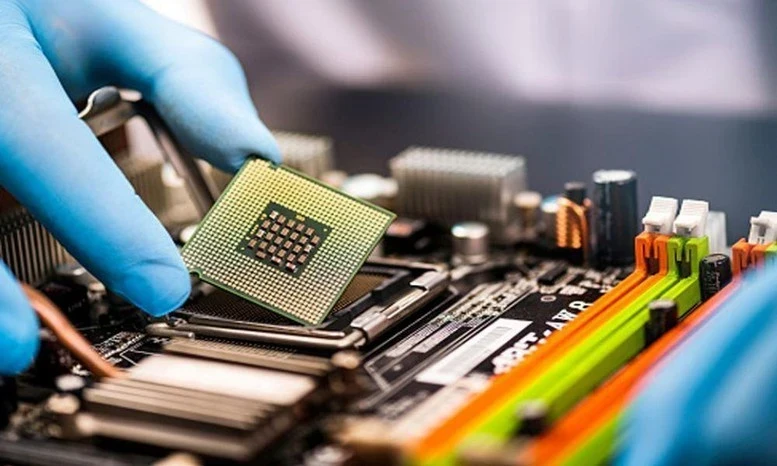

Currently, the world is restructuring the semiconductor industry towards diversifying supply sources at all stages. Vietnam has an important geopolitical advantage as it is located at the global center of the semiconductor industry.

With good strategic relations with most semiconductor industrial powers, Vietnam is a bright spot attracting foreign direct investment in this field.

Development strategy Semiconductor industry Vietnam to 2030 and vision to 2050 has just been issued, laying the foundation, orientation and vision for the rapid and sustainable development of this industry.

According to the roadmap set out in the Strategy, Vietnam strives to become one of the global centers of the semiconductor and electronics industry by 2040; and to be among the world's leading countries in the semiconductor and electronics industry by 2050.

MANY ADVANTAGES

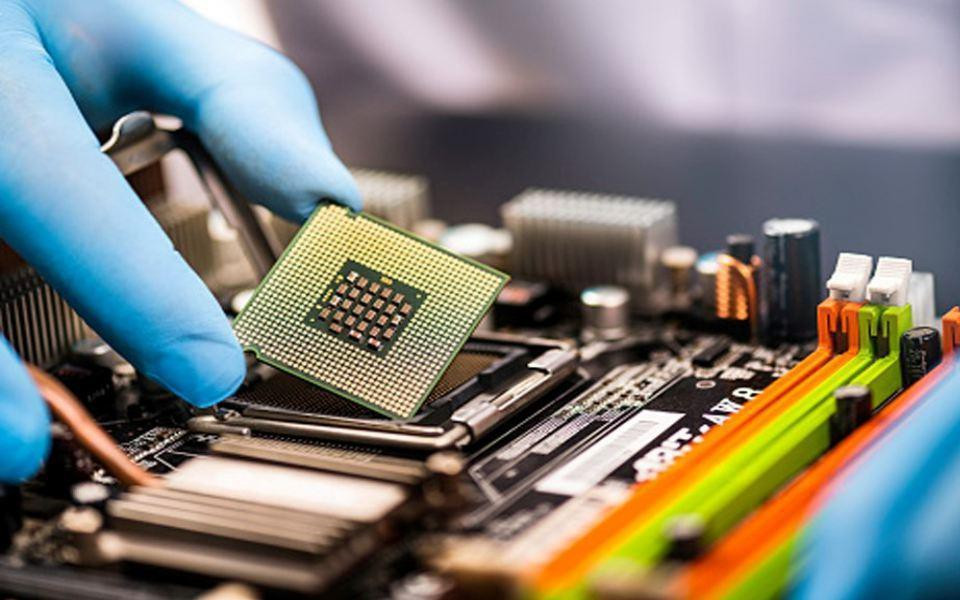

In recent years, the global semiconductor industry has recorded remarkable growth with total revenue estimated at 600 billion USD in 2024, expected to reach 1,000 billion USD in 2030.

