According to information on Tuoi Tre , the State Bank said that outstanding real estate credit by the end of 2023 is about 2.88 million billion VND, of which real estate business loans are about 1.09 million billion VND, consumer loans are 1.79 million billion VND.

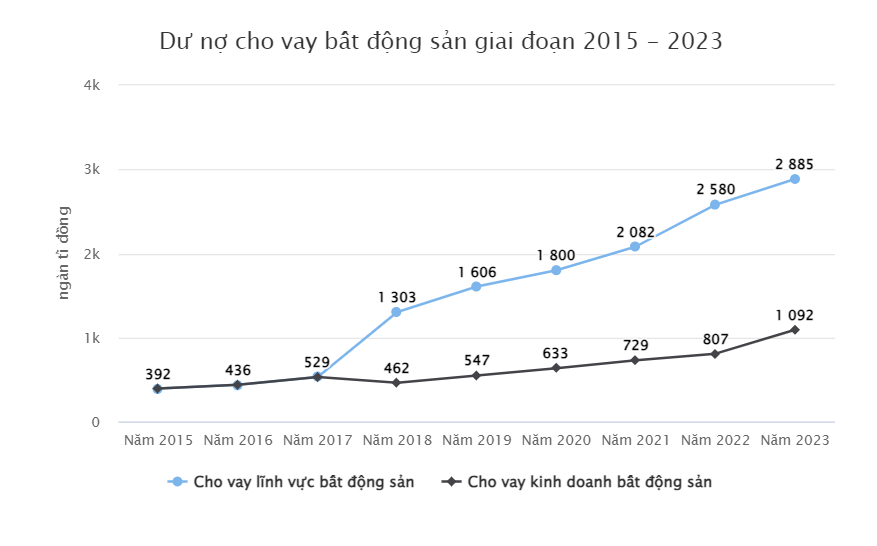

According to data provided by the State Bank in a recent report sent to the National Assembly's thematic supervision delegation on the implementation of legal policies on the real estate market and social housing development in the 2015-2023 period.

Regarding the credit situation related to the real estate market, the State Bank said that credit growth in the 2015-2023 period increased rapidly.

In 2015-2016, outstanding real estate credit was only about 400,000 billion VND, the real estate bad debt ratio was about 4.2%.

But in the following years, real estate lending increased rapidly. In 2017, the total outstanding loans for real estate and construction business of the banking system increased to VND529,000 billion, an increase of 9.21%, and the bad debt ratio for real estate also increased to 4.58%.

Also according to the State Bank, from 2018 to present, outstanding debt for the real estate sector, including real estate business and consumption purposes, and real estate self-use, has always increased.

Real estate loans account for about 21% of total outstanding loans in the economy - Photo: NAM TRAN

In 2019, real estate loans increased dramatically by 23.26%, reaching 1.6 million billion VND. During the 2020-2021 pandemic, real estate outstanding loans still increased by 12.06% and 15.7% annually, respectively.

Then in 2022, real estate debt increased sharply again, reaching 2.58 million billion VND, an increase of 23.91% over the same period last year.

In 2023, real estate loans will continue to increase by 11.81%, reaching VND2,880 trillion.

The State Bank said that the ratio of real estate credit to total outstanding debt is still high.

The State Bank said that the outstanding credit ratio for real estate is mainly medium and long-term debt. In the period 2015-2023, credit for the real estate sector accounts for 18-21% of the total outstanding debt in the economy.

To control the flow of money into real estate, the State Bank has issued circulars 36, 22, and 41 in recent years, regulating the ratio of capital mobilized for medium and long-term loans of banks from 24-34%.

Regarding guarantees for the sale of future houses, according to the State Bank, in the period 2015-2023, credit institutions have committed to guarantee about 307,000 billion VND.

As of December 2023, the outstanding balance of loans issued to home buyers is about 35,600 billion VND.

Besides, credit institutions are buying about 191,400 billion VND of corporate bonds as of December 2023.

Previously, the Ministry of Construction requested the State Bank of Vietnam to continue reviewing and promoting credit lending to real estate enterprises. Directing commercial banks to have appropriate and effective solutions for enterprises, real estate projects and home buyers to access credit capital more conveniently, both creating convenience and supporting enterprises and controlling risks, contributing to removing difficulties, promoting the development of the real estate market, especially considering specifically lending to unfinished and near-completed real estate projects.

KHANH LINH (t/h)

Source

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

Comment (0)