Abuse of power to not refund taxes to businesses

Lawyer Tran Xoa (Minh Dang Quang Law Firm) affirmed that the Law on Value Added Tax (VAT) issued in 2008, the Law on Tax Administration from 2006 and the amended laws since then are all consistent on the issue of tax refunds for enterprises.

Business tax refund applications need to be processed quickly.

Accordingly, enterprises eligible for tax refund must meet three conditions: having invoices for goods and services purchased or documents proving VAT payment at the import stage; having documents for payment via bank; having a signed contract for exporting goods and a customs declaration for exported goods. The law also clearly stipulates the time for checking and verifying completed documents. For enterprises eligible for refund first and inspection later, the implementation time is within 6 working days after receiving all valid documents.

In case the enterprise is subject to pre-inspection and post-refund, the maximum time for the tax authority to inspect is 40 consecutive days from the date of receipt of valid documents. After the prescribed time, the tax authority still has the right to re-inspecte if there is any doubt or problem and request a tax refund. If the enterprise's documents have been submitted completely and validly, they must be processed according to the time prescribed by law. Any employee who leaves the documents late must also be considered responsible.

"Since the promulgation of these two laws, businesses have been able to get tax refunds normally, without too many problems arising. However, in recent years, the tax sector has started to issue a number of new documents. This has made it very difficult for many businesses to complete VAT refund procedures," Mr. Xoa commented. At the same time, according to tax management principles, each VAT refund dossier is separate. Businesses have the right to submit a VAT refund dossier when the tax amount paid is 300 million VND or more. Therefore, even if the previously submitted dossier is incomplete or needs to be verified, only that dossier is delayed. When other dossiers are submitted by businesses, the tax authority must receive and process them as usual.

Attorney Tran Xoa (Minh Dang Quang Law Firm)

"Tax authorities cannot assume that when the previous dossier has not been resolved, enterprises cannot submit subsequent dossiers. Tax refunds are legitimate and legal rights and interests of taxpayers according to the law. No one is allowed to deprive taxpayers of their rights. State management agencies in general or tax management agencies in particular are required to comply with the law. Following internal documents of the industry when there is no law is an obstacle to business operations. This will cause enterprises to be stuck, possibly bankrupt, which will lead to slow development of the whole country's economy and a decrease in budget revenue, which requires reconsidering responsibilities," said lawyer Tran Xoa.

While supporting a business to sue the tax authority for delayed tax refunds, Mr. Truong Thanh Duc, Director of Anvi Law Firm, said that the tax authority's guidance documents for tax refunds require additional things that are not in accordance with the law. If a business meets the conditions prescribed by the law on tax refunds but still does not receive a refund after 1-2 years, the tax authority has abused its power and refused to refund the tax to the business.

Pay first - check later

"The fastest way to resolve tax refund applications now is to refund the business first, and if anyone is suspicious, they will be inspected. At the same time, apply measures, the business must pay interest to the tax refund application no matter how late. Not only that, there are also regulations to pay penalties if the application is too long. Only then can tax officers and tax authorities do it quickly. Otherwise, yelling until your throat is sore will not solve the problem," Mr. Truong Thanh Duc proposed.

Dr. Nguyen Ngoc Tu, lecturer at Hanoi University of Business and Technology, said: "To quickly resolve the congestion in VAT refunds, the Ministry of Finance and the General Department of Taxation need to remove obstacles, and at the same time, dispel the mentality of avoidance and taking advantage of making things difficult from tax officials."

Prime Minister requests quick settlement of tax refund dossiers

After the Prime Minister issued Official Dispatch 470 requesting ministries and branches to remove difficulties for production and business of enterprises and people, the Ministry of Finance issued Notice 5427 to the General Department of Taxation to immediately direct units to provide guidance and implement VAT refunds for tax refund dossiers if they meet the prescribed conditions.

For cases that are not eligible for tax refund, promptly explain and notify taxpayers in a public and transparent manner. At the same time, the General Department of Taxation has just issued an official dispatch directing tax departments of provinces and cities to speed up the settlement of VAT refund dossiers for enterprises and people. For VAT refund dossiers that have been checked and determined to have tax amounts eligible for refund, promptly issue tax refund decisions for enterprises, ensuring compliance with the prescribed deadline. For dossiers that are being checked, notify the settlement deadline. For VAT refund dossiers that are having problems or feedback from associations and enterprises, organize dialogues immediately with associations and enterprises during the week from May 29 to June 2 to clarify the problems; proactively handle and resolve problems and make tax refunds in accordance with regulations and within the authority, not allowing them to linger for a long time, causing frustration for people and enterprises.

