Speaking at the opening of the workshop, Deputy Governor Pham Tien Dung affirmed that over the past time, under the direction and orientation of the Government, the banking sector has made continuous efforts and closely coordinated with relevant ministries and branches in the digital transformation process and has achieved many results on important pillars: transforming awareness, perfecting institutions, upgrading infrastructure, applying data mining and developing digital banking models; along with ensuring security and safety;...

To date, more than 87% of adults have had a payment account at a bank and many banks have processed over 95% of transactions on digital channels. Non-cash payments have grown strongly, especially in the number of payment transactions via mobile (Mobile) and QR code, reaching an average of more than 100%/year from 2017-2023.

Banking technology infrastructure is regularly invested in, upgraded, and developed to ensure continuous, smooth, and safe operations; the interbank electronic payment system processes an average of VND830 trillion/day (equivalent to USD40 billion), and the financial switching and electronic clearing system processes an average of 20-25 million transactions/day.

The Banking sector has closely coordinated with the Ministry of Public Security in crime prevention and control, and in particular has pioneered the effective implementation of tasks in Project 06/QD-TTg on applying population data to serve data cleaning, accurately identifying/authenticating customer information, supporting consumer lending activities on electronic channels, electronic guarantees, and contributing to ensuring the safety of banking operations.

However, in addition to the benefits and conveniences that online banking products and services bring, the banking industry also faces risks and challenges related to security, safety, and confidentiality in the face of cyber attacks, the use of high technology to defraud and appropriate people's money and bank accounts, and increasingly sophisticated and complex tricks.

To limit and minimize risks related to information security and safety in banking activities in cyberspace, in recent times, the banking industry has proactively deployed key groups of solutions, including: perfecting mechanisms, policies and directing implementation; deploying technological solutions and coordination mechanisms; disseminating and warning about fraud prevention and control; coordinating with competent authorities in preventing and combating online fraud.

Notably, on December 18, 2023, the Governor of the State Bank of Vietnam issued Decision No. 2345/QD-NHNN on implementing safety and security solutions in online payments and bank card payments (Decision 2345), effective from July 1, 2024.

According to Decision No. 2345/QD-NHNN, from July 1, 2024, individual electronic transactions with a value of more than VND 10 million or a total daily payment value exceeding VND 20 million must apply one of the biometric authentication measures.

The implementation of this decision contributes to ensuring that online payment transactions are only performed by the account owner, thereby improving the security, safety and confidentiality of online payment transactions, minimizing the risk of fraud and scams in online payment transactions, as well as preventing cases of renting, borrowing, buying and selling payment accounts and e-wallets for illegal purposes.

This is also one of the solutions that helps protect customers using banking services. According to statistics from banks, after 3 days of implementation (from July 1, 2024), transactions have basically been smooth.

Also according to Deputy Governor of the State Bank of Vietnam Pham Tien Dung, in the coming time, in order to promote and enhance security, safety and confidentiality for banking services on cyberspace according to the policies of the Party and the Government, contributing to protecting customers using financial and banking services, the State Bank of Vietnam will continue to focus on the following key tasks:

Firstly, continue to research, complete and promptly issue documents and Circulars to replace, amend and supplement regulations on safety and security for providing banking services on the internet...; effectively implement Decision No. 2345/QD-NHNN to ensure safety and security in payment transactions in particular and the use of banking services in general.

Second, continue to invest in perfecting the information technology infrastructure of credit institutions and payment intermediary organizations; at the same time, upgrade and develop payment infrastructure to ensure continuous, smooth, safe operations, seamless and continuous connection with other sectors and fields (such as public services, healthcare, education, e-commerce, etc.) and cross-border payment connections to meet the diverse and rapidly increasing demand for banking services of organizations and individuals in the economy.

Third, continue to coordinate with the Ministry of Public Security to effectively implement Project 06, focusing on exploiting information on chip-embedded Citizen Identification Cards and VneID accounts to identify and accurately authenticate customer information and coordinate and support in the process of providing banking products and services conveniently and safely, ensuring risk prevention and crime prevention of taking advantage of payment services for fraud and scam purposes.

Fourth, strengthen security and information safety in payment and banking activities, coordinate with functional units in preventing, investigating and handling high-tech crimes; protect the legitimate rights and interests of customers...

Fifth, continue to promote communication and financial education to improve public knowledge and skills; continue to innovate and diversify forms of expression, apply 4.0 technology and modern media; target people in rural areas, remote areas, young people, students, etc.

