisions on tax enforcement by withdrawing money from the account of the Hanoi Tax Department. The total amount of enforcement is more than 91 billion VND because the company has overdue amounts that must be enforced according to regulations.

Of the tax amount to be enforced this time, more than VND 15.2 billion is personal income tax; VND 61.7 billion is corporate income tax; VND 3.2 million is late payment of administrative fines and VND 14.2 billion is late payment of tax.

FLC Group continues to be forced to pay more than 91 billion VND in taxes

At the same time, the Hanoi Tax Department sent 19 decisions to commercial banks where FLC has accounts such as the Bank for Agriculture and Rural Development, Bao Viet Bank, Lien Viet Post Bank, Vietnam Joint Stock Commercial Bank for Industry and Trade, Vietnam Bank for Investment and Development, Vietnam Maritime Bank...

Previously, in early January, the Hanoi Tax Department also decided to enforce FLC's payment of nearly VND90 billion in taxes, including late payment of personal income tax, corporate income tax, and administrative fines by withdrawing money from FLC's bank accounts.

In addition, FLC also sent an official dispatch explaining after receiving an official dispatch from the Hanoi Stock Exchange (HNX) reminding it to disclose information and requesting an explanation for the unusual delay in disclosing information.

According to FLC, on January 2, the group held the 2024 Extraordinary General Meeting of Shareholders and submitted a document to announce the results of the meeting that did not meet the requirements to be conducted according to regulations through the CIMS system. On January 8, HNX issued a notice of rejection due to the request to supplement the vote counting minutes. Immediately after receiving the notice from HNX, the company submitted additional documents as requested and was again rejected due to the request for the enterprise to stamp the vote counting minutes in red. By January 9, FLC had supplemented the documents and the documents were approved.

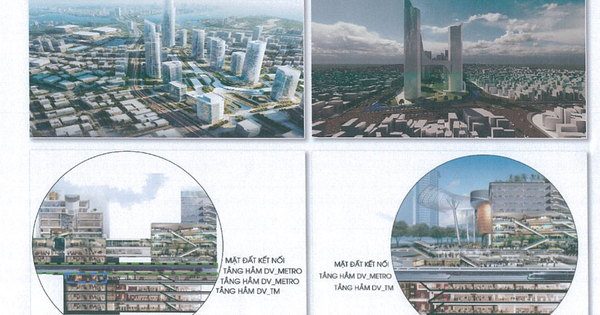

Recently, on February 20, FLC successfully held an extraordinary shareholders' meeting and approved its business plan. In 2024, the company will continue to promote restructuring and reshaping its core areas with three main pillars: Real estate business, resort business and M&A projects to restructure loans and maintain business operations...

Quick view at 12:00: Investigation of military personnel assisting former FLC Chairman Trinh Van Quyet

Source link

Comment (0)