Key challenges of the economy

The world economy (KTTG) in the first quarter of 2025 continued to recover slowly, due to many complex and unpredictable factors, especially the reciprocal tax policy announced by US President D. Trump on April 2 and then along with the retaliatory actions of other countries, which have had, are having and will have a strong impact on the global economy, trade, investment and financial markets, especially affecting countries with large trade surpluses with the US, including Vietnam. Global inflation continued to decrease slightly along with the slowing economic recovery, causing central banks in many countries to continue to loosen monetary policy and lower interest rates to boost growth.

However, the world economy still faces many risks and challenges; especially geopolitical tensions, trade and technology wars, increased trade protectionism, causing commodity prices and inflation to rise again, interest rates to decrease more slowly than expected, slowing global growth; risks to energy security, food, cyber security, natural disasters, and extreme climate are still present...etc.

Accordingly, most international organizations have recently forecast that global economic growth in 2025-2026 will decrease by 0.7-1 percentage points, from the forecast growth of 2.7% to 1.7-2% in 2025-2026, while inflation will remain higher than forecast, around 2.5-3%, unable to reach the target of 2% soon.

Regarding the domestic economy, Vietnam will face five main risks and challenges in 2025. First, external risks and challenges are increasing, including: (i) geopolitical risks, especially trade-technology wars, increased trade protectionism (especially the imposition of reciprocal tariffs by the US and the response of other countries), causing commodity prices to increase, inflation and interest rates may decrease more slowly than expected, thereby creating pressure on inflation, interest rates and exchange rates in Vietnam; (ii) some countries' recovery momentum is slowing down (US, China, Japan, etc.), causing global growth to slow down significantly; (iii) inflation and interest rates, although decreasing, are still at high levels and will be anchored for a long time, making recovery much more difficult, and public and private debt risks are still high; (iv) risks of energy security, food security, cyber security, natural disasters, saltwater intrusion, and extreme climate change are still present.

Second, traditional growth drivers have recovered but not evenly, are still lower than before the pandemic and are not sustainable. The contribution of the difference in import and export of goods and services to overall growth (6.46%) is only higher than the level during the Covid-19 pandemic (2.7-3.5%), much lower than the same period in the past 2 years (14-20%) due to the high service balance deficit. Private investment has recovered quite well (up 5.5%) but is much lower than before the pandemic (13.6%), lower than the increase in total social investment capital (8.3%) and the lowest among the 3 regions; retail sales (excluding price factors) increased by 7.5%, only 83% of the pre-pandemic level (9%)...

Newly registered FDI capital is slowing down (down 31.5% year-on-year) and FDI inflows will be reduced if the US countervailing tax rate is 25% or higher. Public investment disbursement has improved but is still slow (35/63 localities have not allocated annual capital plans, the target of disbursing 95-100% of the plan is very challenging).

Third, bad debt is increasing and there are still many challenges in handling: the bad debt ratio on the balance sheet of the whole system (excluding 5 commercial banks under special control) at the end of 2024 was at 1.93% of total outstanding debt, up from 1.69% at the end of 2023, of which group 5 debt (with the possibility of losing capital) of 27 listed commercial banks was at more than 131 trillion VND at the end of 2024, up 43% over the same period last year, showing that bad debt pressure is still high, while Circular 06/2024/TT-NHNN allowing debt restructuring expired at the end of 2024, along with tariff risks negatively affecting import and export, investment and domestic consumption, causing bad debt to increase, requiring more drastic prevention and handling in the coming time.

Fourth, business operations still face many difficulties: in Q1/2025, the number of enterprises temporarily suspending business for a period of time still increased by 15.1% and the number of enterprises completing dissolution increased by 23% over the same period. The number of enterprises withdrawing from the market was 78.8 thousand, 1.08 times higher than the number of enterprises entering the market (72.9 thousand), although it does not indicate a trend, it is a point to note.

