Strong selling pressure at the end of the session caused many stock groups to fall below the reference level. VN30-Index lost the 1,300-point mark in the session on January 10. Foreign investors had a series of 4 consecutive net selling sessions.

Strong selling pressure at the end of the session caused many stock groups to fall below the reference level. VN30-Index lost the 1,300-point mark in the session on January 10. Foreign investors had a series of 4 consecutive net selling sessions.

VN-Index ended the previous session at 1,245.77 points, down 0.42%, trading volume down 21% and only 50% of the average. Entering the trading session on January 10, trading still did not improve. Investor sentiment remained cautious. The main state of VN-Index this morning was narrow fluctuations around the reference level. The index opened the session in red and fluctuated below the reference level for about 1 hour of trading. After that, the market showed a glimmer of green but the increase was very modest.

However, with weak demand and sellers gradually losing patience, the number of stocks decreasing gradually increased. VN-Index reversed and gradually widened its range at the end of the morning trading session.

Moving on to the afternoon trading session. The situation was not much better, the selling pressure continued to increase, causing the VN-Index to fluctuate quite strongly. Although there were a few times when the demand increased, helping the market recover. However, when the market recovered, the new money flow did not come in, causing the selling pressure to increase. After 2:00 p.m., a series of stock groups were sold heavily, pushing the index deep below the reference level. The VN30-Index today "broke" the 1,300 point mark.

At the end of the trading session, VN-Index decreased by 15.29 points (-1.23%) to 1,230.48 points. HNX-Index decreased by 2.45 points (-1.1%) to 219.49 points. UPCoM-Index decreased by 0.94 points (-1.01%) to 92.15 points. The whole market recorded 507 stocks decreasing, while only 201 stocks increased in price and 836 stocks remained unchanged/no trading. The market still had 32 stocks hitting the ceiling and 29 stocks hitting the floor.

|

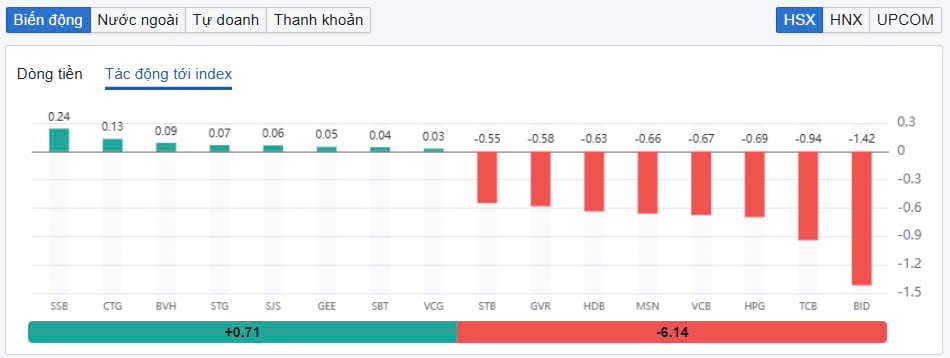

| Top 10 stocks affecting VN-Index |

The widespread selling pressure has caused a series of stock groups to sink into the red. In the VN30 group today, only 3 stocks increased while 26 stocks decreased. HDB and STB both decreased by over 3%. Stocks that decreased by over 2% include SSI, MSN, PLX, TCB, BID, GVR and BCM. Meanwhile, BID was the stock that had the worst impact on the VN-Index, taking away 1.42 points from the index. At the end of the session, BID decreased by 2.13%. TCB also decreased by 2.3%. In addition, stocks such as HPG, MSN... were also submerged in the red.

On the other hand, SSB, CTG and BVH were the stocks that had the most positive impact on the VN-Index in today's session. SSB increased by 2% and contributed 0.24 points. CTG increased by 0.27% and contributed 0.13 points. In the small and medium-cap group, YEG hit the floor to VND14,750/share. The steel group also recorded ITQ and MEL hitting the floor. In addition, VGS fell by 5.7%, TLH fell by 2.3%, HPG fell by 1.7%, HSG fell by 3%, and NKG also fell by 1.1%.

