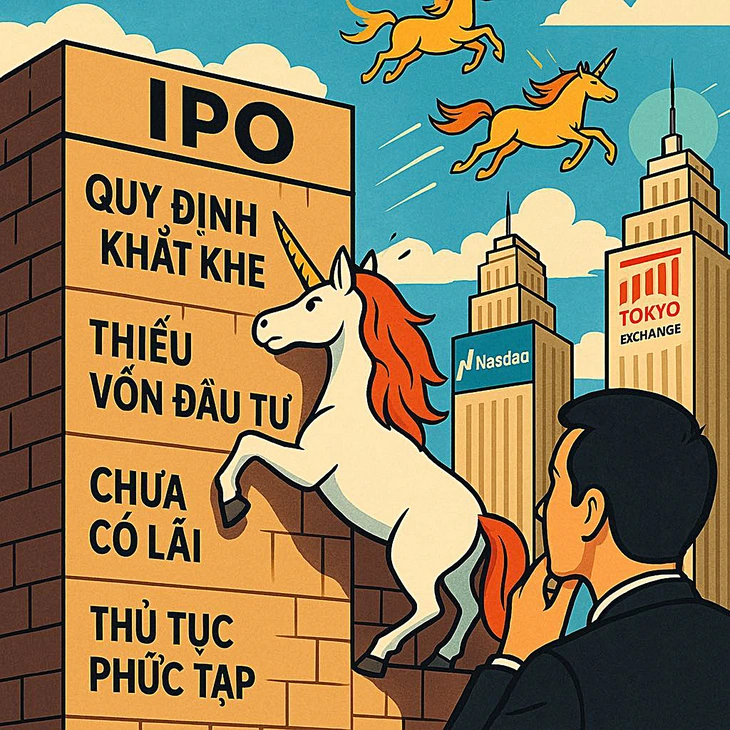

Many potential Vietnamese tech unicorns (private startups valued at over $1 billion) are also finding it difficult to IPO due to strict regulations - Photo: AI

For the past decade, no technology company has had a successful IPO in Vietnam. Many experts believe that it is time to look at why businesses are so hesitant to IPO and list. We should consider a more open mechanism or find a solution to apply specifically to the technology group.

There are only 16 tech stocks on the floor.

A recent report from SSI Asset Management (SSIAM) shows that Vietnam is currently the market with the lowest number and value of IPOs in the region. While Indonesia has 41 IPOs in 2024, Malaysia has 55, then Vietnam has 1.

The rare IPO in Vietnam was conducted by DNSE Securities Company, raising about 37 million USD. But DNSE is essentially a securities company, just following a technology model.

Previously, in 2021, a Vietnamese-founded tech company went public but chose the Tokyo Stock Exchange (Japan). Meanwhile, VNG, a Vietnamese tech unicorn, chose to go public in the US but withdrew its application last year.

Looking at the structure of businesses on the stock exchange, there are only 16 technology companies, accounting for about 1% of more than 1,600 listed units. Compared to other countries in the region, Vietnam's number is extremely lame when China has 997 technology stocks on the exchange, Japan 903, South Korea 648, India 332, Malaysia 125...

MSc. Doan Ngoc Khanh, chief of office of the Institute of Digital Economic Development Strategy, said that the structure of the Vietnamese stock market is quite monotonous and outdated, focusing mainly on banking, real estate, consumer goods stocks...

This is also the reason why VN-Index has had difficulty growing after nearly two decades. When the supply of high-quality goods is scarce and there is a lack of new "winds" from the technology sector, the digital economy will make the market less attractive to "big players" in the international investment community, Ms. Khanh assessed.

Because the regulations are too strict?

There are many reasons why the Vietnamese market lacks IPO deals, especially in the technology sector. The founder of a start-up in the field of communication programming told Tuoi Tre that he did not IPO even though he needed capital.

"We are still growing revenue for 3 consecutive years, expanding to the US, India... Currently we cannot make a profit due to the huge investment costs," he said.

Meanwhile, Ms. Nguyen Ngoc Anh - General Director of SSIAM - said that according to current regulations, in order to conduct an IPO, the business operations of the enterprise must be profitable for 2 consecutive years immediately preceding the year of registration for the offering, and there must be no accumulated losses up to the year of registration for the offering.

