Minister Ho Duc Phoc: In the context of the economy still facing many difficulties after the pandemic, the resilience of enterprises is at its limit, the Ministry of Finance has proactively advised the Government, the Standing Committee of the National Assembly and the National Assembly to synchronously and promptly issue many solutions to exempt, reduce and extend taxes, fees, charges and other state budget revenues to remove difficulties for the economy, unblock cash flow for enterprises, support economic and social recovery and development, and contribute to nurturing revenue sources for the state budget.

It is estimated that the support packages on tax, fee, charge exemption, reduction and deferral policies are up to 200,000 billion VND. I believe that this is a particularly important milestone, clearly demonstrating the positive and effective role of fiscal policy in stabilizing the macro-economy, promoting economic recovery and growth.

In addition, the Ministry of Finance has submitted to the Government and the National Assembly for approval a Resolution on the application of additional corporate income tax in accordance with the regulations against global tax base erosion and will be applied in Vietnam from 2024. This shows Vietnam's proactiveness in participating in the international playground, affirming the right to collect taxes on production and business activities in Vietnam according to international regulations and domestic laws.

Along with that, the Ministry of Finance has directed the Tax and Customs authorities to strengthen revenue management through the application of information technology systems and big data systems to manage revenue, manage risks, prevent fraud in the use of invoices, refund value added tax, and ensure correct, sufficient and timely collection of revenues for the State budget.

As a result, the estimated state budget revenue in 2023 will exceed the estimate by about 5%; despite the tax exemption and reduction, this year's budget revenue will exceed the estimate assigned by the National Assembly by about 9-10%. Notably, both the central and local budgets have exceeded the estimate.

Regarding state budget expenditure, the Ministry of Finance has coordinated with ministries, branches and localities to manage state budget expenditure strictly, thoroughly and economically, and effectively. At the same time, it has advised the Government to direct the drastic implementation of solutions to promote the disbursement of public investment capital from the state budget and capital from national target programs, creating momentum to promote economic recovery and growth.

At the same time, thoroughly save regular expenses, review and arrange spending tasks, cut down on unnecessary and urgent expenses, and strictly manage spending within the budget estimates and budget collection capacity at all levels.

In 2023, we have balanced and ensured resources to increase the basic salary from 1.49 million VND/month to 1.8 million VND/month (an increase of 21%) from July 1, 2023. This is extremely meaningful because in the past 3 years, due to the impact of the Covid-19 pandemic, the financial and budgetary economy has been difficult and we have had to focus on epidemic prevention, so we have not been able to reform wages, so the lives of a number of civil servants have been difficult. This is also an important premise for us to continue to comprehensively reform the wage policy in 2024 according to Resolution 27.

Minister Ho Duc Phoc: Public investment capital is identified as one of the important driving forces to promote economic growth in the context of many fluctuations in the domestic and international situation, with many factors negatively affecting the socio-economic situation.

In 2023, the total public investment capital from the State budget will be injected into the economy, the highest in recent years, with VND 711,684 billion, an increase of 22.1% compared to 2022. In absolute terms, the disbursed capital compared to the same period last year increased by more than VND 122,000 billion. Most of the capital is focused on important national projects, highways, regional connectivity, coastal roads, and national target programs.

Despite positive results, the disbursement of public investment capital in recent times has not been as expected. There are many reasons leading to this situation.

There are contradictions, overlaps, and inconsistent application of some legal regulations. Some legal regulations need to be amended to suit practical implementation, such as problems with land use planning, focusing on determining the origin of land, and problems related to unclear regulations on minerals.

Therefore, it is necessary to regulate the separation of site clearance into independent projects, assign a locality as the governing body to implement public investment in road traffic projects through many localities and use the budget of one locality to support another, assign the locality as the governing body, use local budget capital to invest in implementing tasks and projects under the authority of ministries and central agencies in the area.

Another reason is due to the implementation organization such as planning work not being close to the implementation capacity, investment preparation work, approval of investment policy and project investment decision are not good, having to adjust many times during the implementation process.

In particular, there is a situation where officials, civil servants, and public employees show signs of avoiding and fearing responsibility. The lack of land, sand, and construction materials is also the reason why the disbursement results are not as expected.

To unblock the flow of public investment capital and create momentum for economic development, I believe that the key factor is still to perfect the legal regulations in a synchronous and practical direction, to strengthen decentralization along with inspection, supervision, and simplification of procedures at all steps and stages related to public investment projects. Regarding implementation, it is necessary to promote the sense of responsibility, to cover the work, and to set an example for the leader. The Party Executive Committee and the Youth Union need to make the disbursement of public investment capital a key task.

