The Ho Chi Minh City Tax Department has sent an urgent document to the Ho Chi Minh City People's Committee regarding the resolution of shortcomings and difficulties in the process of handling land records since August 1. This unit stated that from August 1 to August 27, the tax agency received a total of 8,808 records.

Of these, 5,448 were personal income tax records from real estate transfers, 2,737 were in cases where no financial obligations arose (personal income tax from real estate transfers, registration fees, etc.). The remaining 346 were land use fee collection records for cases of land use right recognition and 277 were land use fee collection records for cases of land use purpose change.

This Department recommends that the Ho Chi Minh City People's Committee promptly issue a decision to adjust the land price list and provide guidance and direction on the application of the land price list, adjustment coefficients, and percentages for calculating land rent... This will help tax authorities promptly calculate financial obligations on land for records arising from August 1.

In addition, to avoid backlog of records and complaints, the Department said it will report to the General Department of Taxation on resolving cases where no financial obligations arise when carrying out procedures to grant certificates to people, to avoid backlog of records and complaints.

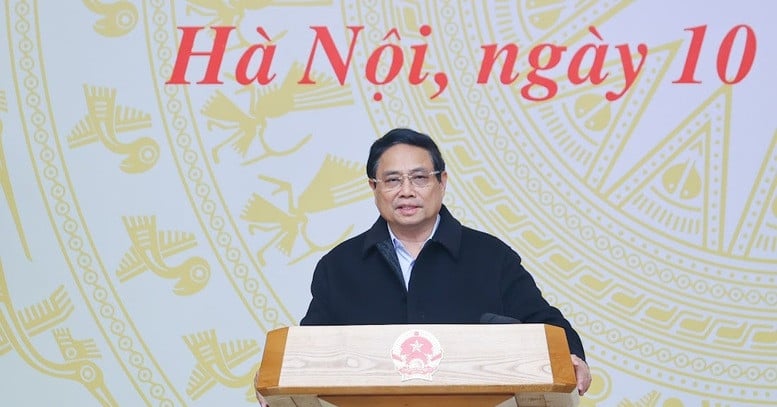

More than 8,800 land records have been stuck for nearly a month, according to the Ho Chi Minh City Tax Department (Illustration photo: Trinh Nguyen).

Previously, at the end of July, the Department of Natural Resources and Environment of Ho Chi Minh City issued and solicited opinions on the draft adjusted land price list. If the draft is approved, the new land price list will be applied from August 1 this year to December 31, 2025.

After that, the Department and other units will summarize and assess the economic and social impacts to continue adjusting the land price list applicable from January 1, 2025 to December 31, 2025. For the construction of the first land price list applicable from January 1, 2026 according to the provisions of the 2024 Land Law, the Department will hire a consulting unit to implement it.

The Department of Natural Resources and Environment stated that the basis for adjusting the land price list is Clause 1, Article 257 of the 2024 Land Law, effective from August 1, allowing localities to apply the old land price list until December 31, 2025. After that, localities will apply the new land price list from January 1, 2026. If necessary, the Provincial People's Committee shall decide to adjust the land price list according to the provisions of this Law to suit the actual situation of land prices in the locality.

In addition, the 2024 Land Law stipulates that the land price list from August 1 will no longer have a land use coefficient and there must be a land price list for resettlement. The city is forced to adjust so that there is no longer a land use coefficient and cannot wait until January 1, 2026 to make a price list. Therefore, the Department of Natural Resources and Environment must develop a new land price list to comply with the provisions of the law, there is no other way to postpone the implementation date to early 2026 as some opinions have proposed.

Ho Chi Minh City is still in the process of collecting opinions on this draft. The Ho Chi Minh City People's Committee also sent a document asking for the Prime Minister's opinion on guiding the calculation of land financial obligations for records arising after August 1 until the adjusted land price list is available.

Source: https://dantri.com.vn/bat-dong-san/cuc-thue-tphcm-hon-8800-ho-so-dat-dai-ton-dong-trong-chua-day-mot-thang-20240905164752935.htm

Comment (0)