In fact, educating children about financial management focuses on the details and moments of daily life. For example, when a child asks his mother for money, the mother's words can influence the child's view of money. Parents need to pay special attention when talking to their children about this issue.

Two mothers (China) were chatting at the school gate, with their children beside them. The children had a good relationship, and decided to go see a new movie together that evening. So little girl Xiao Li raised her head to ask her mother for money to buy movie tickets: "Mom, I want 200,000 VND to watch a movie tonight." Without saying a word, the little girl's mother took out 500,000 VND and gave it to her daughter. The child was overjoyed, kissed and hugged her mother's waist, smiling happily.

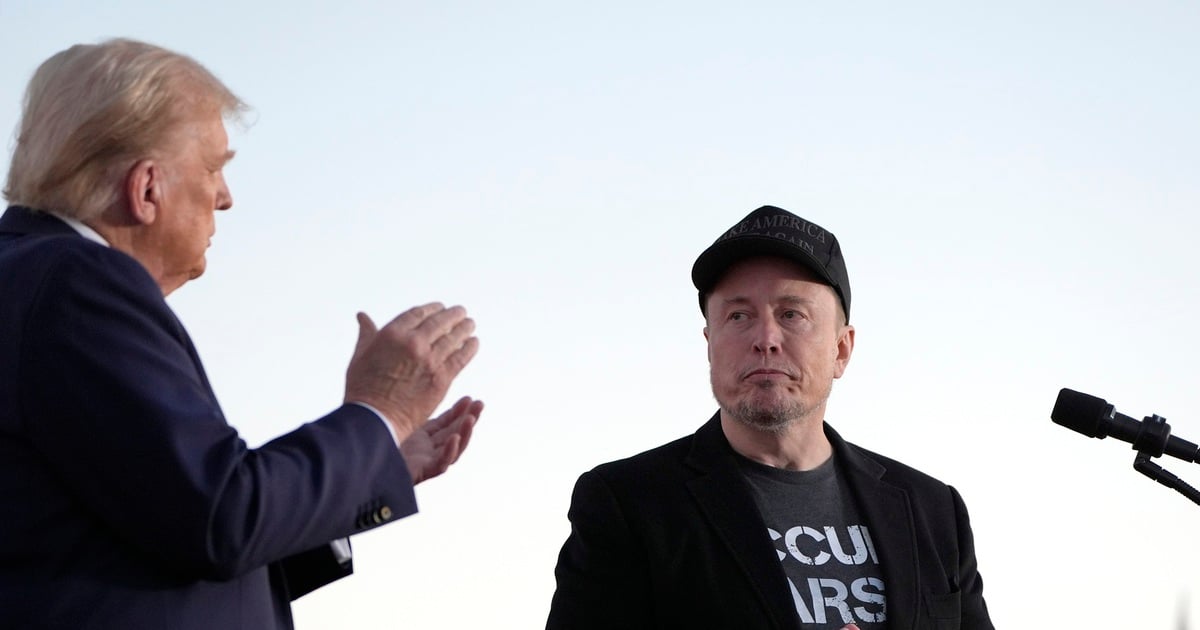

Illustration

But Tieu An's mother did the exact opposite. Tieu An also raised his head to ask his mother for money: "Mom, I want 100 thousand to watch a movie." The mother bent down and patiently asked her son: "What is the name of the movie? Where do you plan to see it, how many tickets do you need, how do you plan to get there, and what is the total estimated cost?"

Tieu An was confused by her mother's question. She pondered for a long time, then blushed and answered her mother: "The movie is a new one, it might cost more than 70 thousand. I plan to buy my own ticket, plus bus fare and water bill of about 100 thousand dong."

After Tieu An answered her mother, her mother took out 100 thousand dong from her pocket and gave it to the child, then gently said: "I'll give you another 50 thousand, this amount will be considered as a reserve fund. You can choose to buy a ticket for your friend, or you two can buy some snacks. This is the second time I've given you pocket money this month." Tieu An took the 150 thousand dong, nodded and smiled happily.

According to experts, it is never too early to educate children about money. Illustration photo

Two children were asking their mother for money, but their methods were very different. The first mother immediately gave the child as much money as she wanted. The second mother, instead of agreeing to the amount her child asked for, asked her why she wanted 100 thousand.

