From April 1, 2025, e-commerce trading floors will deduct, pay taxes on behalf of businesses and individuals, thereby contributing to reducing costs for the whole society.

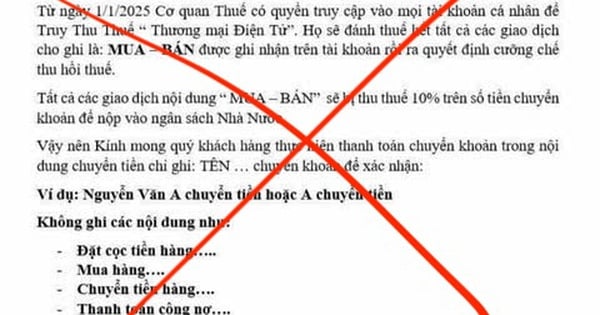

On January 10, the General Department of Taxation said that the information recently spread on social networks that "From January 1, 2025, the Tax Authority has the right to access all personal accounts to collect taxes on e-commerce" is incorrect according to tax law.

Specifically, according to the provisions of the Tax Administration Law No. 38/2019/QH14 - all individuals who have business activities are responsible for self-declaring, self-paying taxes to the State budget and self-responsible before tax laws, including e-commerce business activities.

Applying technology and digitizing transparent, efficient and convenient processes for taxpayers will be the "key" to completing the "problem" of tax management in the context of the e-commerce boom.

On that basis, the Tax Authority has the right to request relevant agencies and organizations including e-commerce trading floors, commercial banks, shipping units, etc. to provide relevant information for the purpose of inspection, examination, determination of tax obligations of taxpayers and implementation of measures to enforce administrative decisions on tax management according to the provisions of tax law.

In addition, the Tax Authority said that based on information collected from many sources, it will review and compare the information declared by taxpayers to identify taxpayers who do not declare or pay taxes or do not fully declare the amount of tax payable and will collect and impose penalties according to regulations. Accordingly, in cases where taxpayers are found to have committed tax evasion, the Tax Authority will transfer the case to the police for handling according to the law.

In recent times, the Tax sector has always focused on and implemented many forms of propaganda, guidance and support for taxpayers in implementing tax policies and regulations for e-commerce and digital business activities through communication on mass media (newspapers, radio, television, social networks, etc.), building an AI application "Virtual assistant in supporting taxpayers", providing 24/7 support for taxpayers' questions and concerns. This aims to raise awareness, responsibility and consensus of people and businesses in complying with legal regulations on tax obligations.

In addition, the Authority said there are still some cases where taxpayers intentionally take countermeasures to conceal revenue and evade tax obligations. For these cases, the Tax Authority has transferred the case files to the police to investigate and prosecute tax evasion, the most recent example being the case of criminal prosecution of an individual for tax evasion in e-commerce business in Hanoi in November 2024.

According to current tax management laws, business individuals with revenue of over 100 million VND/year are subject to VAT and personal income tax. According to Circular No. 40/2021/TT-BTC dated June 1, 2021 of the Ministry of Finance, individuals selling goods online pay personal income tax at a rate of 0.5%, VAT at a rate of 1%. Individuals with income from advertising on digital information content products, services, and other services pay personal income tax at a rate of 2%, VAT at a rate of 5%, ...

From December 19, 2024, the Tax sector has officially operated the "Electronic information portal for households and individuals doing business to register, declare, and pay taxes from e-commerce and digital-based business" to provide an additional channel for convenient tax obligations for households and individuals doing business in e-commerce.

Furthermore, Law No. 56/2024/QH15 has stipulated the responsibilities of managers of e-commerce trading floors and digital platforms (including domestic and foreign organizations) in deducting, paying taxes on behalf of, and declaring deducted taxes on behalf of business households and individuals, and regulating direct tax declaration for business households and individuals with e-commerce business activities. This provision takes effect from April 1, 2025./.

Source

Comment (0)