VN-Index adjusted after 2 consecutive months of increase

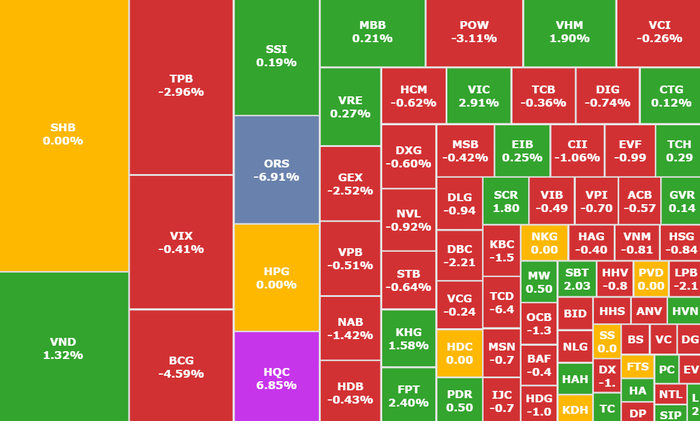

Last week saw a clear differentiation between trading sessions. Although the week started with positive green, selling pressure gradually increased in the following sessions, causing the index to fluctuate within a narrow range and be under correction pressure.

Thus, VN-Index had its second week of decline within a small range of 0.32%, and the weekly trading volume also decreased by 10.5% compared to the previous week. This shows the slowdown of the growth momentum. Trading liquidity last week decreased to the lowest level since the beginning of the month but still maintained an increase of 42.2% compared to the average level of 20 trading weeks.

The market "struggled" with 11 sectors decreasing compared to 10 sectors increasing, creating great pressure on the market and trading psychology last week including: Consumer food (-6.55%), Aviation (-2.16%), Steel (-1.73%), Chemicals (-1.72%),...

On the contrary, the industry groups that went against the trend last week included: Plastics (+2.61%), Seaports (+2.41%), Industrial Park Real Estate (+1.18%),...

Foreign investors had the strongest net selling week since the beginning of February with a trading value of VND3,993 billion on the HOSE floor. The focus was on large-cap stocks such as: FPT (FPT, HOSE) reached VND1,937 billion), TPB (TPBank, HOSE) reached VND262 billion, SSI (SSI Securities, HOSE) reached VND246 billion,...

Check out the notes on stock buying opportunities in April

According to analysts, the upward trend of the main index is slowing down, but only in the short term, there is still a lot of room for growth this year. Investors can consider taking advantage of the opportunity to hold potential stocks.

Specifically, we can mention the technology group that is always expected to grow strongly when the demand for digital transformation, technology and AI has exploded after the COVID-19 period until now, as evidenced by FPT stock (FPT, HOSE). Therefore, although it is under strong net selling pressure, there is still room for stock price increase, but it will largely depend on whether the roadmap to implement FPT's business plan is really feasible or not and this will be evaluated by the market at the upcoming General Meeting of Shareholders.

Additionally, the stocks in focus next month will revolve around key market drivers , such as:

(1) Profits of listed enterprises maintain positive growth in Q1/2025;

(2) Stable macroeconomic environment with low interest rates, exchange rate pressure and inflation under control;

(3) Expectations of upgrading Vietnam's stock market after FTSE's review. Priority will be given to selecting leading enterprises with a healthy financial foundation and positive profit growth prospects in the first quarter and the whole year of 2025.

Banking industry expected to grow well in 2025

Last year, with positive results from credit growth (TTTD), +15.09% compared to the beginning of the year (svđn).

In addition, most banks have reduced their outstanding balances for investments in corporate bonds in the context of the corporate bond market remaining gloomy. Some banks leading the industry's TTTD are HDB (HDBank, HOSE), MBB (MBBank, HOSE), TCB (Techcombank, HOSE), VIB (VIB, HOSE), LPB (LPBank, HOSE), TPB (TPBank, HOSE),....

Banks are expected to grow strongly thanks to credit growth.

Along with that, in 2024, the bad debt ratio will decrease in the fourth quarter of 2024.

Therefore, the banking group with a solid foundation and increasing participation in government policy programs will receive a higher credit room allocation in 2025, in the context of recovering credit demand.

The group of bank stocks with good profit growth potential will be the group of State-owned commercial banks: BID (BIDV, HOSE), CTG (VietinBank, HOSE), VCB (Vietcombank, HOSE) and the group of large private commercial banks with higher credit growth, good control of net profit margin and good asset quality.

