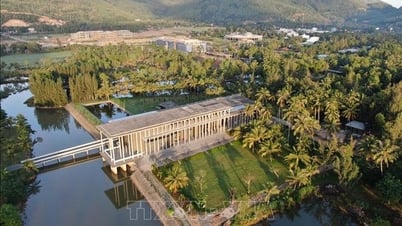

Illustration photo. Photo: Internet

At 9:00 a.m. today, Bao Tin Minh Chau Company adjusted the price of gold bars and gold rings down to 95.8 - 98.5 million VND/tael (buy - sell), down 300,000 VND/tael and 100,000 VND/tael respectively compared to the end of last week (March 22).

Meanwhile, the gold bar price of DOJI Group and SJC Company remained unchanged at 94.4 - 97.4 million VND/tael (buy - sell) compared to the previous trading session.

PNJ Company also maintained the price of gold bars and gold rings unchanged compared to the weekend, currently at 95.7 - 98.3 million VND/tael (buy - sell).

Last week, the domestic and international gold markets witnessed many big fluctuations. The last two days of the week recorded a sharp downward trend, causing SJC gold bars to lose 3.2 - 3.4 million VND/tael in buying price and decrease 2.4 million VND/tael in selling price. Compared to the highest price, the current buying price is 4 million VND/tael lower.

The price of gold rings in the domestic market continued to increase throughout the past week, with an increase of VND100,000 to over VND1 million/tael in the buying direction, while the selling price increased by VND1.3 - 2 million/tael. This is also the third consecutive week that the price of gold rings has increased.

Currently, Bao Tin Minh Chau's Thang Long Gold Dragon ring is priced at 96.1 - 98.6 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in the buy price and an increase of 2 million VND/tael in the sell price compared to the end of last week.

According to experts, economic and political instability, along with the possibility of the US Federal Reserve (Fed) cutting interest rates, were factors affecting the gold market last week.

In the world market, gold closed the week at $3,024/ounce. Compared to the record high of $3,057 set on March 20, the price of this precious metal has decreased by more than $30. However, if calculated for the whole week, the price of gold still recorded an increase of nearly $40, equivalent to 1.3%, completing the third consecutive week of increase.

Expert Truong Vi Tuan (Giavang.net) commented: “Since the beginning of the year, gold prices have set a record 16 times due to increased demand for risk prevention in the context of unpredictable tax policies of US President Donald Trump, the risk of a US economic downturn, prolonged geopolitical tensions and the trend of decreasing interest rates globally.” However, the recovery of the USD and profit-taking activities of investors at high prices contributed to the decrease in gold prices in the last two sessions of the week.

The dollar index, which measures the greenback against a basket of six major currencies, rose nearly 0.3% on Friday to 104.15. It had fallen to a five-month low of 103 earlier in the week. Despite falling 2.3% in the past month, the index is still up more than 0.4% this week.

According to international experts, the need for risk prevention will continue due to trade and geopolitical concerns, continuing to be the main driving force supporting gold prices in the coming time.

Source: https://doanhnghiepvn.vn/kinh-te/gia-vang-ngay-24-03-2025-vang-trong-nuoc-giam-nhe-phien-dau-tuan/20250324093005570

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)