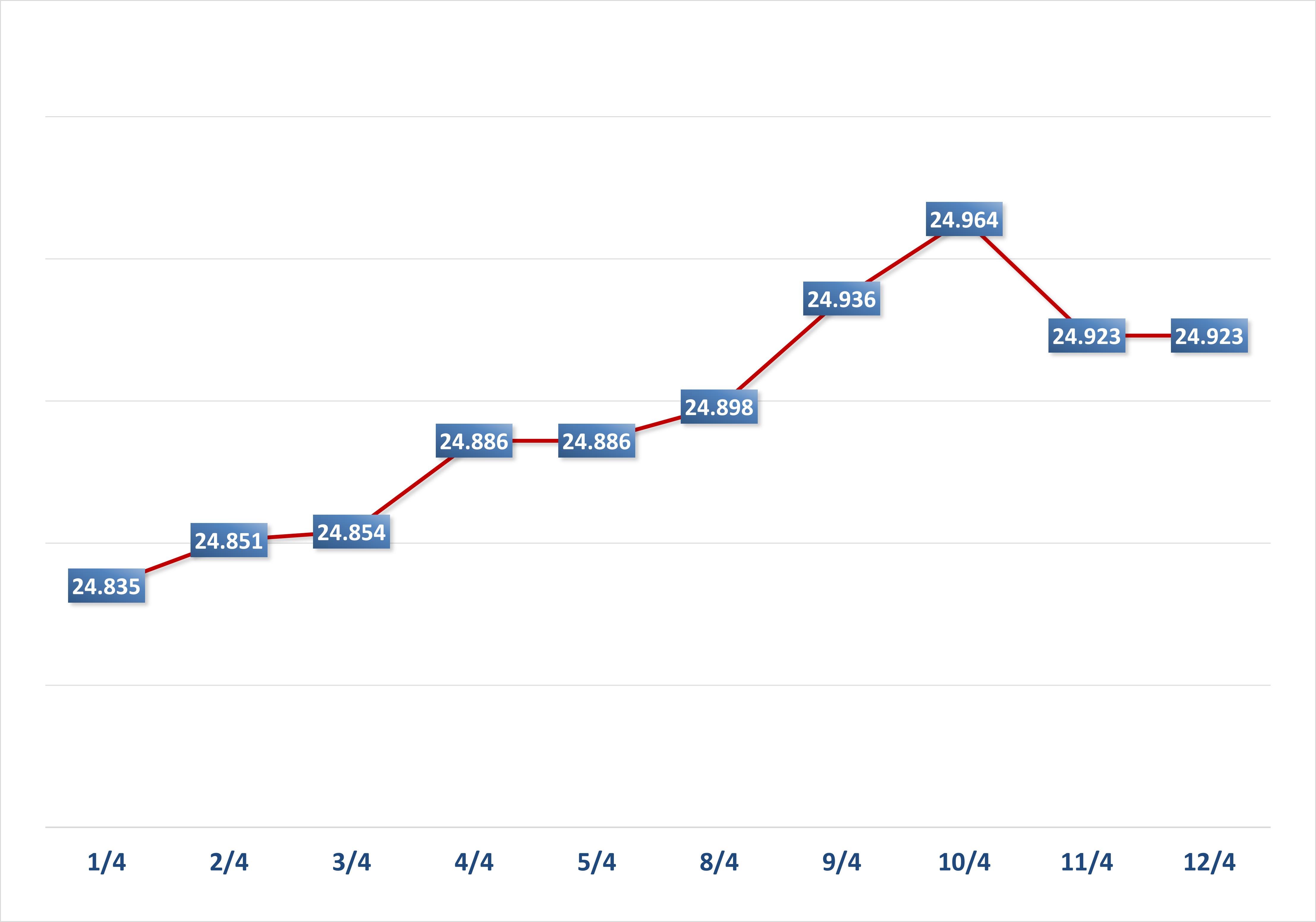

According to Dr. Tu, in many countries, transactions are made through bank accounts, so tax refunds are quite public and transparent. Vietnam still uses cash in payments, tax refunds are mainly based on invoices and vouchers, and large invoices are difficult to control. Each year, tax refunds account for about 10-15% of total budget revenue. In recent years, total budget revenue was about 1.5 million billion VND, while the amount requested for refund was about 150,000 billion VND. This is a huge amount of tax, so it creates many challenges for the tax industry. Many tax refund frauds have occurred, including those involving related officials.

This shows that the tax refund policy still has loopholes. Also because the tax refund is mainly based on invoices, and businesses buy goods nationwide, invoices are also provided by many different localities, making it difficult for tax authorities to control. Because of confusion in management, there are cases where businesses that are right also suffer losses from the strict tax refund policy. The previous tax refund process prioritized refund first - check later, in cases where businesses are at risk, check first - refund later. However, in reality, some tax refund frauds have arisen, causing tax authorities to issue general directives, leading to tax officials being afraid to sign, because if they sign and the tax refund dossier is fraudulent, they will go to jail, but if they do not sign, businesses will have their tax money withheld.

Therefore, according to Mr. Tu, it is necessary to complete the regulations on tax refunds. In particular, unify one domestic VAT rate so that there will no longer be domestic tax refund applications due to the difference in tax rates between 5% and 10%. If this can be done, the number of domestic tax refund applications will no longer exist, instead, the tax authority will focus more on tax refunds for exporting enterprises.

"The Ministry of Finance needs to have specific instructions to remove difficulties for businesses but also ensure that the budget does not lose revenue. As for the regulations in the recent document, no one dares to do it. Do not let a few cases of VAT refund fraud cause difficulties for all remaining businesses," said Mr. Tu.

Source link

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)