An economic expert assessed that if Elon Musk's Tesla started in Vietnam, it would not be able to IPO and raise capital to develop and become a world-leading enterprise.

Because Tesla IPO in 2010 and continuously lost money, even in 2017 losing more than 2 billion USD. 10 years later, 2020 is the first year the company recorded a profit.

Ms. Ngoc Anh pointed out that IPOs in Vietnam still face major barriers due to inflexible listing regulations that are not suitable for the characteristics of innovative businesses. They often need large amounts of capital in the early stages to innovate technology, expand users, build operating infrastructure, etc., so they often suffer temporary losses.

China and India have taken the lead in easing the profitability requirements for IPOs. China allows tech companies that have not yet made a profit or accumulated losses to list on the STAR Market or ChiNext. In India, the Innovators Growth Platform offers more flexibility for tech companies looking to list.

Mr. Duong Quoc Anh, former deputy head of the National Assembly's Economic Committee, said that technology businesses will not be able to borrow large amounts of capital from banks because they do not have many collateral assets: "Businesses can mobilize capital on UpCom but are small in scale and cannot attract investors or international financial investment funds.

Some cases even redirect business registration and IPO to foreign markets, causing a loss of the country's financial resources."

In fact, many technology companies established in Vietnam aim to IPO in large markets such as the US or Singapore. Singapore is considered a "paradise" for the form of SPAC (establishing a shell company to raise capital through IPO).

Mr. Nguyen Hoang Giang - Chairman of DNSE - emphasized that it is time to seriously consider why businesses are hesitant to IPO and list. If the criteria are becoming more and more strict and tight, there should be a more open mechanism. "Vietnam promotes the digital economy and creative economy. So there must also be a mechanism to accept technology and creative businesses that are often different," said Mr. Giang.

However, some opinions say that it is still necessary to improve the quality of IPO deals and protect investors' interests. Strict regulations to manage the listing and IPO of joint stock companies are necessary.

To solve this problem, Mr. Duong Quoc Anh proposed that Vietnam should study and build a separate stock exchange for technology startups. This exchange will have preferential conditions for investors following the model of some successful countries in the world.

IPO decline trend, why?

According to Deloitte's IPO report 2023, in Vietnam, the downward trend in IPOs is attributed to the dominance of the capital market, especially the corporate bond market, which has yet to untie many knots.

According to Dr. Ho Sy Hoa - Director of Research and Investment Consulting at DNSE Securities, the management agencies advocate transparency of financial information and the application of many international standards such as International Financial Reporting Standards (IFRS), which also has a short-term impact on reducing the number of listed companies. However, financial standardization and transparency will contribute to a positive impact in the long term on the stock market.

Associate Professor Dr. Nguyen Huu Huan, senior lecturer at the University of Economics, Ho Chi Minh City, also pointed out that many businesses themselves are reluctant to go public. In particular, the conversion from a private enterprise model or a limited liability company to a joint stock company and a public joint stock company will have stricter requirements on the operating model and management methods, information disclosure, independent audit, etc.

Not to mention, according to Mr. Huan, the process to conduct an IPO is also costly and time-consuming.

Difficult to grow due to capital mobilization barriers

Speaking with Tuoi Tre , many leaders of large technology companies in Vietnam said that there are a number of Vietnamese technology companies that have the potential to develop to a world-class level, but "cannot grow" due to barriers in raising capital to develop their scale.

The 2019 Securities Law requires businesses wishing to IPO on the HOSE or HNX to be profitable for two consecutive years and have no accumulated losses, which makes it impossible for most technology startups to do so due to the large capital investment in research and development (R&D), making it very difficult to erase all accumulated losses upon IPO.

A technology company leader said that even a world-leading name like Amazon would not be able to IPO if it started in Vietnam because it had suffered losses six years after IPO. The NASDAQ does not require profits and must erase accumulated losses, giving Amazon the opportunity to pioneer the revolution in e-commerce and cloud computing. "If Vietnam wants to have Amazons, it should have perspectives more suitable to the characteristics of technology companies," the expert suggested.

Source: https://tuoitre.vn/doanh-nghiep-keu-quy-dinh-chat-ngay-amazon-hay-tesla-cung-kho-ipo-o-viet-nam-20250330224547624.htm

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)