Nam Viet's (ANV) symbolic profit is just enough to escape loss in the third quarter of 2023

Nam Viet - NAVICO Joint Stock Company (HoSE code: ANV) operates in the seafood processing sector, formerly known as My Quy Seafood Enterprise. NAVICO's gloomy business picture began in the second quarter of 2023 with net revenue reaching VND 1,074.3 billion, rising cost of goods sold causing gross profit to drop nearly 5 times compared to the previous quarter, to only VND 48.2 billion. As a result, the company lost VND 51 billion after tax in the second quarter while in the same period it was making a profit of VND 240.7 billion.

Entering the third quarter of 2023, Nam Viet achieved net revenue of VND 1,098.8 billion, down 11% over the same period. Cost of goods sold increased slightly, gross profit brought in VND 84.8 billion. Gross profit margin decreased from 23% to 7.6%.

Pressure from rising interest rates in the first 9 months of the year caused Nam Viet Seafood's (ANV) business cash flow to be heavily negative. (Photo TL)

During the period, financial revenue decreased to VND8.3 billion, a decrease of 47.3%. Financial expenses were also reduced to VND36 billion, a decrease of 27%.

Nam Viet also optimized sales costs and business management costs, accounting for 37.6 billion and 16 billion VND respectively. These two costs decreased by 61% and 24% respectively compared to the same period.

After deducting all expenses and taxes, ANV's after-tax profit reached more than VND1 billion in the third quarter, down 99.2% year-on-year.

It can be seen that although Nam Viet escaped losses in the third quarter, the pressure from cost of goods sold is still a problem for Nam Viet. The symbolic profit of just over 1 billion VND is still not enough to recover the loss of nearly 50 billion VND in the previous second quarter.

Nam Viet's accumulated revenue in the first 9 months of the year reached VND3,328.3 billion, down 11.3%. Accumulated profit after tax reached VND42.4 billion, down 92% over the same period last year.

Long-term debt increased, accumulated undistributed profit after tax reached 1,654 billion VND

By the end of the third quarter, Nam Viet's total assets reached VND5,359.9 billion, down slightly by 2% compared to the beginning of the year. Notably, cash is currently only VND29.8 billion. Meanwhile, the company's deposits have also decreased by nearly half, down to only VND186.1 billion.

The amount of short-term receivables from customers tended to decrease from 412.6 billion to 373.2 billion VND. The amount of provision for short-term doubtful receivables also increased from 36 billion VND at the beginning of the year to 41.6 billion VND.

Nam Viet's inventory increased from VND2,333.3 billion to VND2,448.1 billion, an increase of nearly 5%. Meanwhile, inventory price reduction provisions also increased by 28.4% to VND11.3 billion.

Regarding capital structure, payables account for VND2,174 billion, equivalent to 40.6% of Nam Viet Seafood's total capital. The company currently has short-term debt of VND1,780.5 billion. Long-term debt tends to increase from VND152.8 billion to VND185.2 billion.

ANV's equity is currently VND2,984.2 billion. Of which, undistributed profit after tax is VND1,654.9 billion. The company is also recording negative treasury shares of VND27.6 billion.

Interest payment pressure increases sharply, business cash flow is negative

Another problem in Nam Viet's business operations lies in its net cash flow from operations. The pressure to pay interest on loans has caused the company to suffer a relatively large cash shortage in the first 9 months of the year.

Specifically, in the third quarter cash flow report, net cash flow from operating activities was negative VND62.3 billion while in the same period last year it was positive VND358.4 billion.

Notably, the interest paid by ANV during the period was up to VND110.1 billion, 2.1 times higher than the same period. In addition, the amount of corporate income tax payable also accounted for VND113.4 billion, an increase of 8.5 times.

Meanwhile, other revenue from business activities decreased from 52.5 billion to only 33.5 billion VND. The above reasons caused NAVICO to have a negative cash flow of 62.3 billion VND from business activities. This negative cash flow was later partly offset when the company received 60 billion VND from issuing shares and receiving capital contributions from owners.

Source

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

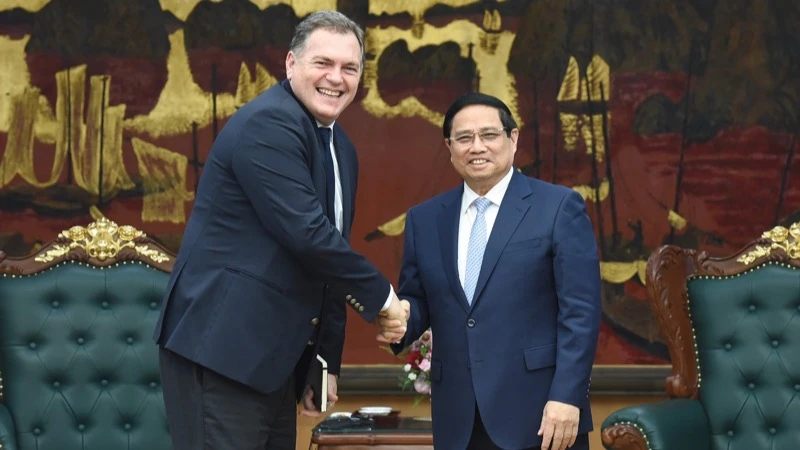

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

Comment (0)