Stocks and real estate increased positively, VN-Index struggled to maintain the 1,250 point mark

Trading on the market remained gloomy as investor sentiment continued to be cautious. Many large stocks fell in price, causing the VN-Index to close in the red.

For the second time this year, the European Central Bank (ECB) officially lowered its policy interest rate by 25 basis points (0.25%). In June, the agency reduced interest rates for the first time in 5 years, also by 25 basis points. This information is expected to help stabilize investor sentiment and make the market fluctuate in a more positive direction. However, positive information such as continuously decreasing exchange rates, the State Treasury buying foreign currency, major economies lowering interest rates... seems to be not enough to help the cash flow return to the domestic stock market.

The main index VN-Index opened the trading session on September 13 in red. The negative point of today's session was that this index remained in red throughout the session. Meanwhile, the HNX-Index also fluctuated around the reference level.

The real estate group attracted attention today when some stocks fluctuated in a very positive direction. Of which, DXG increased by 4.8% and matched orders of 14.6 million shares. The strong increase of DXG helped many stocks in this industry group to increase. DRH, SGR or BII were pulled up to the ceiling price. TCH increased by 2.3%, NLG increased by 2.2%, CEO increased by 1.3%, NVL also increased by 1.3% after 3 sessions of sharp decline. NVL shares previously fluctuated negatively after information was put on the list of stocks not allowed to trade on margin due to the delay in announcing the audited semi-annual financial report for 2024 more than 5 working days from the deadline for information announcement.

However, not all real estate stocks fluctuated positively. Instead, NRC had its second consecutive floor-price drop after announcing its audited report for the first half of 2024 with a loss of more than VND10 billion in the first half of this year, far from the positive VND7 billion in its self-made report.

|

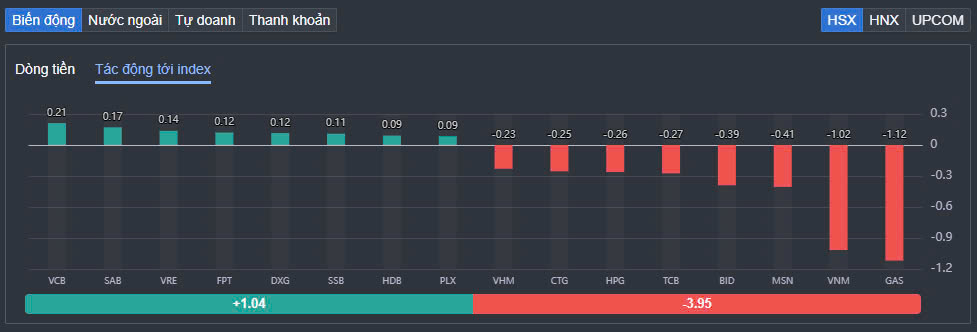

| GAS, VNM, MSN are the locomotives pulling VN-Index down |

In the group of large stocks, pressure on VN-Index came from stocks such as VNM, GAS, MSN, BID or TCB. Of which, GAS decreased by 2.37% and took away 1.12 points from VN-Index even though today's session was the ex-rights trading day to issue bonus shares at a rate of 2% and pay 2023 cash dividends at a rate of 60%. In addition, VNM fell sharply by 2.4% and took away 1.02 points from VN-Index.

On the contrary, VCB had the most positive impact on the VN-Index when it contributed 0.21 points thanks to a 0.45% increase. In addition, SAB, VRE, FPT… also increased in price and contributed to supporting the general market as well as significantly restraining the decline of the VN-Index.

The group of securities stocks had quite positive fluctuations thanks to the information that the State Securities Commission held an urgent meeting to remove bottlenecks for the goal of upgrading the stock market. HCM increased by 1.2%, FTS increased by 2.33%, MBS increased by 1.9%..

At the end of the trading session, VN-Index decreased by 4.64 points (-0.37%) to 1,251.71 points. The entire floor had 163 stocks increasing, 210 stocks decreasing and 90 stocks remaining unchanged. HNX-Index increased by 0.52 points (0.22%) to 232.42 points. The entire floor had 80 stocks increasing, 61 stocks decreasing and 80 stocks remaining unchanged. UPCoM-Index increased by 0.22 points (0.24%) to 92.95 points.

|

| Foreign net selling trend is still overwhelming |

The total trading volume on HoSE alone reached 482 million shares, up 11% compared to the previous session, equivalent to a trading value of VND11,173 billion, of which negotiated transactions accounted for more than VND2,000 billion. The trading value on HNX and UPCoM reached VND745 billion and VND339 billion, respectively.

Foreign investors continued to net sell 73 billion VND on HoSE, in which VHM was the most net sold with 189 billion VND. MWG and VCI were net sold 124 billion VND and 85 billion VND respectively. In the opposite direction, FPT was the most net bought with a value of 195 billion VND. STB and DXG were net bought 83 billion VND and 56 billion VND respectively.

Source: https://baodautu.vn/dong-chung-khoan-va-bat-dong-san-tang-tich-cuc-vn-index-nhoc-nhan-giu-moc-1250-diem-d224894.html

![[Photo] General Secretary To Lam and Prime Minister Pham Minh Chinh attend the first Congress of the National Data Association](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/22/5d9be594d4824ccba3ddff5886db2a9e)

Comment (0)