On August 4, the Ho Chi Minh City Stock Exchange (HoSE) announced that Mr. Truong Anh Tuan - Chairman of the Board of Directors of Hoang Quan Real Estate and Trading Consulting Joint Stock Company (HQC) registered to sell 16.3 million HQC shares through negotiation with the purpose of restructuring the investment portfolio. The expected transaction time is from August 9 to September 7.

It is known that the amount of shares Mr. Tuan registered to sell is equivalent to 3.43% of his ownership ratio at HQC.

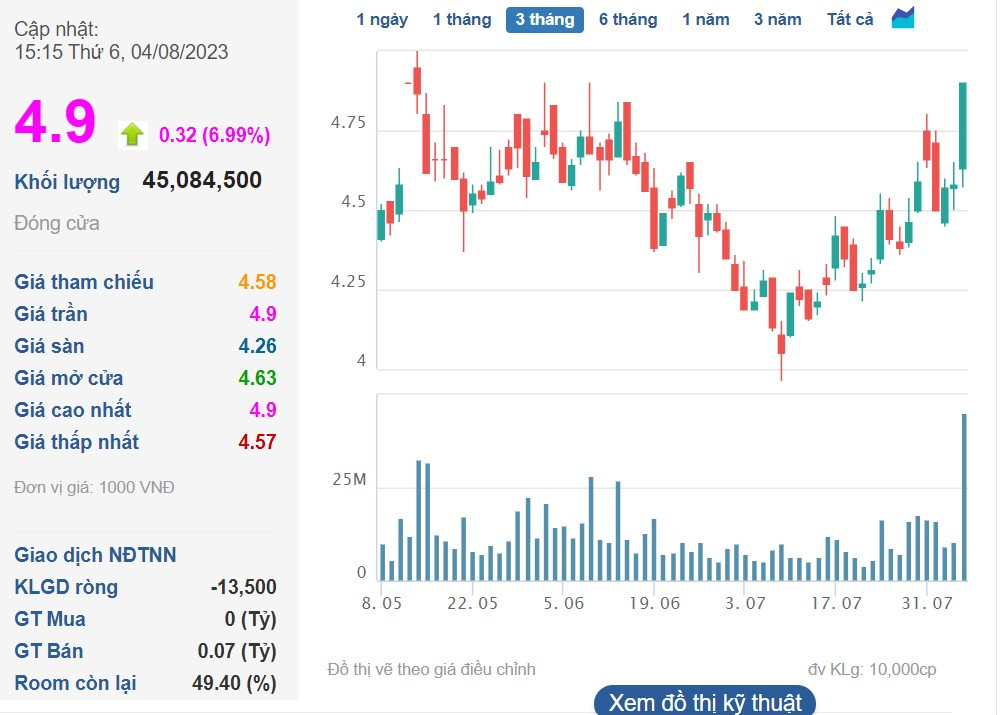

If calculated at the price of 4,900 VND/share on August 4, Mr. Tuan expects to earn about 80 billion VND.

Notably, at the same time, Hoang Quan Group Company Limited, the enterprise chaired by Mr. Tuan, also registered to sell all 3.09 million HQC shares (0.65%).

Previously, in May, Ms. Nguyen Thi Dieu Phuong, Vice Chairwoman of HQC Board of Directors, Mr. Tuan's wife, also divested all her capital at HQC, selling 18 million shares, equivalent to reducing her ownership from 3.82% of capital to 0%.

The rapid divestment of HQC Chairman and his family members has surprised shareholders. Many times before at the annual shareholders' meeting, Mr. Tuan affirmed that HQC's stock price was below the book value.

At the 2023 annual shareholders' meeting in April, Mr. Tuan also said that by 2024, HQC's stock price will return to par value (VND10,000/share). According to Mr. Tuan, the book value of HQC's stock is currently at VND9,000/share.

HQC shares at one point dropped to their lowest level, around 3,000 VND/share, and have been increasing continuously in the past few months. Up to now, HQC shares have increased by 75% compared to the lowest price at the end of February.

At the end of the second quarter, HQC's net revenue was recorded at VND 103 billion, down 29% over the same period last year; profit reached approximately VND 1 billion, down 87% compared to the second quarter of 2022.

In the first 6 months of the year, HQC recorded 147 billion VND in revenue, down 38% over the same period; net profit reached only 2.2 billion VND, down 85% compared to the first half of 2022.

In 2023, HQC set a profit target of 140 billion VND. With the results of the first 6 months of the year, HQC has only achieved 2% of the year's target.

Surprisingly, in the opposite direction, Nam Quan Investment JSC, a unit of which Mr. Tuan's daughter, Ms. Truong Nguyen Song Van, is a member of the Board of Directors, bought 20 million HQC shares to increase its ownership ratio from 0% to 4.2%. The transaction is expected to be negotiated from August 2 to August 25.

Source

Comment (0)