Fifth, the corporate bond market (CBO) is recovering slowly and the real estate market is still unsustainable: according to VIS rating, in the first quarter of 2025, the issuance volume of new CBOs only reached VND 25,130 billion, down 12% year-on-year, partly due to seasonal factors (Q1 of the 2021-2025 period only accounted for about 10% of the total annual issuance volume). The value of individual issuances is the lowest in the past 5 years with only 2 issuances with a value of VND 2,000 billion. The total value of CBOs with delayed payment accounts for 14.6% of outstanding CBOs in the whole market, mainly real estate CBOs (accounting for about 60%) as of the end of the first quarter of 2025.

The real estate market is gradually recovering, but is not sustainable due to high real estate prices; problems related to land valuation, land auctions, planning, site clearance, project document completion, social housing development, etc. are still slow to be resolved and not yet resolved.

Vietnam's economic growth forecast for the whole year 2025

Regarding prospects, in the context of the world economy still facing many risks and uncertainties (especially the US tariff "shock"), inflation and interest rates may decrease more slowly than expected, and world economic growth at a low level (1.8-2% in 2025-2026), Vietnam's economy is forecast to be negatively affected in 2025 and the next 1-2 years. However, it is expected that tariff negotiations and solutions to balance the trade balance with the US will achieve positive results, Vietnam will still maintain certain trade advantages and attract FDI compared to other countries, along with policies and solutions to stimulate domestic demand, promote new growth drivers from the second half of 2025, GDP growth for the whole year of 2025 can approach the target.

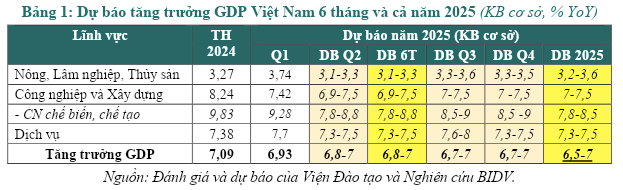

GDP growth: The Research Group forecasts Vietnam's GDP growth for the whole year of 2025 under 3 scenarios.

With the baseline scenario (60% probability), taking into account the possibility of positive results in negotiations with the US on reciprocal taxes, it is assumed that the target is 20-25% (a sharp decrease from the current expected level of 46%, or lower depending on each specific industry); businesses and industries proactively adapt, take advantage of opportunities from existing FTAs, diversify markets, and effectively exploit new growth drivers; GDP growth in the third and fourth quarters remains equivalent to the second quarter of 2025 (at 6.7-7%), accordingly, the forecasted GDP growth for the whole year of 2025 could reach 6.5-7% (a decrease of about 1-1.5 percentage points compared to the growth target of 8% or more without the US tariff shock and the January 2025 forecast of the Research Group).

In the most positive scenario (striving for, probability 20%), GDP growth could reach 7.5-8% (down 0.5% compared to the scenario without the US tariff shock) when negotiations with the US achieve very positive results, while effectively exploiting new growth drivers to offset the decline of traditional drivers and due to tariff risks.

In a more negative scenario (20% probability), the trade war escalates and prolongs, many countries/blocs respond, global trade, investment and consumption activities are severely affected, traditional growth drivers (net exports, investment, consumption, etc.) decline sharply while new growth drivers have not yet shown clear effectiveness, then GDP growth for the whole year is forecast to be only around 5.5-6%. This is an undesirable scenario but also needs to be taken into account.

Regarding inflation: Inflationary pressure may gradually increase in the second quarter of 2025 and the last 6 months of the year due to both cost-push factors (higher prices of imported goods and services due to US tariffs, prices of some State-managed goods increasing according to the roadmap) and demand-pull factors (credit growth is estimated at 14-15%, disbursement of domestic public and private investment increases quite well, cash turnover is at 0.8-0.9 times, higher than in 2024 to meet capital needs for higher growth).

However, the average CPI in 2025 is forecast to increase by 4-4.5%, higher than in 2024 (3.63%) but still below the target (4.5-5%). Accordingly, inflation will increase but remain under control because demand has not recovered strongly, the domestic supply of essential goods and services is guaranteed, exchange rates and basic interest rates are stable and policy coordination is increasingly better.

Source: https://baodaknong.vn/nhung-thach-thuc-chinh-cua-nen-kinh-te-trong-nam-2025-249278.html

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

Comment (0)