Saigon - Hanoi Bank (SHB) has just announced the Resolution of the Board of Directors approving the implementation of the plan to issue SHB bonds to the public in 2024 and detailed plans to use and repay capital raised from the bond offering.

Accordingly, the bank plans to mobilize VND5,000 billion in bonds in two tranches, with the face value of each tranche being VND2,500 billion.

The expected issuance date is from the fourth quarter of 2024 to the first quarter of 2025 after the State Securities Commission issues the Certificate of registration for public bond offering. The specific issuance date will be announced by the bank.

The bank plans to issue the first batch of bonds in the fourth quarter of 2024 and the second batch in the fourth quarter of 2024 - first quarter of 2025. The distribution period for each batch is expected to be at least 20 days and at most 90 days as prescribed by law (excluding cases of extension of the distribution period as prescribed, if necessary). The expected issuance interest rate is 8.2%/year.

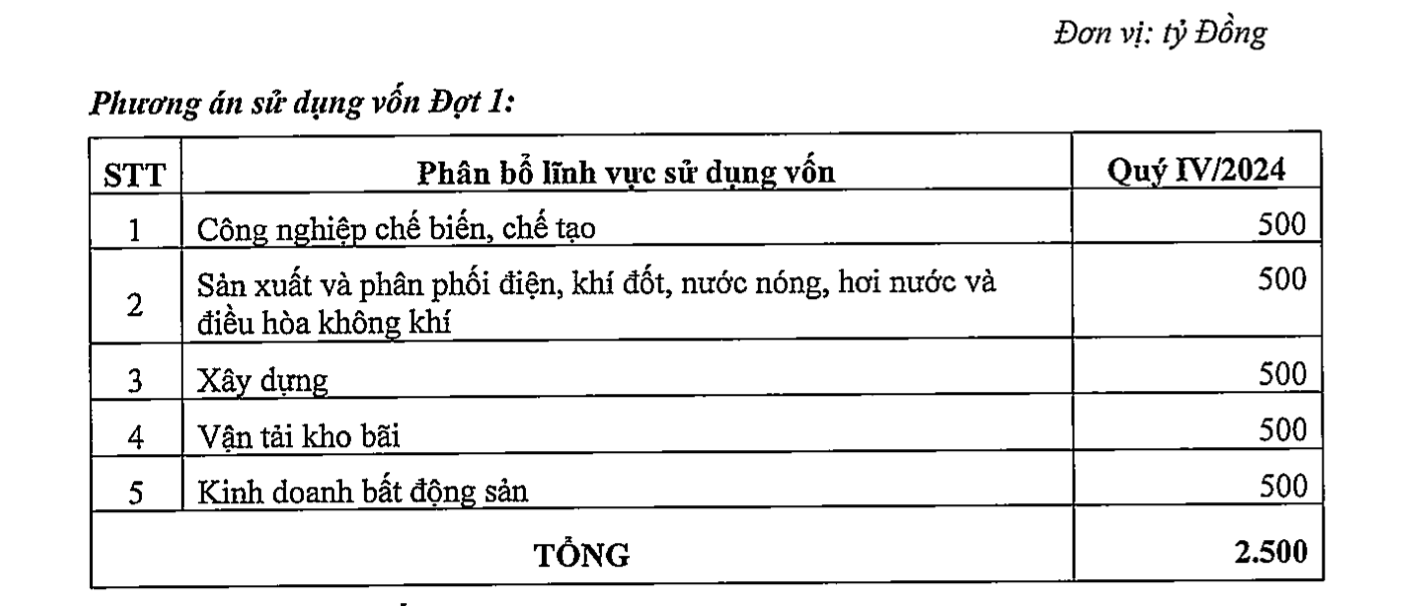

SHB's expected capital usage plan.

According to SHB, the proceeds from the two bond issuances will be used to supplement Tier 2 capital, improve capital adequacy ratio, and serve the bank's customer lending needs in 2024 and the following years for industries and fields such as processing and manufacturing industries;

Construction; transportation and warehousing; real estate business; production and distribution of electricity, gas, hot water, steam and air conditioning. In which, for each field, the bank plans to use 1,000 billion VND.

The actual amount allocated to lending sectors and industries and the disbursement time for sectors and industries will be flexibly adjusted according to actual operations, customers' loan needs and SHB's economic lending progress.

The Board of Directors assigns the General Director full authority to decide the actual amount and disbursement time of each issuance for the business line depending on the time and actual volume of bonds successfully issued in each issuance.

According to information from the Hanoi Stock Exchange, since the beginning of the year, SHB has successfully mobilized a total of 3 bond lots with a total face value of VND 4,000 billion. Of which, the largest bond lot is SHBL2427001 with a total value of VND 2,000 billion, issued on July 8, 2024. The bond lot has an interest rate of 6%/year, a term of 3 years, and is expected to mature in 2027.

This year, the bank has not recorded any bond repurchases. Based on the bond payment report, in the first half of 2024, SHB spent nearly VND93 billion to pay interest on bond lot SHB12301 issued on December 27, 2023.

Source: https://www.nguoiduatin.vn/shb-du-kien-huy-dong-5000-ty-dong-trai-phieu-204240924143209714.htm

Comment (0)