Life insurance “transforms” to meet the needs of young people

As illness is an unpredictable variable and tends to become younger, young people choose to proactively respond and protect themselves with a comprehensive insurance product that optimizes benefits.

Customers are “demanding more” from life insurance

Along with health concerns in modern life, the need for health insurance in Vietnam is increasing. This is also a top concern for young people. According to a 2023 survey in Vietnam, 98% of participants said they were worried about their health. In particular, the 25-34 age group expressed concern about having health problems or chronic diseases by the age of 48.

This insecurity is well-founded. Statistics in recent years show that many diseases are tending to become younger, typically diabetes. According to statistics from the Ministry of Health, Vietnam currently has more than 7 million people with diabetes. Notably, the rate of young people from 20 to under 30 years old [1] suffering from this disease is not small and this rate is increasing. This is a disease that cannot be completely cured, patients need to follow a long-term treatment regimen to live with the disease and limit the risk of cardiovascular complications, eye damage, kidney damage, etc.

|

| Young people increasingly demand higher life insurance products. |

“Having insurance to prevent illness from happening to you is not redundant, because life now has too many potential risks. Like my friend who just discovered he had Type 2 diabetes last month, but luckily he joined insurance, he realized the meaning of “looking far ahead” - Nguyen Binh (29 years old, office worker in Hanoi) shared. That is the reason why Binh always sets aside a fixed portion of his savings fund for the “health jar”, for medical examination and treatment and participating in life insurance. “The benefits of payment, support for hospital fees, treatment costs, surgery,... from life insurance help me worry less about the future and feel more secure” - Binh said.

With countless life insurance products on the market, Binh sets the most important criteria as optimizing benefits and the list of covered diseases. “I prioritize choosing new insurances that are updated with more common diseases, not just focusing on serious cases like cancer and accidents like before.” – Binh shared more.

New generation insurance - pioneering in taking risks

Similar to Binh, many young people today also pay great attention to health, the need for health protection is increasing. This trend encourages insurance brands to "transform", designing solutions to suit new needs. Many units continuously launch digital solutions such as insurance applications, allowing online filing or compensation payments, which are welcomed by young customers because they are fast and convenient.

Based on the trend of “rejuvenation” of diseases, BIDV MetLife Insurance has “taken the lead” in designing the Comprehensive Health Gift product. This is a pioneering insurance product in the market to protect customers against Type 2 diabetes, which is becoming more common and becoming a risk to the whole community, especially young people.

According to BIDV MetLife's advice, Mr. M (27 years old) participated in the Health Gift - Peace of mind every day plan with a contract term of 25 years, the annual premium for the main product is 24 million VND, equivalent to the insurance amount of 916 million VND. At the age of 32, the doctor diagnosed him with Type 2 diabetes. With the insurance product he participated in, he was immediately paid ~ 140 million VND for Type 2 diabetes benefits and supported up to 2 million VND/day of hospitalization because he participated in additional Insurance to support hospital fees and surgery costs. Thus, although it cannot completely eliminate anxiety, this payment will also help patients reduce their financial burden and feel secure in treating the disease.

In addition to Type 2 Diabetes, the Health Gift package also has other outstanding benefits such as protection against early stage cancer with a payout of up to 500 million VND, 3-year fee exemption, many benefits related to hospitalization, surgery,... in case of accidents or serious illnesses when customers participate in additional products.

|

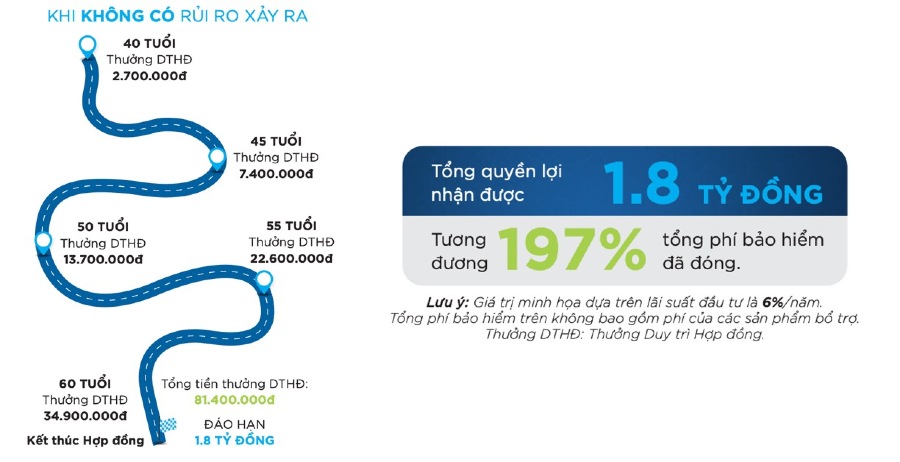

| An example of the bonus when participating in BIDV MetLife's Health Gift - Peace of mind every day |

At the same time, customers will be able to build a contract maintenance bonus that is automatically added to the account value every 5 years until the end, or flexibly withdraw money to pay when needed.

“The Health Gift product is a testament to BIDV MetLife Insurance’s efforts in research and innovation for customers. We always follow the latest health trends to promptly design comprehensive solutions, bringing optimal benefits and the highest peace of mind to customers,” said a BIDV MetLife representative.

Source: https://baodautu.vn/bao-hiem-nhan-tho-chuyen-minh-truoc-nhu-cau-cua-nguoi-tre-d220171.html

Comment (0)