Source

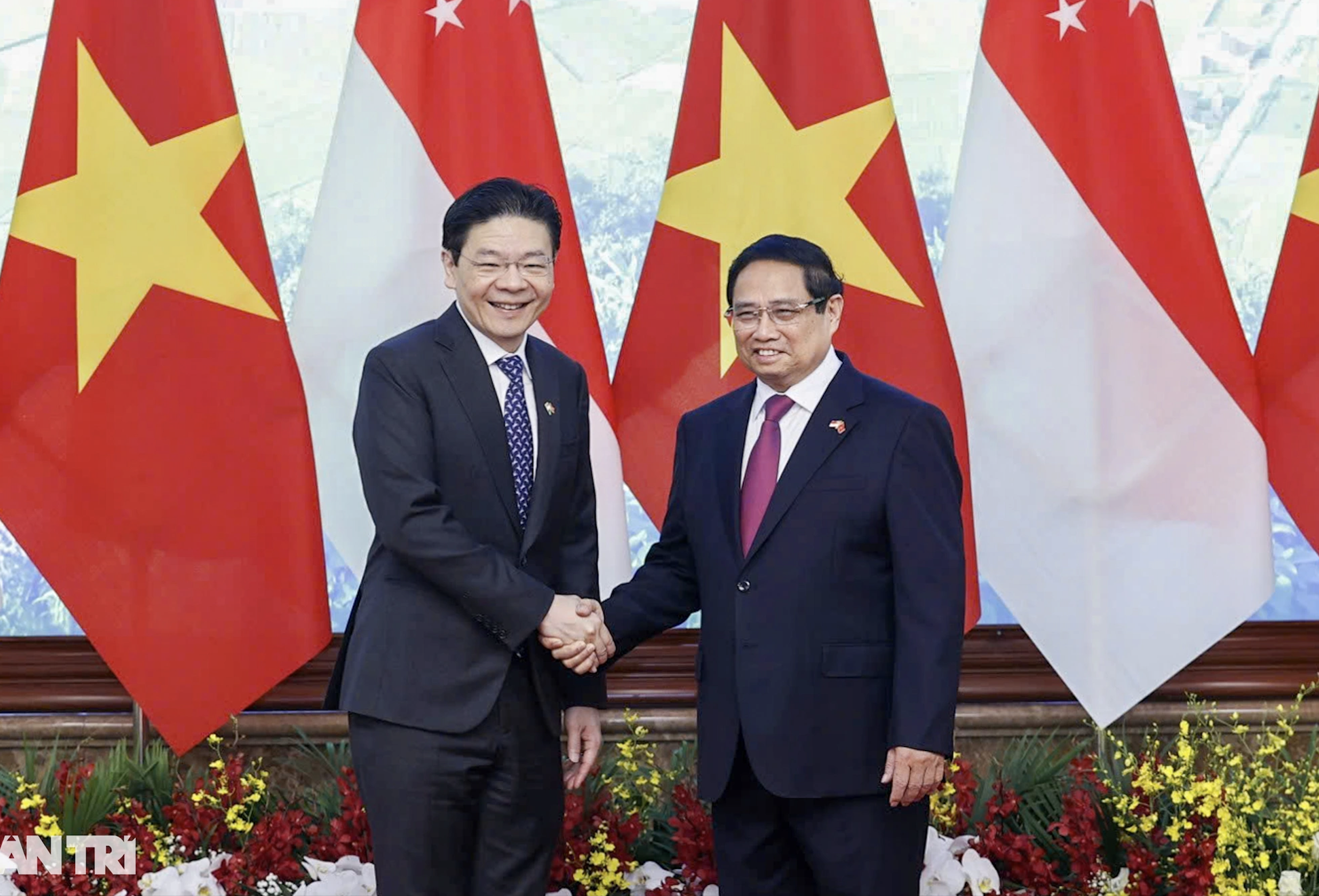

![[Photo] Welcoming ceremony for Prime Minister of the Republic of Singapore Lawrence Wong on an official visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/445d2e45d70047e6a32add912a5fde62)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/04f6369d4deb43cfa955bf4315d55658)

![[Photo] Close-up of old apartment building waiting to be renovated](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/bb2001a1b6fe478a8085a5fa20ef4761)

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia works with key political press agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/3020480dccf043828964e896c43fbc72)

Comment (0)