Minister Ho Duc Phoc: The Ministry of Finance will implement the 2024 financial and state budget tasks in the context of intertwined socio-economic challenges. I predict that there will be more difficulties than advantages.

Meanwhile, the tasks set for the Finance sector are extremely heavy: Estimated state budget revenue is 1.7 million billion VND; Estimated state budget expenditure is 2.1 million billion VND; State budget deficit is 399,400 billion VND, equivalent to about 3.6% of GDP.

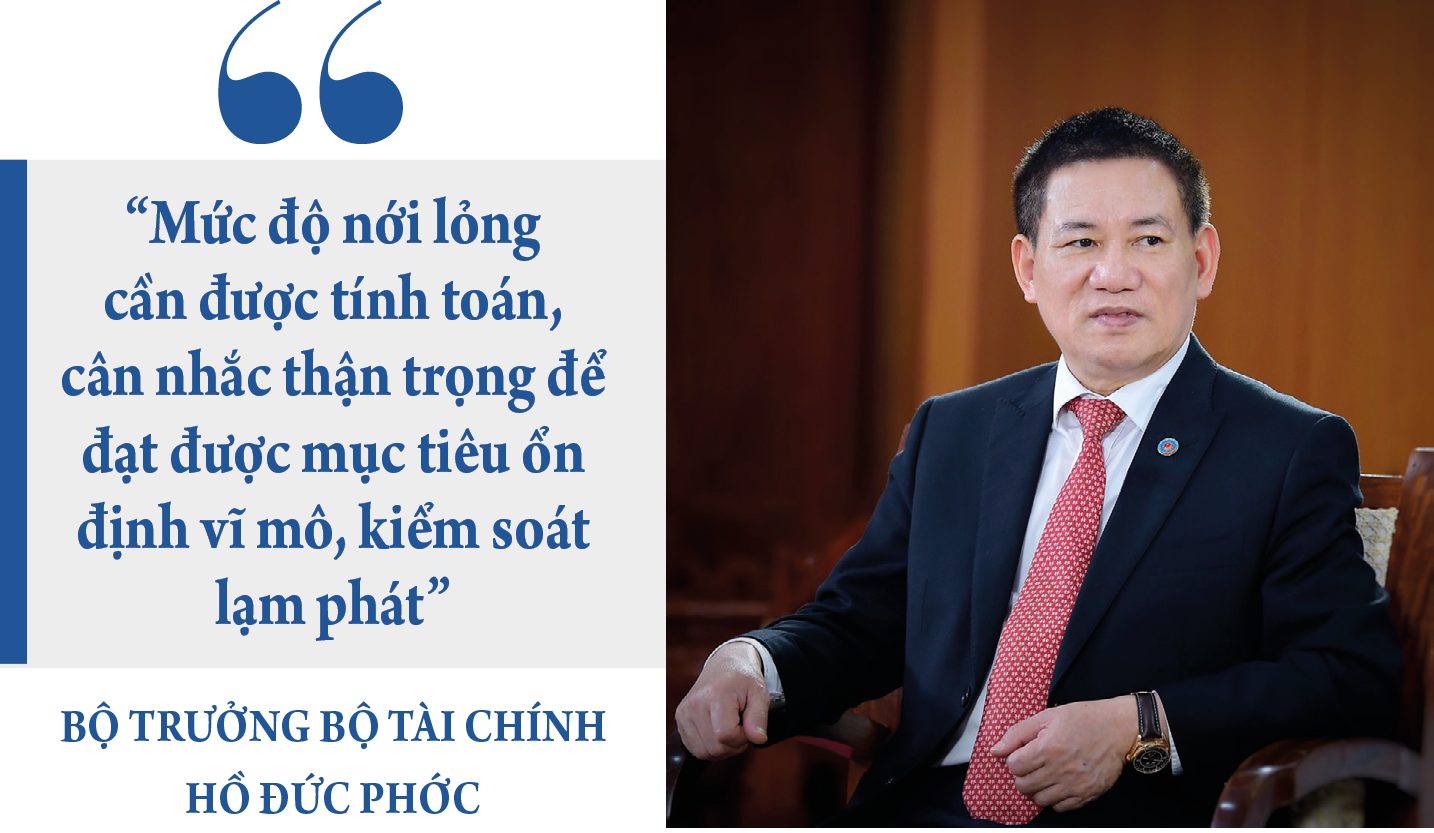

The difficult issue for 2024 is to use a reasonable fiscal policy to both stimulate the economy and ensure macroeconomic stability, control inflation, and ensure national financial security. Therefore, the level of easing needs to be calculated and carefully considered to achieve the above multiple goals, in which the goals of macroeconomic stability and inflation control are still considered the top priority goals.

To achieve the set goals, we will vigorously deploy a number of groups of solutions.

Source

Comment (0)