As countries accelerate their progress towards “net-zero”, Chinese companies stand to benefit the most as they dominate the green energy supply chain.

Seizing the opportunity to switch to green energy also means businesses have to buy more from China. For example, companies like Huawei dominate the supply segment of inverters - used in solar power systems.

“Blockpoint” in the green route

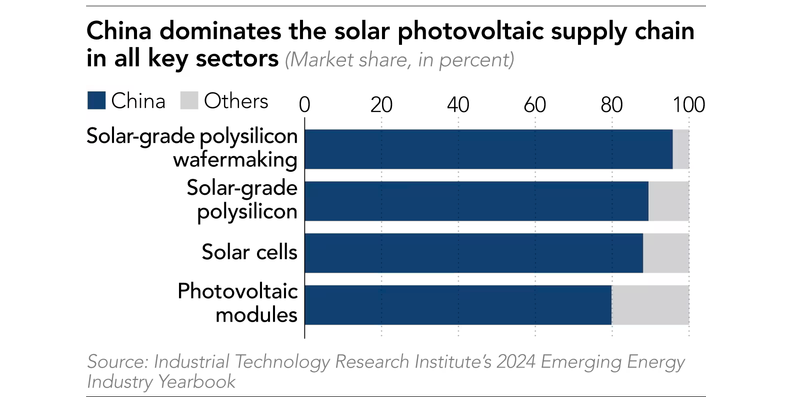

According to the Taiwan Industrial Technology Research Institute (China), the mainland now accounts for more than 90% market share in key segments of the supply chain, from polysilicon at the input to solar modules at the end.

“China has mastered the solar technology and supply chain,” said an executive at Solarest, Malaysia’s largest renewable energy provider. “They offer the best opportunity to generate green energy at a cost low enough to compete with fossil fuels.”

That cost competitiveness has made China a linchpin in the green energy roadmaps of many countries, both in Southeast Asia and beyond.

Beijing is even leveraging its technological expertise in solar infrastructure as part of its Belt and Road Initiative, thereby expanding its influence over critical energy infrastructure in countries like Malaysia, Laos, Thailand, Pakistan, and Saudi Arabia.

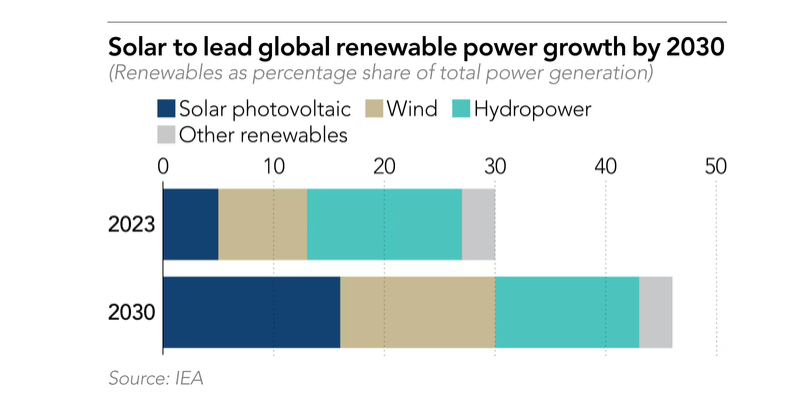

According to the International Energy Agency, solar energy is considered an accessible and easy-to-deploy renewable energy source. In 2024 alone, a total of 500 billion USD was invested in this type of energy, surpassing other alternative energy sources.

Offshore wind projects can take eight years or more to plan and build, while solar power plants can be deployed in less than two years, Nikkei Asia quoted sources as saying.

Pressure to adopt renewable energy is growing, especially among emerging economies in Asia hoping to attract investment from foreign tech giants.

Companies like Apple, Google and Microsoft have all joined the RE100 initiative, committing to use 100% renewable energy.

Double global output

In the 2000s, Japanese and Taiwanese companies such as Sharp, Motech and New Solar Power led the photovoltaic sector, but they gradually lost their competitive edge to the rapid development of the Chinese economy, accompanied by Beijing's subsidies for solar panel manufacturers.

The country is now home to most of the world's leading solar energy companies, such as Longi Green Energy Technology, Tongwei, GCL, Jinko Solar and TCL Zhonghuan Renewable Energy Technology.

In addition, the world's three largest inverter manufacturers are also from China, including: Huawei, Sungrow Power and Ginlong Technologies.

“China's total production capacity in one year can supply the whole world for two years,” said Doris Hsu, president of solar equipment manufacturer Sino-American Silicon Products.

“China’s huge economic and technological scale gives it cost competitiveness. If you ignore trade barriers, it is clear that the mainland suppliers’ solutions are more reasonable,” Doris Hsu added.

According to the IEA, China is still expected to maintain more than 80% of global production capacity for all segments of photovoltaic manufacturing by 2030, despite efforts by the US and India to move supply chains locally.

The agency estimates that the cost of manufacturing modules in the US and India is two to three times higher than in China. “This gap will persist for the foreseeable future.”

Source: https://vietnamnet.vn/trung-quoc-nam-90-thi-phan-cung-ung-nang-luong-mat-troi-2343776.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Video] Using beauty to eliminate ugliness - An effective remedy against "dirty livestreams"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/931f77476e68477eac7b0b6c704b51ae)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)