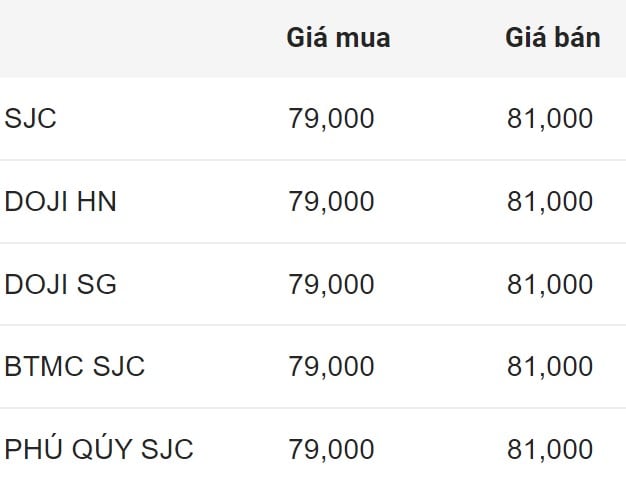

SJC gold bar price

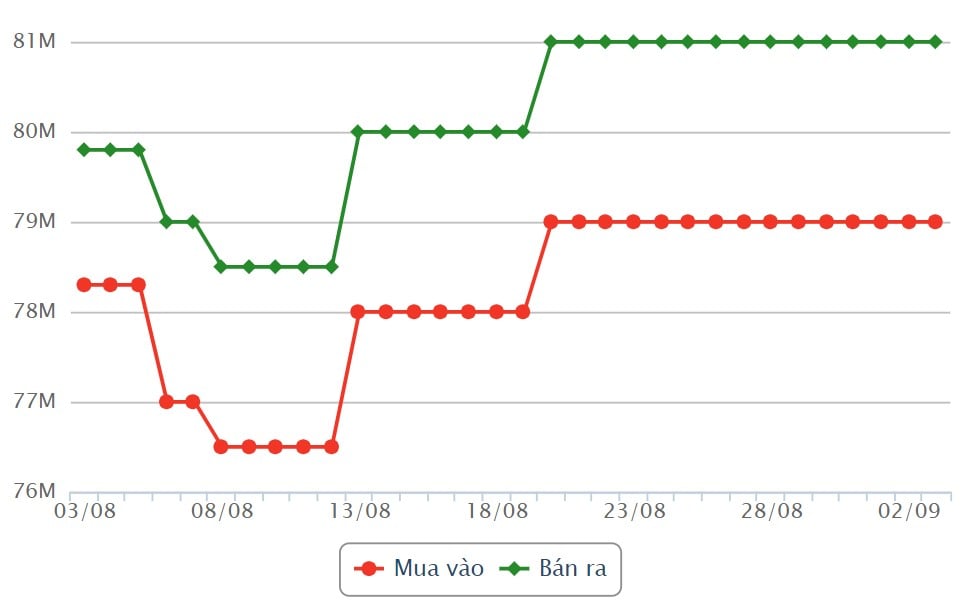

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 79 - 81 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 79 - 81 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 77.50 - 78.60 million VND/tael (buy - sell); unchanged.

Saigon Jewelry Company listed the price of gold rings at 77.3 - 78.6 million VND/tael (buy - sell); unchanged.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

As of 9:00 a.m., the world gold price listed on Kitco was at 2,493.4 USD/ounce, down 3.2 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell amid an increase in the USD index. Recorded at 9:00 a.m. on September 3, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 101.602 points (up 0.02%).

World gold prices fell partly due to investors' concerns that the US Federal Reserve (FED) may not be able to cut rates by 50 basis points in September. Recent economic news has led the gold market to predict a high possibility that the FED will cut interest rates by 25 basis points.

One of the big questions for gold investors recently is whether the Fed will cut rates by 100 basis points after the end of 2024. So, although gold is still trading at a high of $2,500/ounce and could continue to rise, gold investors are hesitant to wholeheartedly pursue the gold price increase.

Phillip Streible - Chief Market Strategist at Blue Line Futures - commented that the weak gold price is an important opportunity for investors to buy at low prices because the gold price is still in an uptrend.

Naeem Aslam - Investment Director at Zaye Capital Market - commented that investors' expectations that the FED would cut interest rates by 50 basis points were too far-fetched, which was a bad thing for the market.

According to CME's FedWatch Tool, the market fully expects the Fed to cut interest rates by 25 basis points at its monetary policy meeting in September. At the same time, there is a 30.5% chance of a 50 basis point rate cut.

However, some experts believe that gold still has a lot of room to rise. Tobina Kahn, president of House of Kahn Estate Jewelers, recently predicted that gold prices could rise even higher as inflation remains high. Kahn said $3,000 an ounce is a realistic target for gold and it could take just a few months to reach that target.

The market is now awaiting the US ISM Manufacturing PMI for August due today. Tomorrow (Wednesday) will be the Bank of Canada monetary policy decision and the US JOLTS Employment Opportunities.

Then on Thursday, traders will keep an eye on the ADP employment index for August, the weekly jobless claims report and the US ISM services PMI.

However, the most attention-grabbing event next week will be the US non-farm payrolls report for August, due out on Friday morning. Some market experts believe the report could boost the Federal Reserve's expected September interest rate cut from 25 basis points to 50 basis points.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-hom-nay-39-tiep-tuc-sut-giam-co-dang-lo-1388550.ldo

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)