China dominates silicon production from raw materials, controlling more than 60% of global supply, and plays a major role in assembly, packaging, and testing (ATP) thanks to its low labor costs and large production scale. The United States leads in logic chips and electronic design automation (EAD) software design,… accounting for more than 50% of the global market share in each field.

South Korea is the leading country in memory chip production, controlling more than 60% of global memory chip production. Meanwhile, Taiwan (China) plays a central role in wafer fabrication (the platform for producing microchips), especially through TSMC - the world's leading contract manufacturer and also an important facility in ATP.

ATP's supply chain is distributed in many countries and territories such as China, Taiwan, Vietnam, Malaysia and the Philippines, creating global connectivity and meeting the increasing production needs of the semiconductor industry.

The above situation leads to concerns about technological dependence, making supply chain diversification a strategic priority for many countries.

Leading semiconductor countries such as the US, EU and South Korea are all looking to build more manufacturing facilities in multiple countries to reduce dependence on a single source of supply, ensuring the security of the semiconductor supply chain. This shift creates a great opportunity for Vietnam to participate deeply in the global semiconductor industry, gradually developing its own semiconductor industry.

In addition, our country also has potential for rare earth reserves, estimated at about 20 million tons. Vietnam is also one of the 16 most populous countries in the world, with a relatively large domestic market; has the advantage of a young population with good STEM (science, technology, engineering, mathematics) capacity, and the ability to quickly meet human resource needs to develop the semiconductor industry.

In addition, Vietnam also has an important geopolitical advantage, with coverage of about 4-5 hours flight to 70% of the world's semiconductor industry centers.

