Deputy Governor of the State Bank Dao Minh Tu said that currently, some commercial banks are increasing deposit interest rates to ensure liquidity but there are no signs of stopping. Interest rates are under control so that depositors do not have to run from one bank to another.

Banks "pump" more than 2 million billion VND into the economy in 2024

On the afternoon of January 7, at a press conference on the results of banking activities in 2024 and the implementation of tasks in 2025 of the State Bank, Deputy Governor Dao Minh Tu said that last year, economic credit increased by 15.08%. Credit focused on production, business, and priority sectors. Previously, the State Bank's target for 2024 was for credit to increase by 14-15%.

With this momentum, the State Bank expects credit growth for the entire system in 2025 to be around 16%. However, according to Deputy Governor Dao Minh Tu, the 16% credit growth figure is not the ultimate goal, but the more important goal is still to control inflation, grow the economy, support the dong, and stabilize the exchange rate.

According to the State Bank, the banking sector's lending turnover for the whole year of 2024 will reach about 23 million billion VND, debt collection turnover will be about 21 million billion VND. The additional supply to the economy compared to the outstanding debt of 2023 is about 2.1 million billion VND. The current outstanding debt is 15.6 million billion VND, while at the end of 2023 it was 13.6 million billion VND. That shows that the proportion of credit capital put into the economy is very high.

Looking back at 2024, the Deputy Governor commented that reasonable monetary policy has been ensured, GDP growth is 7.08%, inflation is controlled at 3.6%. Deposit interest rates and lending interest rates are still in harmony. The average deposit interest rate in 2024 increased by 0.73%/year compared to the end of 2023, the average lending interest rate decreased by 0.59%/year. Of which, the 4 Big4 banks reduced their lending interest rates by an average of nearly 1%/year compared to the end of 2023.

"At the end of 2024, some small commercial banks increased their deposit interest rates to ensure liquidity. The State Bank is still monitoring but there are no signs of having to stop them. Deposit interest rates are completely under control so that depositors do not have to run from one bank to another, and money does not flow from one sector to another," Deputy Governor Dao Minh Tu emphasized.

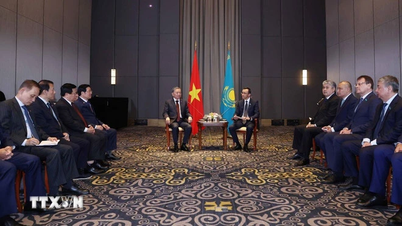

In 2024, deposit interest rates and lending interest rates are still in harmony. The average deposit interest rate in 2024 increased by 0.73%/year compared to the end of 2023, and the average lending interest rate decreased by 0.59%/year. Illustrative photo

Fraud and account appropriation reduced by more than 50%

Regarding exchange rate management, there were times when it increased by more than 7%, but compared to Asia, Vietnam's exchange rate was still the most stable. On average, the exchange rate increased by about 5.03% throughout the year. The exchange rate sometimes increased and sometimes decreased according to market supply and demand, ensuring harmony and balance between export and import. Enterprises and investors can be completely assured about Vietnam's exchange rate.

Regarding the management of gold trading activities, last year, the price difference between SJC gold bars and the world price was at times up to nearly 20 million VND/tael, but now it is only about 3-4 million VND/tael. The State Bank is also considering amending Decree 24 to ensure the legitimate rights of the people.

"The State Bank considers stabilizing the gold market a very urgent task that requires immediate action" - the Deputy Governor emphasized.

Payment technology is the issue of the year 2024. To date, 84.7 million bank accounts have been biometrically authenticated. Fraud and account theft cases have decreased by more than 50% since the application of biometric technology in payments.

The State Bank assessed that in 2024, the world economy will grow slowly and unevenly, inflation in countries will cool down more clearly after a period of monetary tightening and falling oil prices. Central banks will lower interest rates, and commodity and currency markets will fluctuate strongly due to the uncertainty of the global economy. The domestic economy will grow positively, and inflation will be controlled in line with the set goals. Compared to other countries in the world, Vietnam is a bright spot in controlling inflation, stabilizing the macro economy, and contributing to attracting FDI capital.

However, Vietnam has a large openness, so it faces many difficulties and challenges when the world economic recovery is not yet sustainable, inflation risks still exist, international USD interest rates have decreased but are still at a high level, and the correlation between the US economy and other economies will make the USD continue to have complicated developments, creating challenges for Vietnam's monetary policy management.

Commenting on the challenges to credit growth in 2025, Mr. Dao Minh Tu said that many businesses are still facing difficulties and weak financial health, which limits their ability to access capital. This also causes the risk of bad debt in the banking system to increase next year.

Source: https://pnvnweb.dev.cnnd.vn/kiem-soat-lai-suat-de-nguoi-gui-khong-phai-chay-tu-ngan-hang-nay-sang-ngan-hang-khac-20250107174632318.htm

![[Photo] Vietnam and Sri Lanka sign cooperation agreements in many important fields](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/9d5c9d2cb45e413c91a4b4067947b8c8)

Comment (0)