Major changes in leadership

This morning (June 1), Hoang Quan Real Estate Trading and Services Consulting Joint Stock Company (stock code: HQC) held its 2024 annual general meeting of shareholders. Hoang Quan is known as the "boss" of social housing in the South. This company has many projects that have been handed over and aims to complete 50 projects, equivalent to 50,000 apartments by 2030.

Three non-executive members of the company's Board of Directors (BOD) have submitted their resignations. They are Ms. Nguyen Thi Dieu Phuong, Mr. Truong Thai Son and Mr. Nguyen Van Toan.

Among them, Ms. Phuong is the Vice Chairwoman of the Board of Directors of the company, the wife of Chairman of the Board of Directors Truong Anh Tuan; Mr. Son is Mr. Tuan's younger brother. All three individuals above have the same reason for resigning: they do not have enough conditions and time to continue to take on the assigned role.

Hoang Quan Board of Directors has 5 members. When these 3 members resign, the company's Board of Directors still has Mr. Truong Anh Tuan and Mr. Ly Quang Minh - Independent members.

Mr. Truong Anh Tuan said there will be a strong cultural shift at Hoang Quan (Photo: HQC).

Shareholders questioned whether there was a conflict in the Board of Directors when three members resigned. Mr. Truong Anh Tuan affirmed that there was no conflict. "I have been married for 35 years, no concubine, no mistress, no illegitimate children. My family members have also contributed to building the Hoang Quan brand over the years," said Mr. Tuan.

Explaining the reason for his resignation, Mr. Tuan said the change came from the request of the new group of shareholders and to ensure their rights. In addition, family culture has been applied at Hoang Quan for 24 years, since its establishment. However, with the goal of becoming a leading enterprise in social housing, Hoang Quan has changed the family culture to a market culture.

Therefore, some members of the Board of Directors will be changed from this year. 2025 is also the end of the Board of Directors' term (2020-2024), Hoang Quan will continue to have new members, new factors to meet the criteria for the new vision, new mission.

This change will not affect the company but will only be better, starting this year, Mr. Tuan affirmed.

At this congress, the Board of Directors nominated a new member, Mr. Tran Anh Tuan, born in 1984, with a mechanical engineering degree. Mr. Tuan worked at many different companies and started working at Hoang Quan in March 2017. From March 2023 to present, Mr. Tuan has worked at Hoang Quan Group Company Limited. Mr. Tuan himself and related parties do not own HQC shares.