Then, guide the child to plan how to spend money and use this money properly. It is worth noting that the mother knows how to plan money very well, in the end she did not give the child 100 thousand but 150 thousand dong.

At first glance, it can be seen that the second mother's perspective on money is truly admirable. With proper education, children will learn to look at money again and know how to save and manage finances properly.

It has been proven that different financial management education creates very different children. Little Li often spends lavishly, treats his friends, and takes his mother's hard-earned money without hesitation. While his parents are just ordinary wage earners, not very well off.

Xiao An's mother was not generous with her children, but she was the Vice President of a company and had a solid financial background. Under her mother's training, Xiao An was very careful with spending money, often saving her pocket money to buy things she really needed.

The two mothers’ behaviors reflect their views on money and influence their children’s spending habits. The second mother clearly understands the need to actively educate children about finances and emotional intelligence from an early age.

Saving is always a noble virtue, but sometimes saving is easily confused with stinginess and stinginess. The difference can be clearly seen when looking at the photo of people buying vegetables below.

Because they wanted to choose the best and most delicious thing, they were willing to break off all the outer leaves of the vegetable buds, leaving only the young leaves. In addition, when only taking the young buds, their weight would be lighter, so these people bought a bunch of vegetables that were both delicious and cheap. Everyone was excited and happy because they had saved a few coins.

Because they want to choose the best and most delicious thing, they are willing to break off all the outer leaves of the vegetable buds, leaving only the young leaves. Illustration photo

If you don't feel ashamed of it, but rather proud of it. Moreover, using this method to educate your children will have a negative impact on their future that you cannot imagine.

There was once a question on Chinese social media : "Who is the person who annoys you the most? "

A netizen replied: "That's my colleague, Xiao Li. She and I have been classmates since childhood. Although we have a deep fate, I really don't like her.

Tieu Le is a girl with a good family background, her personality is not too bad but she is very picky and likes to take advantage of people around her.

Back then, every child had a pen and eraser, but she always liked to borrow them from other friends. Over time, no school friends wanted to lend them to Tieu Le anymore.

After Xiao Li started working at the company, her personality did not change at all. She always exclaimed and looked envious when she saw the food, cars, clothes or anything else of her colleagues. I wonder what she did to earn money? And that is why she never got promoted.

Illustration

The company often gives gifts to customers. Tieu Le is a sales person so she often cuts or steals gifts from customers. She thinks people don't know, but in fact everyone knows her personality like the back of their hand.

When the opportunity to be promoted to team leader arose, Xiao Li, despite her high abilities, was immediately removed from the list. The department director said that if Xiao Li was promoted, she would brazenly embezzle to such an extent."

It can be said that, just because of the small benefits in front of her eyes, Tieu Le lost her future. The root of the problem is her habit of being stingy and stingy since she was a child.

Therefore, parents need to pay attention, especially when their children are young, which is an important stage in personality formation. Once signs of frugality are detected, they must find a way to help their children cut it off as soon as possible, otherwise it will affect their future.

These actions, although very small, can make a big difference in the future, so parents should never ignore them.

Save money by just using what you have

Excessive saving can lead to trade-offs, sacrificing moral qualities and personal values. For example, children who get new items such as erasers or pens will not dare to use them but keep them hidden, then borrow them from other friends to use.

Children can even steal from other friends. This behavior, in the long run, makes children short-sighted, only interested in small benefits, not knowing how to care and share with others. When they grow up, it is difficult for children to get help from the community because they only know how to ask for help but do not know how to support in return. In the social environment, it is difficult for them to have good friends and good colleagues.

See savings as everything

Saving money is important, but parents should not see it as the only thing to do. "Instead of saving, why don't you teach your kids how to grow the money they earn?" asks financial expert Kim Kiyosaki .

Financial experts advise families to teach children about financial literacy such as mutual funds or how to grow a small business.

Illustration

Not following the rules

At the tourist site, a little girl stopped her mother as she was about to buy an entrance ticket. According to the rules, if a child is over 1.2 meters tall, they must buy a ticket, but the little girl squinted and said to her mother: "You're wearing a skirt. When the ticket inspector checks your ticket, you'll bend your legs down and they won't know."

