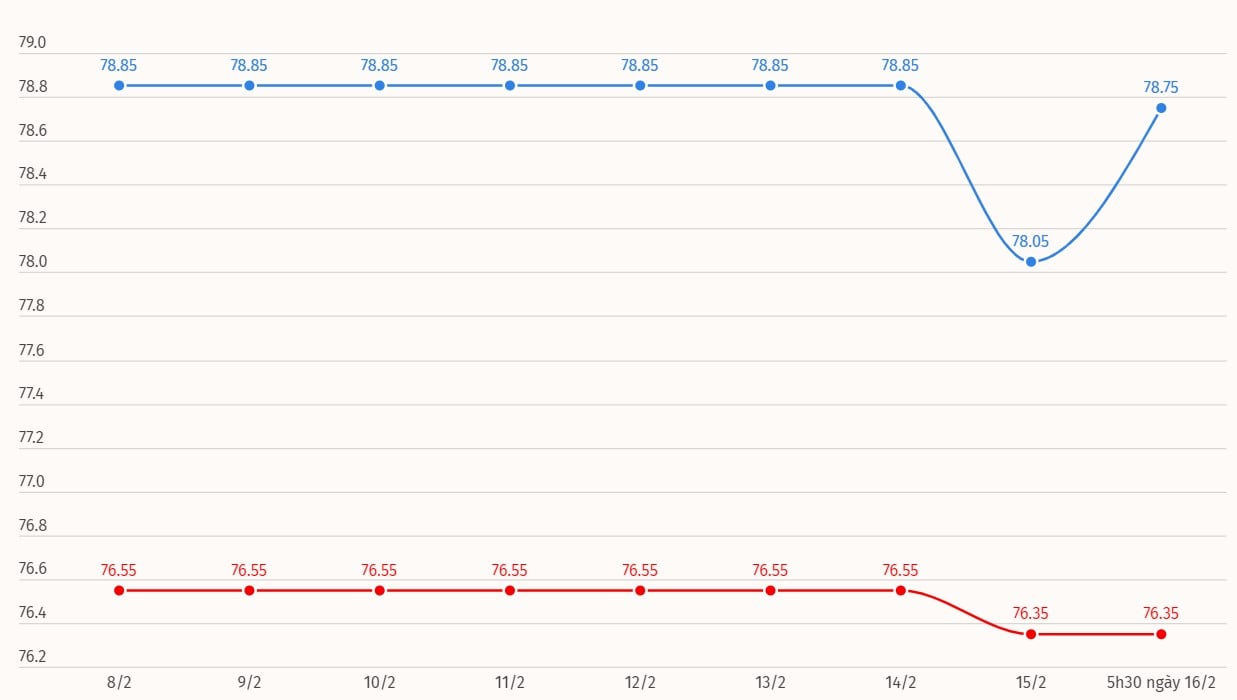

Domestic gold price

Every year, the difference between buying and selling gold is around 700,000 VND/tael. On the day of God of Wealth (the 10th day of the first lunar month), this difference is pushed up to around 1-1.5 million VND/tael. However, just a few sessions later, the gold price quickly cooled down, and the difference between buying and selling also decreased rapidly.

This year, the difference was pushed up very high. On February 15, the difference between buying and selling gold prices was unexpectedly adjusted down to around 1.7 million VND. However, by the afternoon of the same day, the difference was unexpectedly adjusted up to around 2.4 million VND/tael. Rarely has the difference between buying and selling gold been pushed up to such a high level and maintained for such a long time as it is now.

Despite the large price difference, many gold and gemstone stores in Hanoi are crowded with customers.

Sharing about buying gold on God of Wealth day, economic expert Nguyen Tri Hieu said: "Many people believe that if they buy gold on God of Wealth day, they will be supported and bring luck. In this case, they can buy. However, in my opinion, this is just a superstitious concept that has appeared recently. Therefore, if you decide to buy gold for investment, as a dowry... then you should not buy on God of Wealth day because buying on this day is very risky.

From an economic perspective, buying gold before and on God of Wealth Day will bring disadvantages to investors. Instead of choosing to buy gold on a day with very high prices like God of Wealth Day, buyers should choose a later time, when gold prices plummet, to catch the bottom.

