The market ended last week with many fluctuations, VN-Index almost flat. Profit-taking pressure appeared after 8 consecutive weeks of increase, is the stock market about to enter a deeper correction?

VN-Index increased only 0.01% last week - Photo: QUANG DINH

New cash flow opportunities

* Mr. Do Bao Ngoc, Deputy General Director of Vietnam Construction Securities:

- In recent sessions, the upward trend has slowed down, and profit-taking pressure has increased. However, compared to the general developments of many world financial markets, Vietnamese stocks are still relatively positive.

The risk of a correction to the 1,300 mark or even lower may occur when large groups of stocks correct. But with recent stable high liquidity, any correction, if any, will be an opportunity for new cash flow.

Regarding important upcoming information, the market is waiting for FTSE Russell's mid-term review in early April and Q1 business results (from April 20).

With negative factors, exchange rates or the tariff story from the Trump administration are not new issues. Overall, this period is quite lacking in information, so the accumulation break is also reasonable.

In return, domestic cash flow is quite strong in the context of stable low interest rates, high credit, and accepted inflation increase.

Overall, in the long term, the story of stimulating the economy through the Government's monetary and fiscal policies supports the stock market. KRX, upgrading... all bring better confidence in the long-term potential.

For investors holding stocks, they should maintain their holdings and take profits from some stocks that have satisfied their short-term profits. For medium and long-term investors, the opportunity for adjustment is an opportunity to increase their holdings.

Global investment flows may turn cautious

* Mr. Dong Thanh Tuan - expert of Mirae Asset Securities (Vietnam):

- March marks the season of shareholders' meetings along with the 2025 business plan - the profit targets of enterprises are expected to be a suitable measure to measure the growth prospects of the VN-Index this year.

Historical data shows that the average profit completion rate is around 103% for VN-Index, except for the 2022-2023 period (89-94%) due to the impact of unexpected events such as corporate bond defaults and consecutive interest rate hikes from the Fed.

Transportation, retail, and oil and gas sectors recorded higher volatility with median completion rates of 122%, 138%, and 136%, respectively, reflecting management's cautious approach to target setting.

Overall, the 8% GDP growth target in 2025 is expected to be a stepping stone for overall profit growth for the entire market.

Meanwhile, global investment flows may become cautious as US tariff decisions come into effect, along with reciprocal tariffs to be announced in early April, which are risks that the market needs to carefully monitor.

Trading prospects in March are expected to be largely influenced by the shift of cash flows into sectors with better recovery and growth prospects (steel, real estate, securities and retail), while witnessing profit-taking pressure in leading sectors in 2024 such as banking and technology.

VN-Index is expected to continue to grow amid mixed news from the international market surrounding the trade war.

Two scenarios for the stock market

* Expert of An Binh Securities Analysis Center:

With scenario 1: Increase to 1,340 - 1,350. Overall, during this period, VN-Index is likely to continue to increase in price.

During the uptrend, the market may need to consolidate and continue to increase at the 1,325 - 1,330 range. However, in a positive scenario, the market will quickly increase to the target price range of 1,340 - 1,350 without adjusting the consolidation.

At that time, investors' psychology can easily reach a state of excitement when good information is continuously released. The necessary action is to prioritize psychological management and portfolio management, avoiding Fomo following the increase in price.

Scenario 2: Increase to 1,325 - 1,330, then adjust and increase again. The general market has increased for 7 consecutive weeks without any adjustment. In this scenario, when the market enters resistance zone 1 (1,325 - 1,330 points), there will be an accumulation adjustment.

The market may retest the weekly breakout point around 1,305 points. This re-accumulation correction zone will be a new buying zone for stocks to move towards the next uptrend to the 1,340 - 1,350 point zone.

Source: https://tuoitre.vn/chung-khoan-tuan-moi-ra-sao-sau-8-tuan-tang-lien-tiep-20250317094334734.htm

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

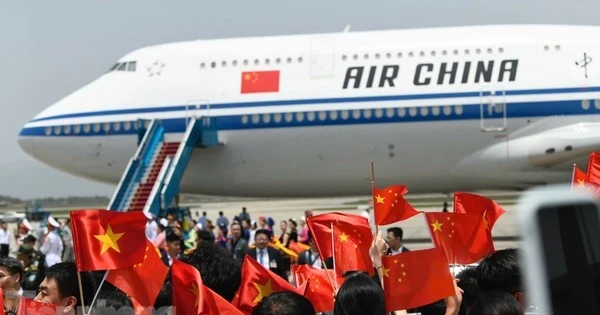

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Hanoi people warmly welcome Chinese General Secretary and President Xi Jinping on his State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/d6ac6588b9324603b1c48a9df14d620c)

Comment (0)