The mother was surprised for a moment and then smiled: "What a good girl, she knows how to save money for her mother."

The act of "ticket evasion" may help this mother and daughter save some money, but what will this dishonesty teach the girl?

A mother may think her child is smart and she cannot foresee that this habit of dishonesty from small things is actually just petty and deceitful and will have a negative impact on the child's personality formation.

Illustration

Not understanding your real needs

Saving properly is an act that is not extravagant or wasteful but still ensures your own needs. In the case of saving to the point of no longer listening to your normal needs, it is a big mistake. This limits children's vision, making them focus too much on immediate things without ever thinking about their own long-term benefits and losses.

Only let your child wear old clothes given by relatives and friends to save money.

Childhood is a very short period of time for every child. This is also the age when a child’s personality is most affected. If at this age, parents let their children wear old clothes given to them by relatives and friends, they may be ridiculed by their friends. Over time, these children will feel less confident and will not dare to go to crowded places.

Children who grow up in such an environment may become extreme when they grow up. Because of the long-term control of their parents, they may increase their efforts to satisfy themselves when they have financial ability. They tend to place a high value on money, work crazy, even reckless to earn money. After having money, they may spend lavishly in the hope of compensating for the disadvantages of childhood.

On the contrary, some children tend to be overly frugal, stingy in spending, and always force themselves to live an ascetic life.

Show your children how to struggle for money so they learn to save.

Many parents constantly complain about money to their children to put pressure on them. When parents do this, children will develop a fear of adult life. Children will even consider money as a burden and the number one goal in their future life.

Illustration

Value for money

Money is very important but it is only material, a means to live, not everything. In many cases, because of poverty, parents are strict with their children, forbidding them from even the most basic needs, making the children afraid of poverty, gradually forming a mentality of worshipping money. When they grow up, children value material things, become calculating, and even trade their honor for money.

Talk to your kids about money early.

Former German Chancellor Angela Merkel said: "Money education is a mandatory life course and is central to children's education, just as money is central to the family."

Meanwhile, Japanese-American businessman Robert Kiyosaki - author of "Rich Dad, Poor Dad" - said: "If you can't teach your children about money, someone else will replace you later, such as creditors, police and even scammers. If you let these people educate your children about finance, I'm afraid you and your children will pay a higher price."

Illustration

According to experts, it is never too early to teach children about money. As children grow up, a lack of proper awareness about money makes them not fully understand the meaning of money, do not know how to use money and are prone to making mistakes.

Teaching children to save is one of the most difficult and arduous tasks for parents. Because raising children requires methods and time, it is not possible for parents to make a child obedient, self-disciplined, and then have a habit in just one or two days.

Teach your children how to use money wisely

Teaching children to save becomes even more difficult when parents need to guide their children on how to use money wisely.

