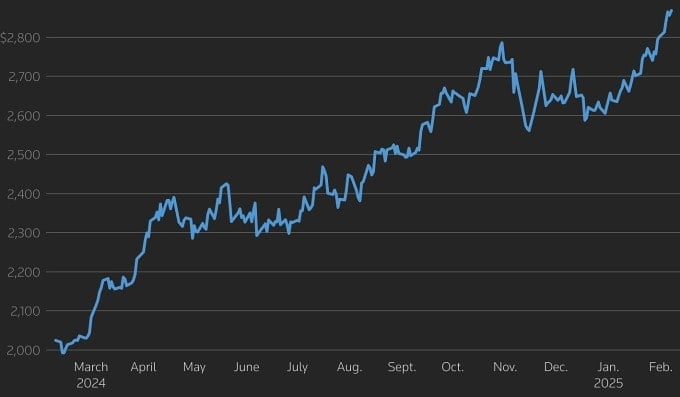

At the end of the trading session on February 7, the world spot gold price increased by nearly 5 USD to 2,860 USD per ounce. During the session, the price reached a new record high of 2,886 USD.

In total, the price increased by more than 2% for the week. This is the 6th consecutive week that the precious metal has increased, due to escalating US-China trade tensions, causing investors to rush to buy gold as a safe haven.

"The market is still focused on the uncertainty caused by US President Donald Trump's import tariffs," said David Meger, director of metals trading at High Ridge Futures. Gold is often considered a safe haven in times of economic and political turmoil.

Last week, Mr. Trump signed an executive order imposing import tariffs on China, Mexico, and Canada. However, just a few days later, he delayed the deadline for the two neighboring countries by a month. Chinese goods will be subject to tariffs starting February 4.

Another reason that could be driving gold's strong gains this week is buying from China's central bank and its new policy allowing hedge funds to invest in gold, according to Peter Grant, senior metals strategist at Zaner Metals.

Except for gold, other metals lost value yesterday. Silver price decreased 0.8% to 31.9 USD/ounce, platinum lost 0.3% to 982 USD/ounce, palladium decreased 0.7% to 971 USD/ounce.

TB (summary)Source: https://baohaiduong.vn/vang-the-gioi-quay-dau-tang-gia-len-muc-2-886-usd-moi-ounce-404794.html

Comment (0)