Export stocks continued to plummet. In the textile group, GIL continued to decrease by 3.5%, VGT decreased by 2.9%, STK decreased by 2.7%, TNG decreased by 2.1%. Similarly, in the seafood group, VHC decreased by 4.4%, ANV decreased by 3.5%, FMC decreased by nearly 2%. The real estate group was not out of the general market trend. PDR recorded a decrease of up to 5%, TCH decreased by 4.3%, HDC decreased by 3.9%, DXG decreased by 3.7%.

|

| Foreign investors extend net selling streak for fourth consecutive year |

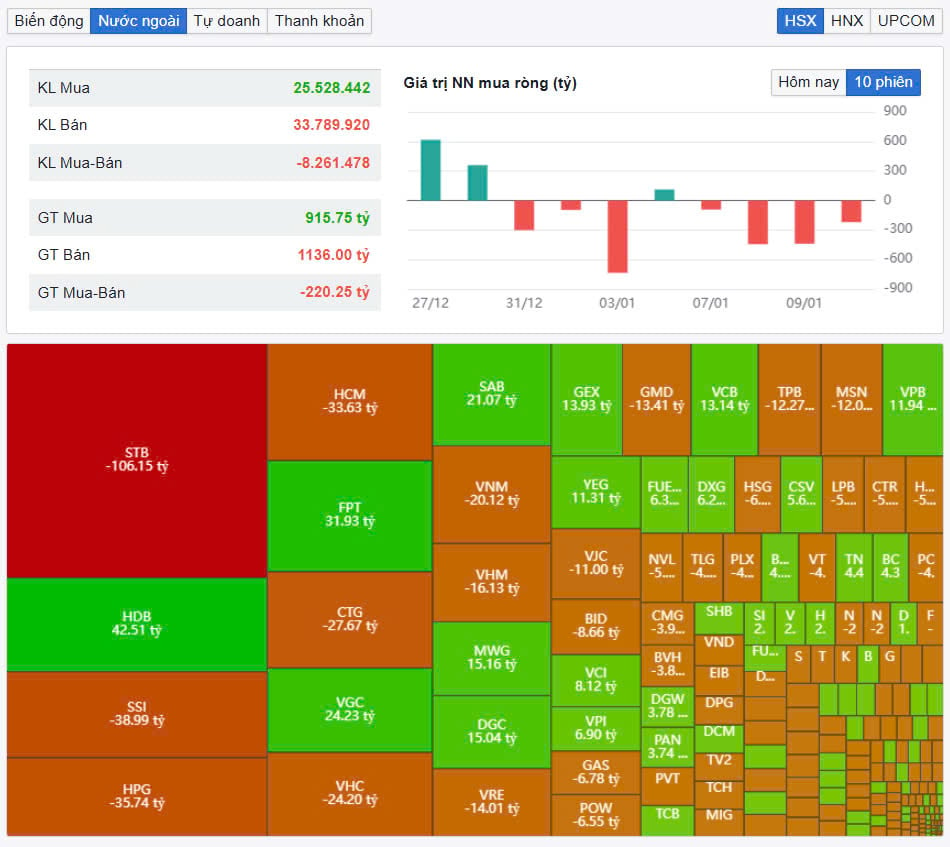

Total trading volume on HoSE reached VND499 billion, equivalent to a trading value of VND11,235 billion, up 50% compared to the previous session, of which negotiated transactions contributed VND798 billion. Trading values on HNX and UPCoM reached VND765 billion and VND694 billion, respectively. STB topped the list of strongest transactions on HoSE with VND556 billion. SSI and FPT followed with values of VND514 billion and VND374 billion, respectively.

Foreign investors continued to net sell VND283 billion in today's session, in which, this capital flow net sold the most STB code with VND106 billion. SSI and HPG were net sold VND39 billion and VND36 billion respectively. Meanwhile, HDB was net bought the most with VND43 billion. FPT was also net bought VND32 billion in today's session.

Source: https://baodautu.vn/ban-tren-dien-rong-vn-index-giam-hon-15-diem-trong-phien-101-d240223.html

![[Photo] Prime Minister Pham Minh Chinh dialogues with Vietnamese youth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/7fd8b4735134417cbaf5be67ee9f88b1)

![[Photo] Vietnam team's strength guaranteed for match against Laos](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/1e739f7af040492a9ffcb09c35a0810b)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives the delegation of Nhan Dan Daily](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/a9ac668e1a3744bca692bde02494f808)

Comment (0)