2024 continues to be a "profitable" year for many large banks, recording the highest profits in their operating history, despite many economic difficulties.

The deadline for announcing 2024 financial statements has not yet come, but many banks in the group "Big4" has estimated business results for last year.

Revealing the profit champion of the entire banking industry

Specifically, information from the Joint Stock Commercial Bank for Investment and Development of Vietnam - BIDV, pre-tax profit in 2024 will reach 30,006 billion VND (equivalent to more than 1.1 billion USD), an increase of 12.4% over the previous year.

With this profit, BIDV can become the second most profitable bank in the system, after Vietcombank. This is also the year of record profits for this bank.

What about Vietcombank, up to now, this bank has not announced detailed figures, but said that pre-tax profit continues to be the highest in the banking industry and completed the plan assigned by the State Bank and the general meeting of shareholders.

Thus, with the 5% growth target set from the beginning of 2024, Vietcombank's estimated consolidated pre-tax profit could exceed VND 43,300 billion, and individually VND 42,500 billion.

Previously, Vietcombank's report showed that consolidated pre-tax profit in 2023 reached VND41,244 billion, setting a new record. With the expected results in 2024, this bank will continue to break the old record.

In fact, after 3 business quarters of 2024 (January 1, 2024 to September 30, 2024), this bank recorded consolidated pre-tax profit of VND 31,533 billion, an increase of 6.7% over the same period in 2023.

At Agribank, information from the bank shows that in 2024, although business operations faced many difficulties and challenges in the general context of the economy, the bank's pre-tax profit still increased by over 8%.

With the above growth rate, Agribank's individual pre-tax profit in 2024 is VND 27,567 billion, and consolidated profit is more than VND 27,928 billion.

At VietinBank, this bank also said that revenue in 2024 will grow positively, with profits reaching and exceeding the set plan.

Previously, in early October 2024, VietinBank agreed on the 2024 business plan targets with the parent bank's pre-tax profit target of VND 26,300 billion, an increase of 8.7% compared to 2023.

Thus, the total pre-tax profit of the "Big 4" banking group is approximately more than 126,300 billion VND (approximately 5 billion USD).

How is the credit growth of the Big4 group?

According to the report of State Bank, as of December 31, 2024, economic credit increased by about 15.08% compared to the end of 2023, equivalent to 2.1 million billion VND pumped into the economy.

Unlike some private banks, many state-owned banks have recorded lower or higher loan balances, but not significantly higher than the industry average.

Specifically, according to information from VietinBank, the bank's credit balance growth in 2024 will reach 16.88% compared to 2023, higher than the average growth rate of the whole industry.

However, similar to the trend in many other banks, VietinBank's total mobilized capital reached VND 1.8 million billion, an increase of 15% compared to the end of 2023 - lower than the increase in loan capital.

At Vietcombank, by December 31, 2024, total assets exceeded VND2 million billion for the first time, an increase of 13% compared to the level achieved at the end of 2023.

Vietcombank's total assets grew thanks to its focus on lending to the economy. According to the report, Vietcombank's total outstanding credit balance reached over VND1.44 trillion, up nearly 14%.

However, capital mobilization from market I (residential and corporate market) of this bank reached 1.53 million billion VND, an increase of only more than 8% compared to 2023 - much lower than credit growth.

By the end of 2024, Agribank's total assets will reach over VND 2.2 million billion (up nearly 10%), capital will reach over VND 2 million billion (up 7.6%), and outstanding loans will reach over VND 1.72 million billion, up only 11%.

At BIDV, total assets of the commercial banking sector reached nearly 2.7 million billion VND (equivalent to more than 100 billion USD), growing by 19.4%, maintaining its position as the joint stock commercial bank with the largest total assets in Vietnam.

According to BIDV, total mobilized capital in 2024 will reach VND2,140 trillion, up 13.1%. Meanwhile, total outstanding credit will reach over VND2,010 trillion, up 15.3%; credit market share will be the largest in the market, reaching 13.1%.

Source

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

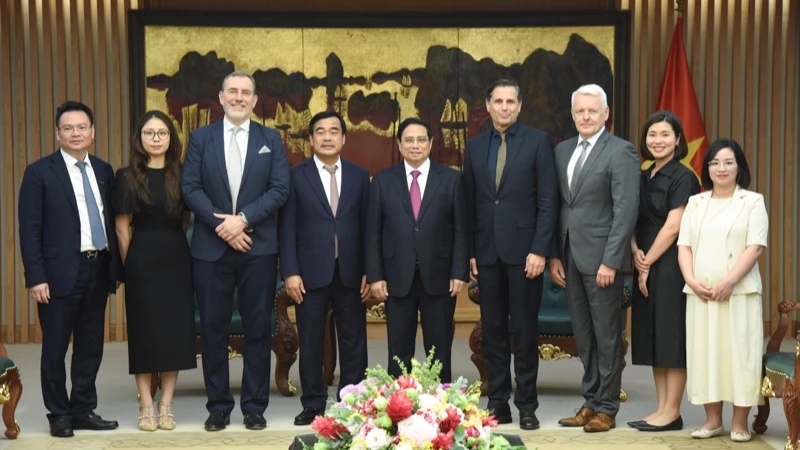

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

![[6pm News] Thanh Hoa still has nearly 9,000 households in mountainous districts in need of housing support](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/f67bbe1ab09943bead5a009e47703c5b)

Comment (0)