VN-Index needs more internal strength; A female CEO of a Securities Company resigns after 2 months; Banks lead to positive business results in 2024; Dividend payment schedule.

VN-Index still cannot break out

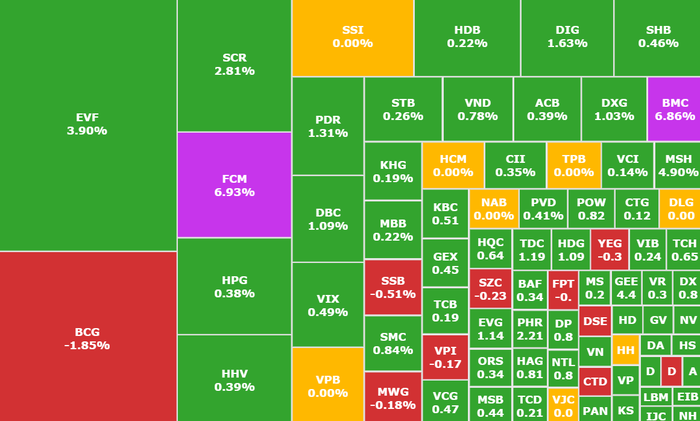

Last week, the market fluctuated strongly when VN-Index opened with a strong correction, then quickly recovered by the end of the week, the index recovered 0.07%, increased to 1,276.08 points, towards the strong resistance zone of 1,280 - 1,300 points, marking the 4th consecutive week of increase.

Market breadth was quite positive as most industry groups, notably minerals, rubber, telecommunications, textiles, and oil and gas, saw strong corrections in the IT and consumer services groups.

VN-Index lacks strong momentum before the 1,280 - 1,300 point zone (Photo: SSI iBoard)

Market liquidity is quite good, up 4.8% compared to last week in trading volume but has not really exploded, showing that cautious sentiment still dominates the market.

Foreign investors still maintained net selling pressure with a value of 1,842 billion VND last week.

VN-Index is in the accumulation phase around the 1,280 - 1,300 point range, still needs greater momentum to overcome, so going to this area, the market is showing that it needs a break before breaking out.

Vietnam's stock market likely to qualify for upgrade in March

In the February 2025 strategy report by Viet Dragon Securities (VDSC), Vietnam is likely to be assessed as eligible for an upgrade according to FTSE in the March assessment period with market reform efforts.

The bright spot comes from the 2025 business plan and the first quarter 2025 profit story of listed companies. In the first quarter of the year, the estimated after-tax profit of VN-Index could reach a growth rate of 7% compared to the same period. However, the growth rate has slowed down somewhat when the low base effect no longer exists.

Banks lead gains on stock exchange

According to an updated report from An Binh Securities (ABS), as of February 7, 2025, almost all listed enterprises have announced their financial reports for the fourth quarter of 2024 and the whole year of 2024, with a total of 1,088/1,660 enterprises.

The growth momentum in business of enterprises remains positive, with some industry groups clearly differentiated. The total market profit after tax in 2024 will reach VND502,860 billion (about USD20.7 billion), an increase of 19.4% compared to 2023.

In the fourth quarter of 2024 alone, total profit after tax reached VND 138,158 billion, up 28.1% over the same period. Of which, the financial group maintained its growth momentum, generating VND 66,537 billion in profit after tax in the last quarter of 2024, up 15.9% over the same period.

Banking group leads the business results of the whole stock exchange (Illustration photo: Internet)

Notably, the banking group maintained its leading position with a profit contribution of VND 62,512 billion in the fourth quarter of 2024, an increase of 17.3% over the same period. In 2024, this group brought in VND 235,951 billion in profit, an increase of 16.5% and accounting for half of the total market share.

Equally prominent, the non-financial group recorded a strong increase with VND71,622 billion in profit in the fourth quarter of 2024, up 42.1% over the same period and VND248,172 billion for the whole year, up 22.8%. However, differentiation appeared within the industries.

Typically, the retail group continued to break through with a 356.2% growth in after-tax profit in the fourth quarter of 2024, reaching VND 1,379 billion; the whole year increased by 461.8% to VND 5,471 billion. The real estate group increased by 75.6% in the fourth quarter of 2024, reaching VND 18,697 billion; the whole year reached more than VND 58,100 billion, unchanged compared to 2023. In addition, there are technology and services - tourism.

On the contrary, some industries witnessed a decline in profits such as: Oil and gas decreased by 5.5% in the fourth quarter and decreased by 11.9% for the whole year; Chemicals decreased by 16.6% in the fourth quarter, reflecting weakened market demand...

