The Hanoi Stock Exchange (HNX) has just announced that VKC Holdings (VKC) shares are likely to be delisted according to the provisions of Point e and Point h, Clause 1, Article 120 of Decree 155/2020/ND-CP. The reason is that the company's total accumulated losses exceed its actual contributed charter capital. In addition, the auditing organization also refused to give an opinion on the company's 2022 financial statements.

HNX will consider compulsory delisting of VKC shares according to regulations, and request VKC Holdings to respond in writing on the above issue within 5 days from March 9.

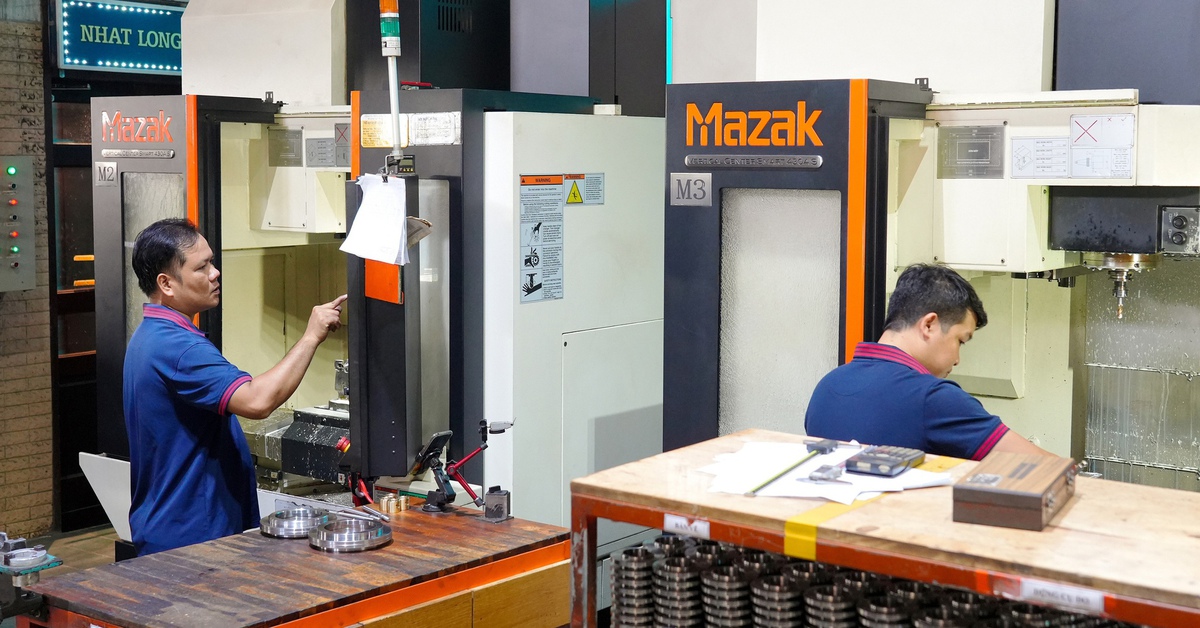

With an accumulated loss of VND217 billion, VKC Holdings is doubted about its ability to continue operating (Photo TL)

Regarding VKC Holdings' large losses, in the audited financial report for 2022, VKC had a net loss of up to VND 239 billion. The loss in 2022 pushed VKC's accumulated loss to VND 215 billion, larger than the company's charter capital of VND 200 billion. The fact that the accumulated loss exceeds the owner's equity shows the existing risks in VKC Holdings' business operations and capital management.

Regarding the loss of hundreds of billions of VND above, VKC Holdings explained that it was mainly due to the cost of handling unexplained inventory shortages, interest expenses on loans and bonds, costs of handling unformed fixed assets, and provision for bad debts. In addition, the company's revenue also decreased sharply, causing this accumulated loss to increase sharply.

Regarding the 2022 financial report, the auditor also refused to give an opinion because he did not receive a debt confirmation letter regarding the issue of total short-term debt exceeding total short-term assets. The company has set aside provisions for overdue receivables of up to VND 68.16 billion, but the auditor could not collect evidence related to this amount.

In addition, in the short-term loans and financial leasing debt item, the description of the cash flow from the bond issuance is also not consistent with the information disclosure of the acquisition of all capital contributions owned by Louis Land JSC at Toccoo Vietnam LLC with the amount of VND 80.8 billion. The auditors believe that up to VND 35 billion was recorded for expenses for the wrong purpose.

In the 2022 short-term financial leasing and borrowing indicators of VKC Holdings, there is an explanation describing that An Giang Import-Export Joint Stock Company (AGM) used assets such as the right to use, the right to own houses and assets attached to the land plot No. BR626016, located in Nui Sap Town, Thoai Son District, An Giang Province, as collateral for the issuance of bonds of VKC Holdings. However, the auditor determined that this asset had not been signed by 3 parties as collateral in accordance with regulations.

Regarding VKC's accumulated loss up to the end of December 2022, recorded at VND 217 billion, short-term debts exceeded total short-term assets. The company also has a number of short-term loans, interest debts, and overdue bonds with an estimated total value of more than VND 178 billion.

Source

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

Comment (0)