VN-Index still maintains short-term growth with the nearest support zone around 1,315 points.

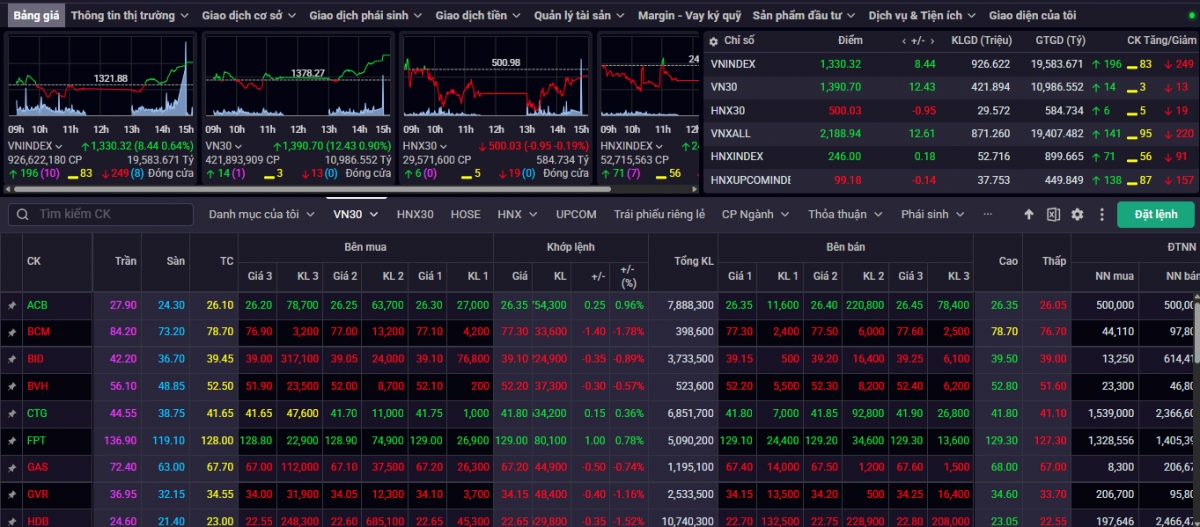

After a week of slight correction pressure, VN-Index had a fairly positive first session of the week. At the beginning of the session on March 24, VN-Index was under pressure to correct to support around 1,315 points, then recovered and increased points well under the positive influence of large-cap groups, notably: VIC, VHM... and banking and technology codes. At the end of the trading session on March 24, VN-Index increased by 8.44 points (+0.64%) to 1,330.32 points, maintaining above the 20-session average price range of around 1,320 points. VN30 increased by 12.43 points (+0.90%) to 1,390.70 points, continuing to move towards the strong resistance zone of 1,400 points - 1,420 points, corresponding to the highest price range in May 2022.

The breadth on HOSE is still negative with 179 stocks decreasing in price, concentrated in the real estate group due to negative information such as PDR, minerals, oil and gas stocks..., 117 stocks increasing in price, notably Vincom stocks due to positive information, securities group, strong differentiation in the banking group... and 58 stocks keeping the reference price. Market liquidity increased with trading volume increasing by 11.3% on HOSE, above average. The general market sentiment is still quite optimistic when many stocks are under pressure to adjust, liquidity decreased while the market still has outstanding opportunities. Foreign investors continued to net sell strongly with a value of -718.9 billion VND on HOSE in the session of March 24.

According to experts from Saigon - Hanoi Securities Company (SHS), VN-Index is still maintaining short-term growth with the nearest support zone around 1,315 points, corresponding to the lowest price on March 11, 2025, with a stronger support of more than 1,300 points. After the price increase period, VN-Index is still under pressure to restructure its portfolio as it is approaching the end of the first quarter of 2025, waiting for updates on fundamental factors and business results.

In the short term, the market is still quite positively differentiated, with short-term rotation. VN-Index is under relatively normal adjustment pressure under the rotational influence of many groups of codes in the market. Code groups are still maintaining a fairly good trend such as: securities, banks before expectations of growth in first quarter business results, leading real estate codes after a long period of decline with quite good opportunities. Many groups of codes have also been under strong selling pressure, prolonged adjustment to relatively attractive price ranges and gradually started to rebalance such as technology, telecommunications, aviation, insurance groups...

“Many stocks are at relatively reasonable prices, investors can further evaluate growth potential, to consider accumulating again. Investors maintain a reasonable proportion. Investment targets are stocks with good fundamentals, leading in strategic industries, and outstanding growth of the economy,” said SHS experts.

The market is likely to continue its upward momentum.

According to the analysis team of Kien Thiet Securities Company (CSI), the VN-Index increased by more than 8 points in the first session of the week, regaining the MA10 threshold and ending the previous 4-session correction series. Market liquidity increased, but still could not reach the 20-session average threshold. Along with the recovery momentum that has not yet spread widely, the increase on March 24 is more of a pullback and cannot completely deny the previous short-term correction trend.

“Investors should still be cautious and patiently wait for the VN-Index to test the strong support zone of 1,286 - 1,290 points before returning to a net buying position,” CSI experts noted.

Meanwhile, experts from Yuanta Vietnam Securities Company (YSVN) said that the market may continue to increase in today's session, March 25, but the risk of correction remains high in the coming sessions. At the same time, short-term risks remain high and the indices are being dominated by a few large-cap stocks, while small- and medium-cap stocks may show signs of recovery, indicating that the market may be diverging between stock groups. In addition, short-term sentiment indicators continue to decline, so investors should limit buying during this period.

“The short-term trend of the general market remains neutral. Therefore, investors can continue to hold a low proportion of stocks at 30-40% of the portfolio and limit chasing buying at uptrends. In addition, investors can prioritize holding financial, technology and real estate stocks because cash flow is strongly concentrated in these groups of stocks,” YSVN experts recommended.

► Some stocks to watch on March 25

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-253-thi-truong-co-the-se-tiep-tuc-da-tang-post1163533.vov

![[Photo] President Luong Cuong attends the 90th Anniversary of Vietnam Militia and Self-Defense Forces](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/678c7652b6324b29ba069915c5f0fdaf)

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives Iranian Ambassador Ali Akbar Nazari](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/269ebdab536444818728656f8e3ba653)

Comment (0)