However, risks still exist, coming from slower-than-expected economic recovery, sharp increase in bad debt, corporate bond defaults, and changes in monetary policy are potential risks, negatively affecting industry growth.

Comments and recommendations

Mr. Nguyen Nhat Tan, Investment Consultant, Mirae Asset Securities, commented that the main trend of VN-Index in the coming time is likely to be sideways to slightly increasing with the point range of 1,300 - 1,340 points. At the same time, thanks to the strength of internal cash flow and positive macro news (first quarter business results, shareholders' meeting, policies, etc.), VN-Index will likely not decrease deeply, maintaining a higher price base compared to the end of 2024.

VN-Index enters a short-term sideways or slight increase correction around the 1,300 - 1,340 point range

Overall, the short-term market picture is positive with corrections, VN-Index is more likely to move sideways and accumulate and then increase further than to reverse and decrease deeply. Fundamental factors (profits, policies) are supportive, but technical factors show that more time is needed to consolidate momentum.

Investors should prepare scenarios for both sides: be optimistic but not subjective, and at the same time manage risks for unexpected bad situations.

He recommended that investors maintain a balanced stock ratio , avoid using high financial leverage during periods when the market fluctuates and there are no clear signs of a breakthrough; wait for corrections (1,300-1,315 points) to disburse in parts, instead of chasing high prices in hot sessions; select stocks with solid fundamentals; be ready to take partial profits if the VN-Index exceeds 1,340-1,350 points; prioritize risk management principles.

Industries that should be focused on are those that benefit from a low interest rate environment and monetary policies that support credit growth and those that benefit from stimulus policies focused on the Government's GDP target this year.

Specifically:

Banks with MBB (MBBank, HOSE), HDB (HDBank, HOSE), CTG (VietinBank, HOSE);

Construction (public investment) with VCG (Vinaconex, HOSE), VLB Bien Hoa Construction, UPCoM), CTI (IDICO, HOSE), CTD (Cotecoons, HOSE), REE (REE Refrigeration, HOSE);

Aviation and Tourism with ACV (Vietnam Airlines, UPCoM), HVN (Vietnam, Airlines, HOSE), VJC (VietJet Air, HOSE), SGN (SAGS, HOSE);

Real estate with AGG (An Gia Real Estate, HOSE), PDR (Phat Dat Real Estate, HOSE), HDC (HODECO, HOSE), DPG (Dat Phuong Group, HOSE).

TPS Securities assessed that in a positive scenario, the market this week could end the correction and head towards the 1,340 point area, or even higher at 1,360 points. On the contrary, if the correction pressure continues, the VN-Index could retest the support levels of 1,315 points or 1,300 points.

TPS believes that the Vietnamese stock market will maintain positive stability in the medium and long term, and assesses the current adjustments as healthy.

Asean Securities notes that investors should remain cautious and keep a certain amount of cash ready to disburse when the market adjusts, taking advantage of the strong growth potential in the long term.

Dividend schedule this week

According to statistics, there are 10 businesses that have decided to pay dividends for the week of March 23-27, of which 8 businesses pay in cash, 1 business pays in shares and 1 business issues additional shares.

The highest rate is 50%, the lowest is 6%.

1 company pays by stock:

Song Da Cao Cuong Joint Stock Company (SCL, UPCoM) ex-right trading date is March 25, rate 20%.

1 company issues additional shares:

Chuong Duong Joint Stock Company (CDC, HOSE) , ex-rights trading date is March 28, rate 50%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| TPH | HNX | 3/24 | 5/23 | 6% |

| SD9 | HNX | 3/24 | April 18 | 10% |

| CHP | HOSE | 3/24 | 10/4 | 10% |

| VTC | HNX | 3/24 | 24/4 | 7% |

| ADC | HNX | 3/26 | 15/5 | 15% |

| DNT | UPCOM | 3/26 | April 21 | 6% |

| CCM | UPCOM | 3/28 | 5/22 | 20% |

| HJS | HNX | 3/28 | 11/4 | 10% |

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia received the delegation of Nhan Dan Daily](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/cdb71275aa7542b082ec36b3819cfb5c)

![[Photo] Nhan Dan Newspaper Youth Union visits Vietnam Military History Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/374e4f70a35146928ecd4a5293b25af0)

![[Photo] Prime Minister Pham Minh Chinh meets with the Ministry of Education and Training; Ministry of Health on the draft project to be submitted to the Politburo](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/c0e5c7348ced423db06166df08ffbe54)

![[Photo] General Secretary To Lam chairs the Standing Meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/839ea9ed0cd8400a8ba1c1ce0728b2be)

Comment (0)