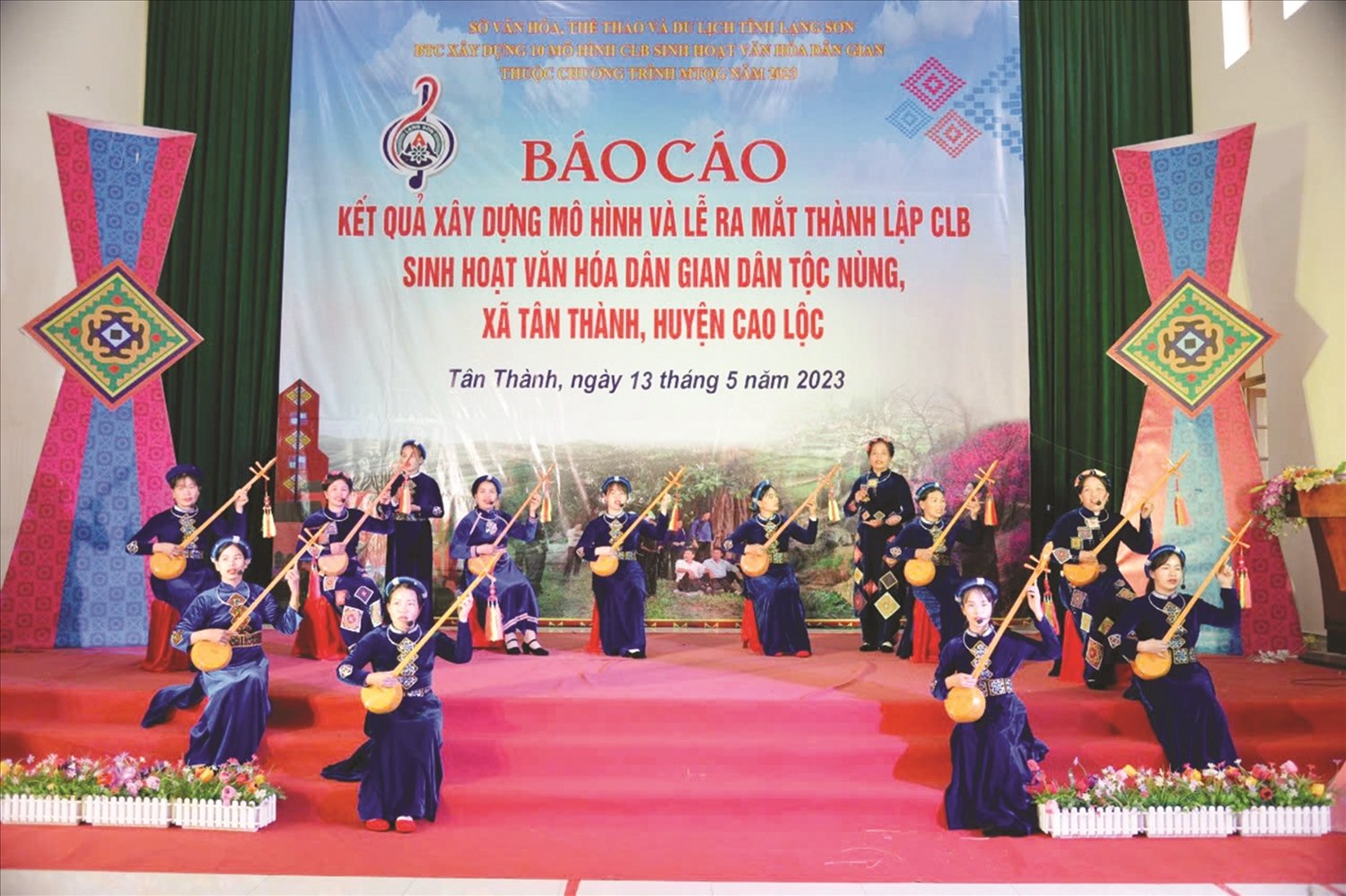

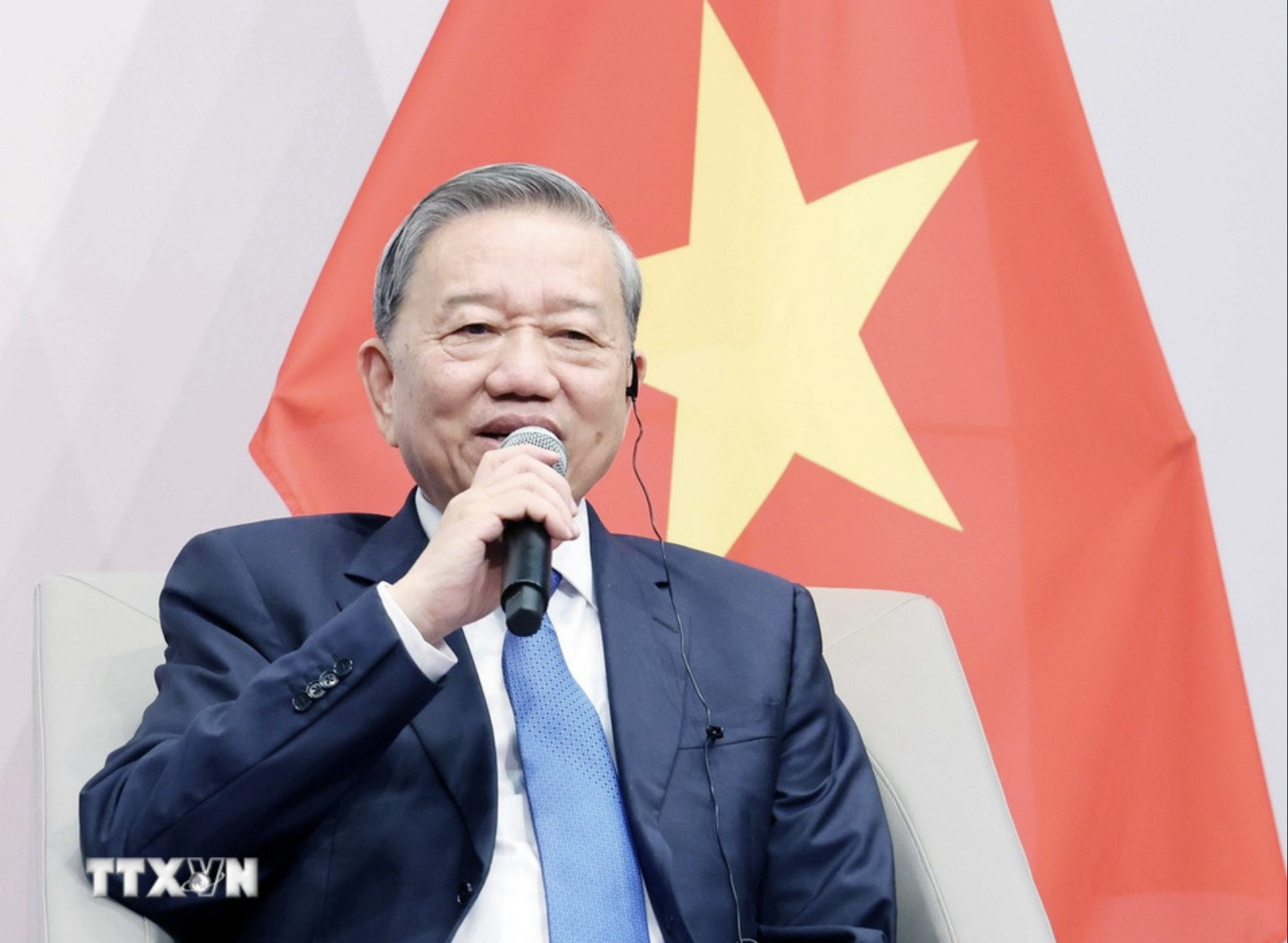

Minister of Planning and Investment Nguyen Chi Dung said that Vietnam has many advantages to prepare for the semiconductor industry. These include high political determination from the central to local levels; a favorable investment and business environment that has attracted many large FDI enterprises in the electronics sector.

Vietnam has also upgraded its comprehensive strategic partnership with most countries with developed semiconductor industries. The Joint Statement on upgrading Vietnam-US relations to a comprehensive strategic partnership clearly stated two breakthrough cooperation contents: innovation and high technology, including the semiconductor industry.

DIFFERENCE IN STRATEGIC THINKING

In Vietnam, the first semiconductor factory Z181 was established in 1979, producing semiconductor electronic components in circuits such as diodes or transistors for export.

However, by the early 1990s, due to global political turmoil, the factory had no more orders, leading to the production and packaging of microchips having to stop. Up to now, the Vietnamese semiconductor supply chain is still in its early stages, focusing mainly on two main activities: Semiconductor chip design (Fabless) and outsourced semiconductor chip assembly and testing (OSAT).

The design sector has about 40 enterprises, most of which are foreign enterprises such as HCL, Hitachi, NVIDIA, Synopsys, Marvell, etc., and six Vietnamese enterprises, including FPT and Viettel. In the OSAT stage, Vietnam has been attracting potential chip packaging corporations such as Intel, Amkor, Hana Micron, with significant investment capital. Specifically, Intel has invested 1.5 billion USD in Vietnam; Amkor Technology has invested 1.6 billion USD in a factory in Bac Ninh; Hana Micron, a memory chip OSAT unit, has also invested 600 million USD.

On September 21, 2024, the Prime Minister signed and promulgated the Strategy for the Development of Vietnam's Semiconductor Industry to 2030 with a vision to 2050. The highlight and difference in the thinking behind this strategy is that Vietnam will participate in all stages of the semiconductor supply chain, while most other countries build strategies based on an approach that focuses on a few stages with strengths.

The Strategy sets a target of over 25 billion USD in revenue from the semiconductor industry in Vietnam by 2030, over 50 billion USD by 2040 and over 100 billion USD by 2050. On the other hand, the Strategy also sets out 38 specific tasks assigned to relevant ministries, branches, localities, enterprises, training and research institutions to implement and meet the set goals.

Source

Comment (0)