On the morning of November 24, at the Workshop on Building and Perfecting the Legal Corridor for the Derivatives Market, Prof. Dr. Le Hong Hanh - Director of the ASEAN Institute of Law and Economics said that derivatives and derivative instruments are financial instruments used to create market liquidity.

At the same time, it promotes investment development activities by converting financial resources frozen in traditional assets into a form of assets that can be transferred immediately instead of waiting for the end of futures contracts or the maturity of bonds, stocks and other term financial instruments.

In the legal systems of countries, many derivative securities appear because the laws in those countries allow many types of property rights to participate in financial transactions.

However, in Vietnam, there are currently only 4 types of derivative securities allowed to participate in transactions, including: VN30 index contracts; government bond contracts; stock warrants; futures contracts. But in reality, mainly VN30 index contracts and government bond contracts participate in transactions.

According to Professor Dr. Le Hong Hanh, in many countries, derivative securities exist in most assets as underlying assets.

For example, in the US, derivatives law appeared quite early, starting with futures contracts, whose trading objects are agricultural products. In this country, derivatives and derivatives trading are regulated by federal law.

Prof. Dr. Le Hong Hanh - Director, ASEAN Institute of Law and Economics spoke at the workshop.

Among the goods considered by US law as basic assets, the term product is easily recognized. Products are understood as tangible assets, valuable and produced in different fields. Thus, almost anything can be a product, including mathematical calculations or measurements of phenomena, services and other intangible or contingent assets that do not fall under that term in any other factual context.

In China, derivatives are a new phenomenon for the country, but the country's dynamic economy and strong integration into the world financial and monetary markets, plus the legacy from Hong Kong, have made China develop significantly in this field.

“China issued the Law on Futures Contracts and Derivatives in 2022 to overcome the limitations and shortcomings in current legal documents on securities in general and derivatives in particular,” said Prof. Dr. Le Hong Hanh.

In Vietnam, according to regulations: "Derivative securities are financial instruments in the form of contracts, including options contracts, futures contracts, and forward contracts, which confirm the rights and obligations of the parties to pay money and transfer a certain quantity of underlying assets at a determined price within a period of time or on a determined date in the future".

Current Vietnamese law only identifies 3 types of derivative securities including: Option contracts, Futures contracts, and Forward contracts.

“The current definition of derivative securities is quite simple and does not eliminate the risk factor of the derivative securities market when the value of derivative securities fluctuates and the market itself fluctuates every hour” – Professor, Dr. Le Hong Hanh assessed.

In terms of regulatory content, current Vietnamese law cannot create a foundation for the development of the derivatives market.

“The 2019 Securities Law regulates the traditional securities market with only 11 mentions of derivative securities and one mention of the derivative securities market. There are almost no specific provisions in the 2019 Securities Law that can create specific regulations for derivative securities, whether they are futures contracts, options or forward contracts,” said Prof. Dr. Le Hong Hanh.

According to Professor Dr. Le Hong Hanh, in the context of trade globalization and globalization of financial and banking services, the development trend of the derivatives market is irresistible.

For Vietnam, just a preliminary assessment of the scope of regulation of Vietnamese law on securities transactions in comparison with some countries has shown that it is too backward .

Source

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

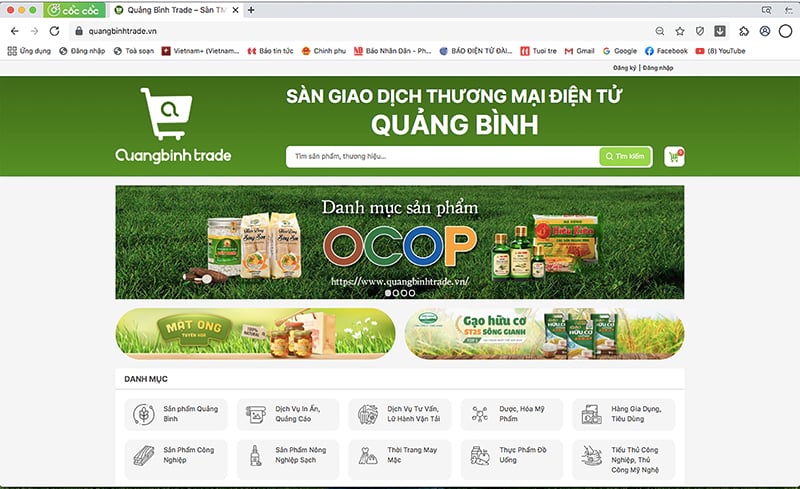

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)