(NLDO) - Information about e-commerce transactions being taxed at 10% is spreading on social networks and is attracting public attention.

Tax authorities confirm that the information that all transactions with the content BUY - SELL will be taxed 10% is fake.

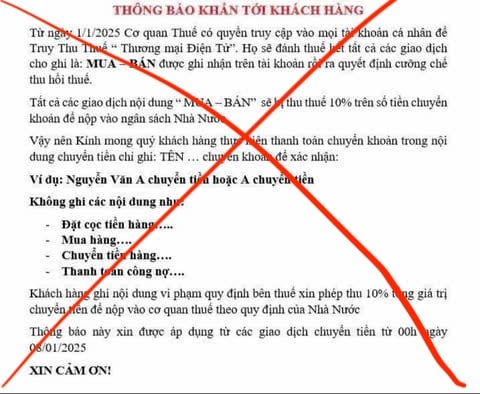

On January 9, a notice appeared on social media with the following content: "From January 1, 2025, tax authorities have the right to access all personal accounts to collect e-commerce transactions. Specifically, all transactions with the content BUY - SELL will be taxed 10% on the transferred amount."

Accordingly, those who do e-commerce business through livestream and social networking platforms such as Facebook, TikTok, YouTube... inform buyers when making payment by bank transfer to only write: NAME... transfer for confirmation.

At the same time, individuals doing e-commerce business should also note that if the buyer makes a payment by bank transfer with content that violates the above regulations, the seller will be allowed to collect 10% of the total transfer value to pay to the tax authority.

For example: Nguyen Van A transfers money or A transfers money. Do not record contents such as deposit for goods, purchase of goods, transfer of goods, payment of debts...

This information makes online business people extremely confused and worried.

However, speaking to a reporter from Nguoi Dong Newspaper, Mr. Nguyen Tien Dung, Deputy Director of the Ho Chi Minh City Tax Department, confirmed that the information about e-commerce transactions being taxed at 10% spreading on social networks is fake.

"The Ho Chi Minh City Tax Department is preparing to release official information on tax rates related to e-commerce for people to know and implement," Mr. Dung added.

According to current regulations, the tax rate for e-commerce business is 1.5% of revenue, including 1% value added tax and 0.5% personal income tax. These tax rates apply to sellers through e-commerce. Buyers of goods and services do not have to pay additional tax because the 1% value added tax has been added to the price of the goods by the seller.

For online sellers who have not declared and paid taxes, tax authorities always track down to determine revenue to collect taxes and impose fines for late tax payment.

According to data from the Ho Chi Minh City Tax Department, in 2024, the department reviewed celebrities, content creators (such as YouTubers, TikTokers, KOCs, KOLs) and individuals selling products via livestream on social platforms such as Facebook, TikTok, YouTube, etc. to check their compliance with tax laws. As a result, the tax authority handled more than 14,500 organizations and individuals with a total of over 286 billion VND in tax arrears and fines.

The General Department of Taxation also said that currently there are 76,428 individuals doing e-commerce business nationwide. Through inspection, more than 30,019 individuals were handled for violations, with tax penalties of 1,225 billion VND.

Source: https://nld.com.vn/thuc-hu-thong-bao-thu-thue-thuong-mai-dien-tu-10-dang-lan-truyen-tren-mang-xa-hoi-19625010911225252.htm

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)