(NLDO) - If the VN-Index falls back to around 1,300 points, it will open up opportunities to accumulate bank stocks, securities, real estate, electricity, public investment, etc.

After 8 consecutive weeks of increasing from 1,220 points to 1,350 points, VN-Index began to differentiate strongly. At the end of the last trading week, VN-Index stopped increasing at 1,321.88 points, down 0.32% compared to the previous week; HNX-Index closed at 245.82 points, up 1.27% compared to the previous week.

Many stocks have started to take profits after a period of continuous growth such as steel, retail, insurance, chemicals, agriculture...

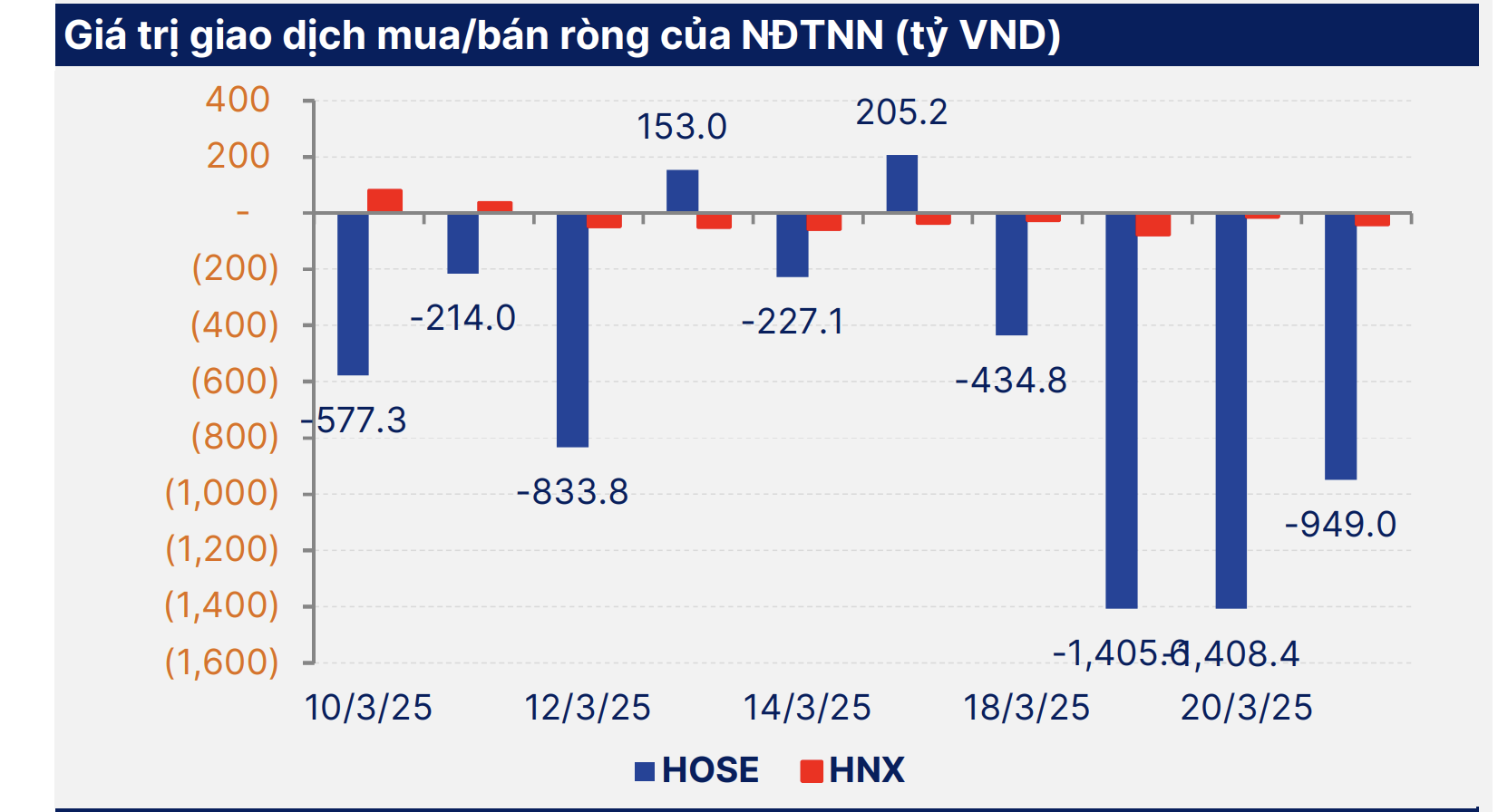

Many stocks fell sharply with sudden volume, showing short-term distribution pressure. In particular, some banking stocks saw strong liquidity increases with sudden transactions by foreign investors. Foreign investors remained net sellers on HOSE with a value of approximately VND4,000 billion.

VN-Index breaks its upward trend after 8 consecutive weeks

Mr. Dinh Quang Hinh, Head of Macro and Market Strategy, VNDIRECT Securities Company, analyzed that last week, the market faced strong selling pressure from foreign investors, especially in the last 3 sessions with net selling value each session fluctuating between 1,000-1,500 billion VND. This move caused large-cap stocks such as FPT and MWG to fall sharply, putting pressure on the general market.

"Market sentiment is more cautious as the FED continues to keep its operating interest rate at 4.25 - 4.5% and signals that it is "not in a hurry" to cut interest rates due to concerns about inflation risks from President Donald Trump's tariff policy. The market is also carefully assessing the risk of Vietnam being on the US's reciprocal tariff list in mid-April," Mr. Hinh analyzed.

Forecasting the stock market next week, experts from Pinetree Securities Company believe that the market's trading range may be widened to the 1,305 - 1,315 point range. A stronger correction to this range is necessary for the market to take a break and "shake off" some old stocks, while absorbing more cash flow so that the VN-Index has the momentum to conquer the 1,340 point range again.

Foreign investors are still net sellers on the stock market. Source: SHS

Mr. Dinh Minh Tri, Head of Analysis, Mirae Asset Securities Company, said that the adjustment pressure may continue in the early sessions of next week. However, the adjustment will mainly be short-term as the market has had a streak of 8 consecutive weeks of increase.

In the medium term, the market still has many supportive factors such as attractive valuations, positive corporate earnings outlook this year, benefits from the KRX system and the possibility of upgrading to emerging markets by FTSE Russell.

According to SHS Securities Company, in the short term, many stocks have been under strong selling pressure such as technology, telecommunications, logistics, insurance and have rebalanced to a reasonable level, which can be monitored and considered for accumulation again. Buying positions to increase the proportion of stocks need to be carefully selected and evaluated based on the business results of the first quarter of 2025.

"If the VN-Index falls back to around 1,300 points, it will open up attractive disbursement opportunities, especially in promising sectors such as banking, securities, residential real estate, electricity and public investment," said Mr. Dinh Quang Hinh.

Information technology was the sector that fell the most last week. Source: SHS

Source: https://nld.com.vn/chung-khoan-tuan-toi-tu-24-den-28-3-co-hoi-mua-hap-dan-khi-vn-index-xuong-1300-points-196250323155115196.htm

![[Photo] Vietnam team's strength guaranteed for match against Laos](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/1e739f7af040492a9ffcb09c35a0810b)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives the delegation of Nhan Dan Daily](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/a9ac668e1a3744bca692bde02494f808)

Comment (0)