In 2025, banking and finance are expected to maintain their position thanks to stable growth in credit demand. The real estate and retail groups will benefit from market support policies, while the information technology group has a positive outlook thanks to the digital transformation trend.

However, the oil and gas, chemicals and tourism groups still face challenges as the global economy remains volatile. The speed of public investment disbursement, interest rates and consumer demand will be important factors shaping the market next year.

Female CEO of DVSC Securities resigns after 2 months

On February 14, Ms. Nguyen Thi Ha submitted her resignation from the position of General Director of Dai Viet Securities (DVSC) for personal reasons, after only 2 months in office.

Portrait of Ms. Nguyen Thi Ha (Photo: Internet)

Previously, Ms. Ha started working at DVSC from January 2024 as Deputy General Director. In September, she was appointed as Acting General Director for a maximum term of 3 months, replacing Mr. Diep Tri Minh after he resigned.

Ms. Ha has many years of experience in the financial sector. Specifically, in 2008, she joined Tan Viet Securities (TVSI) in the Investment Banking Services Division and held the role of Head of TVSI's Supervisory Board for the 2018-2023 term.

Regarding business operations, DVSC reported losses for two consecutive quarters in 2024. However, at the end of 2024, the company still recorded a net profit of nearly VND 11 billion, an increase of nearly 40% compared to 2023.

Comments and recommendations

Ms. Pham Anh Tuyet, Investment Consultant, Mirae Asset Securities , assessed that VN-Index continues to fluctuate in the range of 1,260 - 1,280 points, approaching the resistance level of 1,280 - 1,300 points. Liquidity shows signs of improvement but has not really exploded, showing that cautious sentiment still dominates the market, so for VN-Index to surpass the 1,300 point threshold, more momentum is needed from macro factors or stronger participation from domestic cash flow.

On the macro front, inflationary pressures are rising, mainly due to rising food and housing prices, which has narrowed the room for monetary policy. The State Bank of Vietnam can maintain a stable policy but will find it difficult to loosen it as strongly as last year, which will affect market liquidity and credit growth.

Investors should pay attention to macro information, avoid chasing and disbursing part of the investment during corrections.

Investors need to closely monitor macroeconomic factors to adjust their strategies. In addition, prioritize banking and public investment, two sectors that are benefiting from economic policies and smart cash flows.

Banking group with CTG (VietinBank, HOSE), TCB (Techcombank, HOSE), VPB (VPBank, HOSE), STB (Sacombank, HOSE) when having stable liquidity foundation and growing credit demand.

Public investment with HHV (Deo Ca Transport Infrastructure Investment, HOSE), PLC (Petrolimex Petrochemical, HNX), CII (Ho Chi Minh City Technical Infrastructure Investment, HOSE) continues to be supported by strong budget disbursement.

During this period, avoid chasing high prices, prioritize partial disbursement when the market has a correction. Closely monitor cash flow, liquidity and foreign transactions to flexibly adjust the portfolio. When the market confirms a breakout trend, holding stocks in the right industry group will help investors optimize profits.

Asean Securities comment, Last week, the market was under strong correction pressure after President Donald Trump's announcement of imposing a 25% tax on steel and aluminum, creating a negative effect on the stock market, however, sentiment gradually stabilized in the following sessions. The market is likely to continue its recovery trend, but there may be fluctuations when the index is fluctuating around the resistance zone of 1,270 - 1,280 points.

Investors should consider disbursing in parts with large stocks with positive fundamentals and business prospects, and have cash ready to establish a solid position when market liquidity is running out and valuations are very attractive.

KB Securities said, The positive point of VN-Index is that the increase is still preserved with green spread across all stock groups and the psychology of demand shows high initiative when many stocks are pulled to the full amplitude. Although the shaking signal may appear more at the above resistance zones, the index is expected to soon regain the upward momentum with the current state.

Dividend schedule this week

According to statistics, there are 3 businesses that have decided to pay dividends in the week of February 17-21, all in cash.

The highest rate is 54%, the lowest is 12%.

Cash dividend payment schedule

* Ex-dividend date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| PMC | HNX | 18/2 | 28/2 | 54% |

| EPH | UPCOM | 18/2 | 5/27 | 12% |

| HGM | HNX | 19/2 | 3/20 | 30% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-17-21-2-vn-index-van-chua-the-but-pha-truoc-vung-tich-luy-1280-20250217092838675.htm

![[Photo] General Secretary To Lam and Prime Minister Pham Minh Chinh attend the first Congress of the National Data Association](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/22/5d9be594d4824ccba3ddff5886db2a9e)

Comment (0)