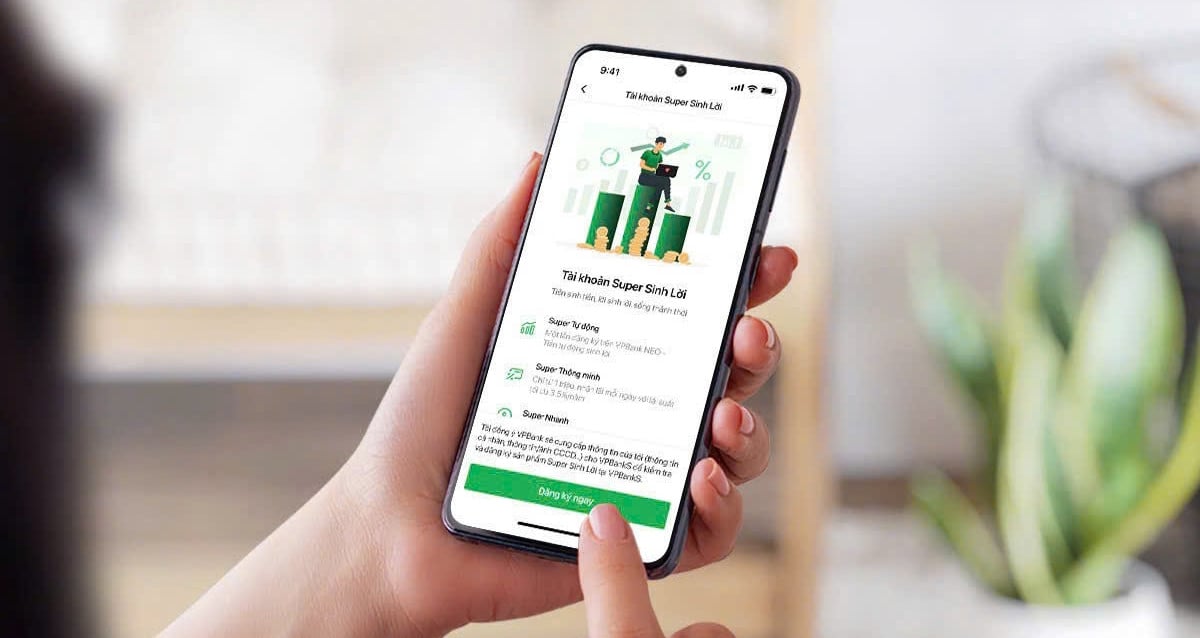

In most Asian countries, parents manage their children's pocket money. They also spend extra money on incidentals. However, this is not the case in Japan. In the land of cherry blossoms, parents want their children to understand the value of money and manage their own spending. In particular, if they want to have money to buy something, children have to work and save.

The way Japanese parents teach their children to save money is considered extremely worth learning. In this country, parents give their children spending money once at the beginning of the month. If they accidentally spend it all, they will not be given any more. Therefore, from a young age, children must learn how to calculate spending and divide money reasonably during the month.

When they are still in kindergarten, each child will be given 50 - 70 yen per day by their parents. They can buy themselves candy or toys for 10 - 50 yen. Therefore, to buy an item for 50 yen, children have to "raise a pig". That gives them the ability to save.

In elementary school, children start receiving monthly pocket money, starting with 1,000 yen, to buy whatever they want. If they run out and want to buy something else, they have to wait until the following month. Each family decides what to spend the pocket money on, whether it's school supplies or toys. As they get older, the amount of pocket money increases, but not by much.

Japanese parents will guide their children to record their monthly expenses, how much are they given? What do they buy? How much does it cost?… Then, let the children organize what is worth buying and what is not so that they can spend more reasonably next month. In addition, Japanese parents always plan to teach their children to have a plan for the future, if they want to have "reward", they have to work and save every day.

The way Japanese parents teach their children to save money is considered extremely worth learning. Illustrative photo

Tell me where money comes from.

Two famous Italian psychologists, Anna Berti and Anna Bombi, observed that children between the ages of four and five often think that everyone has money and that banks are places where money is given out for everyone to use. Most children have only seen their parents and relatives go to the bank counter or ATM to withdraw money, so it is not surprising that they think like that.

Slowly explain to your child where money really comes from. Tell your child about the work you do, how you get paid, why the bank gives you money. Explain that the time you spend away from your child during the day is for work, to earn money. By talking to your child, they will gradually understand that money is earned through work and effort; therefore, they should not waste or squander the money they earn.

Teaching your child the importance of saving money is a process. You have to accept the fact that mistakes will happen. For example, your child may spend too much money on an unnecessary item. While it may be easy to steer your child away from this mistake, sometimes it is better to sit back and let it happen. This will teach your child that they should be more mindful of their money than spending it on things they don’t need.

This can be difficult for us as parents. After all, money is valuable, and you don’t want to see your child misuse it. However, these mistakes will lead to valuable life lessons. You will find that your child will not be tempted to do this again. It encourages your child to think more about their spending habits. If your child makes too many mistakes, it is time to step in and address them.

Rich or poor parents must teach their children this if they want them to have a bright future.

Rich or poor parents must teach their children this if they want them to have a bright future. Teaching children to be independent the Japanese way is simple but has great effects, especially when they grow up.

Teaching children to be independent the Japanese way is simple but has great effects, especially when they grow up.Source

Comment (0)