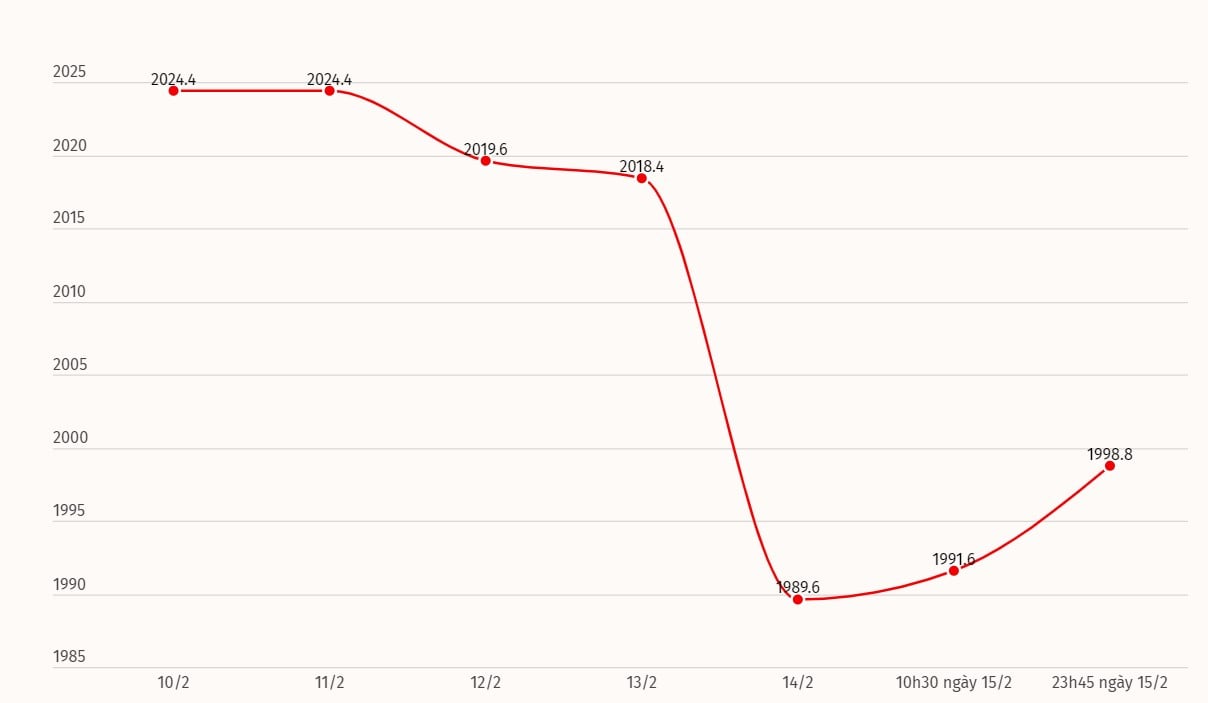

World gold price

Gold Price Forecast

Gold prices are trading near $2,000 an ounce after the number of US workers filing for initial unemployment benefits last week was lower than expected, according to Kitco.

Weekly jobless claims fell 8,000 to 212,000 in the week ended February 10, the US Labor Department said on Thursday.

The figure was also lower than forecast, as economists had expected jobless claims to hold steady at 220,000.

Gold is trading lower on the back of the consumer price index (CPI) data, said Bob Haberkorn, senior market strategist at RJO Futures. He said it will be difficult for gold to recover because part of its recent rally above $2,000 was driven by expectations that the Federal Reserve will ease monetary policy soon.

Bob Haberkorn predicts that the market's increasing certainty that the Fed will not loosen monetary policy soon will push gold prices further down.

U.S. consumer prices rose more than expected in January, rising at an annual rate of 3.1 percent. Economists polled by Reuters had forecast inflation rising 2.9 percent.

Meanwhile, Capitalight Research expert Chantelle Schieven maintained optimism about the yellow metal, saying that the US is not yet out of the recession risk and the longer the FED maintains its tightening policy, the greater the threat of recession.

The expert said it was only a matter of time before the Fed abandoned its inflation target and cut interest rates to support the economy. She added that this change in monetary policy would spur new investment demand for gold, pushing the price to $2,400 an ounce this year, with an average price of $2,170 an ounce.

Source

Comment (0)