As expected by the market, the FED has decided to continue easing monetary policy. Accordingly, the US reference interest rate has decreased to 4.25% - 4.5%, a decrease of 25 basis points (0.25%). This is the third consecutive time that the agency has reduced interest rates, with the previous two reductions being 0.5% and 0.25%, respectively.

This is not a surprising decision by the FED, but what the market is more interested in is the future plans of the US central bank, in the context of stable inflation above target and fairly solid economic growth, these conditions do not usually go hand in hand with policy easing.

“The economy is broadly strong and has made significant progress toward the Fed’s goals over the past two years,” said Jerome Powell, chairman of the Federal Reserve, in a statement after the end of the year meeting. “The labor market has cooled. Inflation has moved much closer to our 2-run objective. The Fed remains committed to maintaining the strength of the economy by supporting maximum employment and returning inflation to our 2-run objective. To that end, the Federal Open Market Committee (FOMC) decided to take another step toward reducing policy constraints by lowering the federal funds rate by a quarter of a percentage point.”

Immediately after the FED's decision, many financial experts and investors predicted that the agency would likely stop cutting interest rates at its meeting in late January 2025. Therefore, next year, US central bank policymakers expect to cut interest rates only twice, each time by a quarter of a percentage point, by the end of 2025. They also raised their inflation forecast for Donald Trump's first year in office, from 2.1% to 2.5%.

That pace is higher than the Fed's target of 2%. In addition, the Fed also plans to make two cuts in 2026 and one in 2027, each by 0.25 percentage points. Notably, the Fed also adjusted the long-term "neutral" interest rate up to 3%, 0.1% higher than its September forecast. The neutral interest rate - which is neither slowing nor stimulating the economy - has been gradually rising this year.

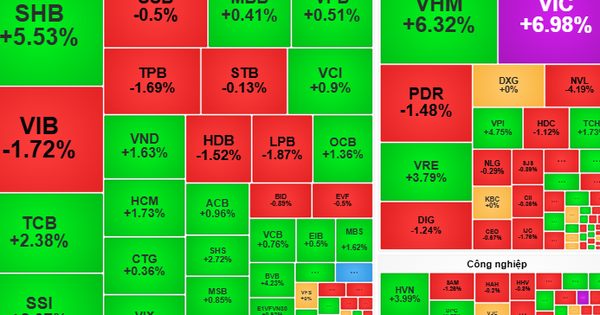

The US stock market plunged after the FED's announcement. At the close of trading on December 18, the Dow Jones index fell 2.58%, while the Nasdaq Composite dropped sharply by 3.56%. This was the biggest drop of these two indexes since August.

“The outlook for the U.S. economy is quite bright. However, we have to continue to do our job and continue to have restrictive policies to be able to get inflation down to 2%. The U.S. is not really feeling the impact of geopolitical uncertainty, but we are certainly in a time of increased geopolitical uncertainty and that remains a risk,” Mr. Jerome Powell added.

Also at this meeting, the FED raised its forecast for US GDP growth in 2024 to 2.5%, half a percentage point higher than the forecast in September. However, in the coming years, policymakers expect economic growth to slow to the long-term forecast of 1.8%.

Source: https://vov.vn/kinh-te/fed-tiep-tuc-ha-lai-suat-phat-tin-hieu-than-trong-trong-nam-2025-post1143128.vov

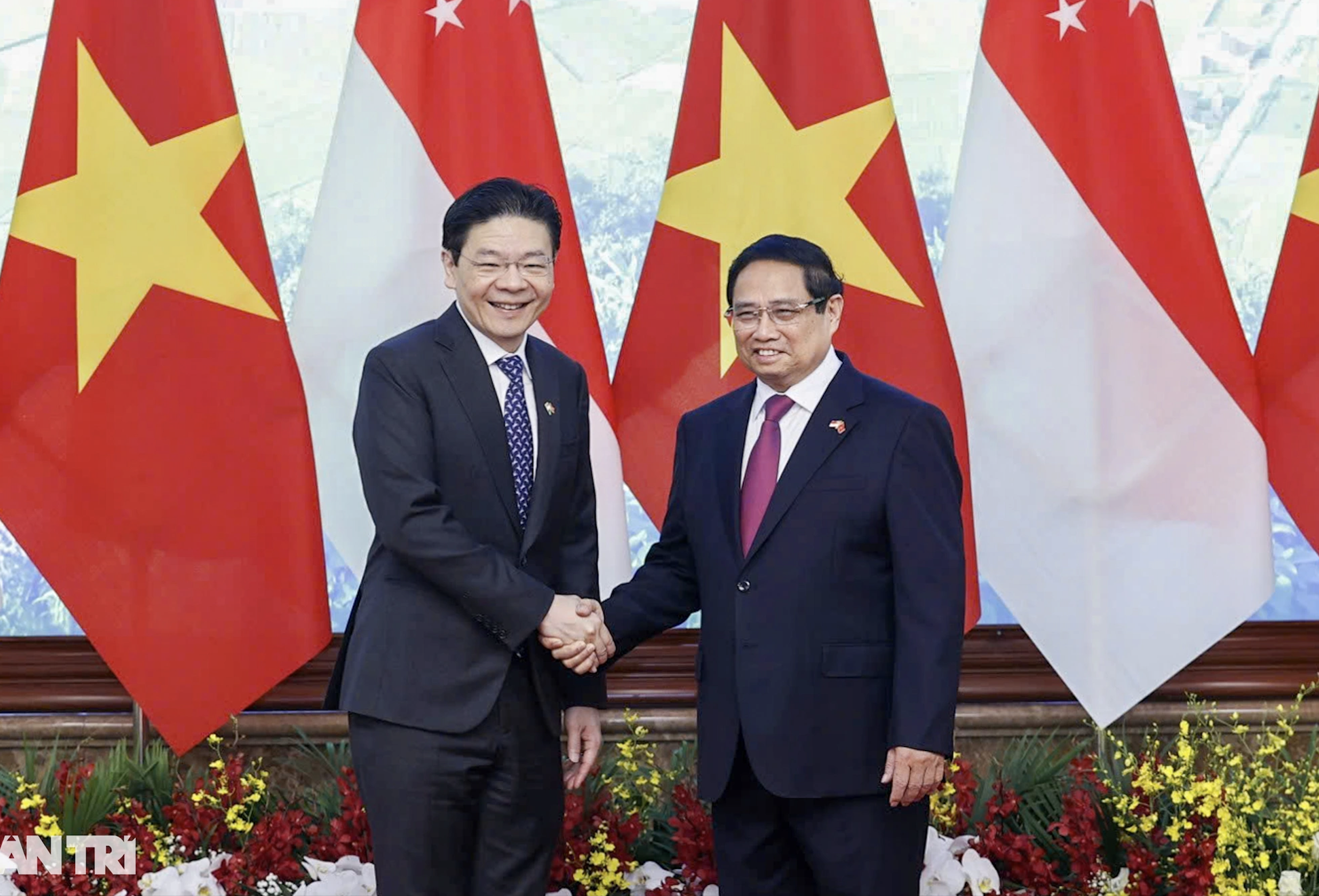

![[Photo] Welcoming ceremony for Prime Minister of the Republic of Singapore Lawrence Wong on an official visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/445d2e45d70047e6a32add912a5fde62)

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia works with key political press agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/3020480dccf043828964e896c43fbc72)

![[Photo] Close-up of old apartment building waiting to be renovated](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/bb2001a1b6fe478a8085a5fa20ef4761)

Comment (0)