Strengthening M&A, confident in land fund for project development

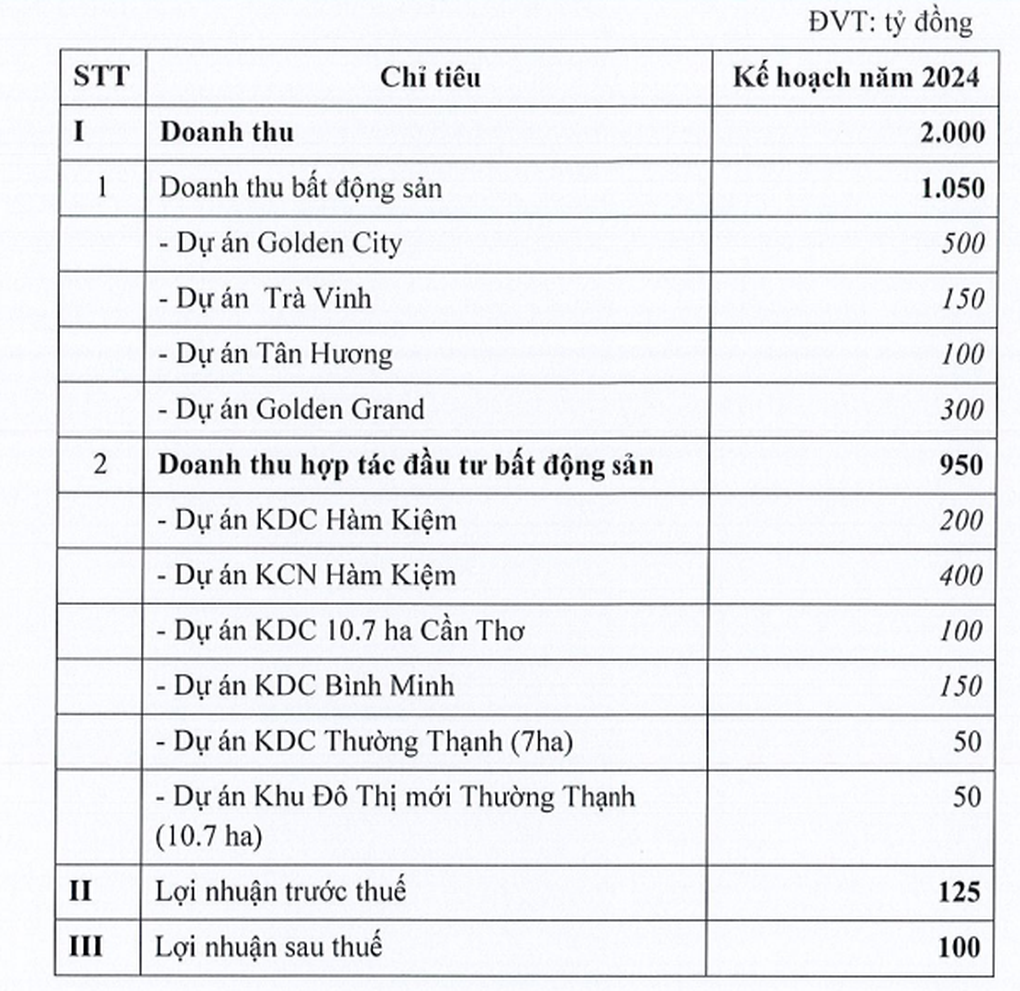

This year, Hoang Quan plans to achieve VND2,000 billion in revenue and VND100 billion in after-tax profit. Of which, the real estate segment will reach VND1,050 billion, and real estate investment cooperation revenue will reach VND950 billion.

Hoang Quan's 2024 business plan (Source: HQC).

Mr. Truong Anh Tuan - Chairman of the Board of Directors - said that to achieve 100 billion VND in profit, it is necessary to achieve at least 1,500 billion VND in revenue. The company plans to try to start and break ground on 3-5 projects this year to create momentum for development in the 2025-2026 period.

Sharing with shareholders, Mr. Tuan assessed that this year the company has advantages in terms of large land funds. Social housing projects have good legal status, have construction permits, and are even under construction. The company has cooperation in land funds such as State public land funds through bidding, cooperation with Novaland and Hoang Quan Group.

In addition, the company has cooperation with banks, banks committed to accompany and actually disburse for Hoang Quan to build social housing, low-income housing not only this year but also next year.

"We are not ambitious in building high-end housing, not ambitious with high profit targets anymore... This year, Hoang Quan's completion of 3,000 units is rare in the market, in the coming years we will ensure to maintain at least 5,000 units. The specific target of 2,000 billion in revenue is not a number to strive for but must be achieved, because the project has been and is being implemented," said Mr. Tuan.

Chairman Hoang Quan added that recently, the company has cooperated with Hoang Quan Group to win a bid for a social housing project in Ninh Thuan, and won bids for two old apartment projects in Ho Chi Minh City. The company will try to expand bidding and auction activities to increase projects.

Mr. Tuan said that Hoang Quan's land fund can help develop social housing projects in the next 3 years. Mergers and acquisitions (M&A) are part of the general strategy for Hoang Quan to operate more effectively. Recently, Hoang Quan also signed a cooperation agreement with Novaland Group to increase its land fund.

It is expected that this year, the two sides can hand over 3,000 social housing units in many localities; jointly research and develop new social housing projects on Novaland's existing land fund.

Mobilizing 1,000 billion VND for project in Long An

Before the congress, Hoang Quan Board of Directors decided to cancel the proposal to approve the plan to issue individual shares to convert debt. The company added a proposal to approve the plan to offer individual shares to meet the capital needs for project development.

Hoang Quan plans to issue 100 million shares at VND10,000/unit, with no limit on the number of investors. The company will use the VND1,000 billion it expects to raise to receive the transfer of shares from An Phu Sinh Construction Investment Joint Stock Company, the investor of An Phu Sinh Residential Area (Can Giuoc District, Long An Province) and disburse capital to continue implementing the project.

The enterprise said the project has a scale of 14.7 hectares, a total investment of 1,400 billion VND, and has full legal documents including Investment Policy, 1/500 approval, construction permit issued on April 6, 2022... The project is expected to generate revenue from 2025 and be completed in 2026.

Of which, the maximum capital for buying shares is 550 billion VND, equivalent to 51% of An Phu Sinh's charter capital and the remaining part for the project in the form of capital contribution or loan, investment cooperation. The total investment value in An Phu Sinh does not exceed 35% of Hoang Quan's total asset value based on the most recent financial statements (total assets as of December 31, 2023 are nearly 7,300 billion VND).

Source: https://dantri.com.vn/bat-dong-san/co-dong-hoi-co-mau-thuan-trong-hdqt-khong-chu-tich-hoang-quan-noi-khong-20240601111917633.htm

Comment (0)