The index representing the Ho Chi Minh City Stock Exchange increased by more than 2 points in the session on October 28, approaching 1,255 points on the lowest liquidity in the past month.

The index representing the Ho Chi Minh City Stock Exchange increased by more than 2 points in the session on October 28, approaching 1,255 points on the lowest liquidity in the past month.

Before entering the new week's trading session, some experts said that investors should carefully manage their portfolios, closely follow exchange rate developments and the State Bank's moves in the coming time. However, most maintain a positive view on the medium and long-term market outlook, focusing on stocks with good fundamentals and positive Q3 business results, waiting for signs of balance confirmation and attractive valuations.

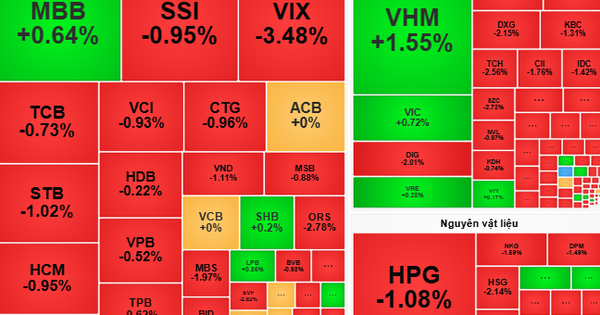

VN-Index opened the first session of the week in green and at one point surpassed the 1,255 point mark. However, the positive development did not last long when selling pressure increased in the middle of the session, causing the index to reverse below the reference. The tug-of-war continued throughout the session, causing the index to reverse from increasing to decreasing and vice versa many times. VN-Index closed today's session at 1,254.77 points, up more than 2 points from the reference and breaking the streak of 2 consecutive sessions of decrease.

Ho Chi Minh City Stock Exchange today recorded nearly 483 million shares successfully transferred, equivalent to a transaction value of VND10,863 billion. The matched volume decreased by 86 million shares compared to the session at the end of last week, while the transaction value decreased by nearly VND3,000 billion. This is the session with the lowest liquidity value in over a month.

VHM led in order matching value with more than VND 840 billion (equivalent to 19.5 million shares), followed by MSN with more than VND 441 billion (equivalent to 5.7 million shares) and STB with about VND 386 billion (equivalent to 11.4 million shares).

Market breadth was skewed to the upside with 211 stocks closing in the green, while only 162 stocks closed below the reference. The large-cap basket was similar, recording 15 stocks gaining, while 9 stocks losing.

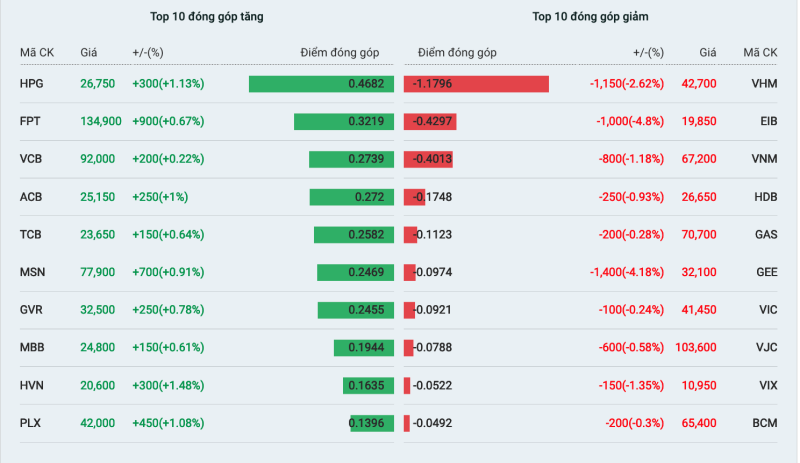

|

| List of stocks with the most positive and negative impact on the market on October 28. |

HPG accumulated 1.13% in today's session, up to VND26,750 and became the main growth driver of the market. This driving force also came from pillar codes of many other industry groups such as food, aviation, oil and gas... Specifically, MSN of the food group increased by 0.91% to VND77,900, HVN of the aviation group increased by 1.48% to VND20,600, PLX of the oil and gas group increased by 1.08% to VND42,000.

The banking group has 4 representatives in the list of stocks that have the most positive impact on the VN-Index. Specifically, VCB increased by 0.22% to VND92,000, ACB increased by 1% to VND25,150, TCB increased by 0.64% to VND23,650 and MBB increased by 0.61% to VND24,800.

Fertilizer stocks also recorded a significant improvement in today's session when most of them increased points. Specifically, BFC increased by 2.7% to VND40,350, DCM increased by 2.2% to VND37,400 and DPM increased by 0.4% to VND34,200.

On the other hand, some stocks in the VN30 basket were under intense selling pressure. Specifically, VHM topped the list of 10 stocks that had the most negative impact on the VN-Index when it fell 2.62% to VND42,700. Next, VNM fell 1.18% to VND67,200, GAS fell 0.28% to VND70,700. The remaining stocks in the large-cap basket on the above list were VIC, VJC and BCM.

Foreign investors continued their net selling streak for the third consecutive session. Specifically, in the first session of the week, this group sold more than 41 million shares, equivalent to a transaction value of VND1,419 billion, while only disbursing about VND962 billion to buy more than 30 million shares. The net selling value was approximately VND458 billion.

Foreign investors dumped MSN shares with a net value of nearly VND280 billion, followed by SHS with more than VND111 billion, HPG with more than VND72 billion. On the other hand, foreign investors bought FPT shares with a net value of about VND50 billion. EIB ranked next with a net absorption of nearly VND49 billion and STB with approximately VND47 billion.

Source: https://baodautu.vn/vn-index-tang-diem-du-thanh-khoan-xuong-thap-nhat-mot-thang-d228539.html

Comment (0)