World gold price is about to "hit rock bottom"

In recent sessions, the world gold market has fluctuated strongly and many times hit the "bottom" of 1,900 USD/ounce.

In the US market last night, the precious metals market continued to sink. Spot gold and gold futures both fell from 0.30% to 0.40%. The direct factors that sank gold were the strength of the dollar and higher US Treasury yields.

The dollar rose 0.35%, bringing the index to 103.05. After a sharp decline in gold prices last week, the first trading day of the week showed further downside momentum based on the latest economic data.

Continued economic strength and inflation would lead to a “No Landing” scenario.

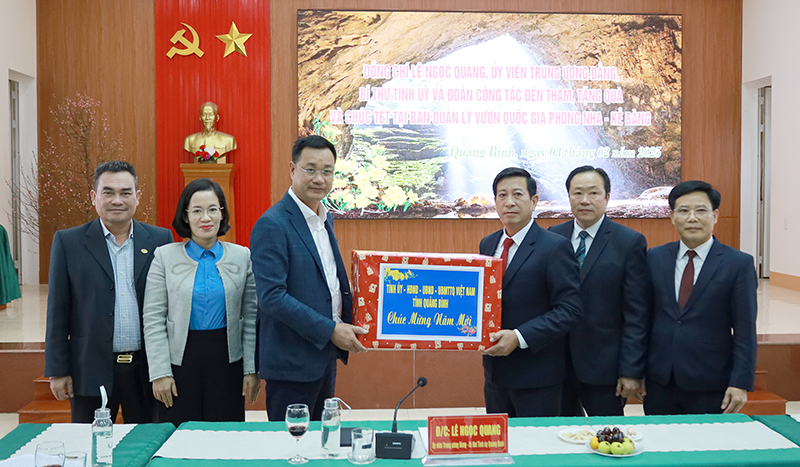

While the world gold price is continuously decreasing and is about to "bottom out" at 1,900 USD/ounce, the price of SJC gold is still strong and increasingly expensive. Illustrative photo

Last week, data showed that the US CPI (Consumer Price Index) rose moderately in July. But as producer prices rose less than expected, members of the US Federal Reserve (FED) are expressing concern that their fight against inflation is not over and as a result may keep interest rates higher for longer.

Recent economic data has shown the U.S. economy to be strong and resilient, and has largely convinced the Fed and economists that a recession is unlikely. The new acronym for the end game of the Fed’s aggressive monetary policy is no longer “hard landing” or “soft landing” but “no landing.”

The meaning behind this acronym is that economic growth is too strong to allow inflation to easily fall to the Fed's 2% target, suggesting that the Fed will need to raise interest rates further to ensure a consistent path to their 2% target.

However, that won't happen at next month's FOMC meeting, according to the CME FedWatch tool, with an 88.5% probability that the Fed will maintain the current rate range of 5 ¼% to 5 ½%. Investors are looking ahead to the next major event, the release of the minutes from last month's FOMC meeting on Wednesday.

In addition, the newly released economic data from Japan and the decline of real estate company Country Garden have caused investors to rush to safe havens. At this time, the safe haven is the US dollar, not gold. In the trading session this morning in the Asian market, the world gold price continued to be in the red when it decreased by 1.8 USD/ounce to 1,905 USD/ounce. At this level, the converted price of SJC gold reached about 54.73 million VND/tael.

SJC gold is increasingly expensive

The domestic gold market is experiencing many “strange” developments. While the world gold price is gradually decreasing and is about to reach the important milestone of 1,900 USD/ounce, yesterday, the price of SJC gold increased quite strongly, far exceeding the milestone of 67 million VND/tael.

By early morning of August 15, despite the world gold price continuing to "sink", the SJC gold price only decreased very slightly and remained at a high level, so the SJC gold price became increasingly expensive compared to the world gold price. Specifically, at Bao Tin Minh Chau Jewelry Company, during opening hours, the SJC gold price was adjusted down by about 20,000 VND/tael - a very modest decrease, down to 67 million VND/tael - 67.8 million VND/tael.

Thus, the price of SJC gold is about 12.75 million VND/tael more expensive than the world gold price. In the recent past, this difference was commonly around 11 million VND/tael.

At Saigon Jewelry Company – SJC, the price of SJC gold also decreased slightly by about 50,000 VND/tael to 66.95 million VND/tael – 67.55 million VND/tael. Phu Nhuan Jewelry Company – PNJ listed the price of SJC gold at: 66.90 million VND/tael – 67.50 million VND/tael. G

SJC gold price at Doji Group is traded at: 66.85 million VND/tael - 67.60 million VND/tael. Meanwhile, non-SJC gold price also decreased slightly. At Bao Tin Minh Chau, Thang Long dragon gold price is traded at: 56.13 million VND/tael - 56.98 million VND/tael, down 50,000 VND/tael.

Source

![[Photo] Close-up of the construction of the first dam to retain water on the To Lich River](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/0b561f1808554026a87a8cb1f79c8113)

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

Comment (0)